Top 3 Stocks Estimated To Be Below Their True Value In The US Market, July 2024

As the S&P 500 and Nasdaq Composite continue to reach record highs, driven by robust performances in technology stocks and optimistic economic indicators, investors are keenly watching the market for opportunities. In this climate, identifying stocks that are potentially undervalued becomes crucial, offering a strategic avenue for those looking to invest amidst prevailing market optimism and upcoming corporate earnings announcements.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

Marriott Vacations Worldwide (NYSE:VAC) | $85.47 | $169.56 | 49.6% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.01 | $31.76 | 49.6% |

Sachem Capital (NYSEAM:SACH) | $2.65 | $5.27 | 49.7% |

Oddity Tech (NasdaqGM:ODD) | $39.95 | $78.46 | 49.1% |

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA) | $20.96 | $41.92 | 50% |

AppLovin (NasdaqGS:APP) | $84.36 | $165.34 | 49% |

Progress Software (NasdaqGS:PRGS) | $53.37 | $103.39 | 48.4% |

EVERTEC (NYSE:EVTC) | $31.20 | $61.12 | 49% |

Viant Technology (NasdaqGS:DSP) | $10.13 | $19.98 | 49.3% |

Hexcel (NYSE:HXL) | $64.44 | $127.33 | 49.4% |

Here's a peek at a few of the choices from the screener.

Medpace Holdings

Overview: Medpace Holdings, Inc. is a global clinical research organization specializing in drug and medical device development services, with a market capitalization of approximately $12.70 billion.

Operations: The company generates its revenue primarily from the development, management, and execution of clinical trials, totaling approximately $1.96 billion.

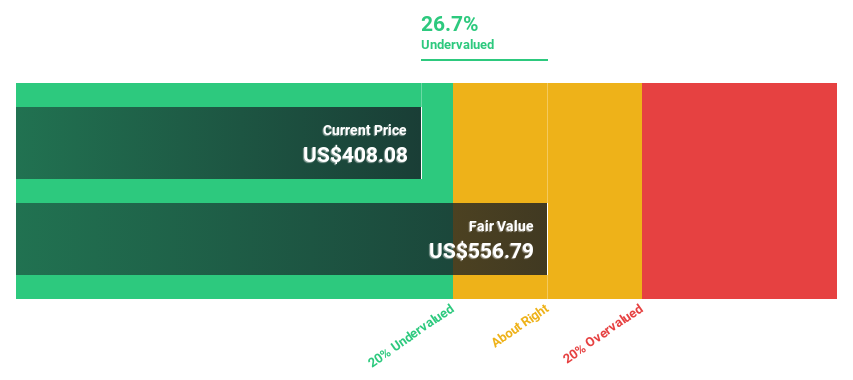

Estimated Discount To Fair Value: 29.4%

Medpace Holdings, with a current trading price of US$419.05, is positioned below the estimated fair value of US$593.68, indicating a significant undervaluation based on discounted cash flow models. Despite recent board changes and corporate governance adjustments, the company forecasts robust revenue growth for 2024 between US$2.15 billion and US$2.20 billion, alongside an anticipated net income range of US$347 million to US$369 million. This financial outlook suggests Medpace's cash flows are strong, supporting its undervalued status amidst stable operational expansions and strategic leadership transitions.

Wix.com

Overview: Wix.com Ltd. operates a global cloud-based web development platform, with a market capitalization of approximately $8.78 billion.

Operations: The company generates its revenue primarily from internet software and services, totaling approximately $1.61 billion.

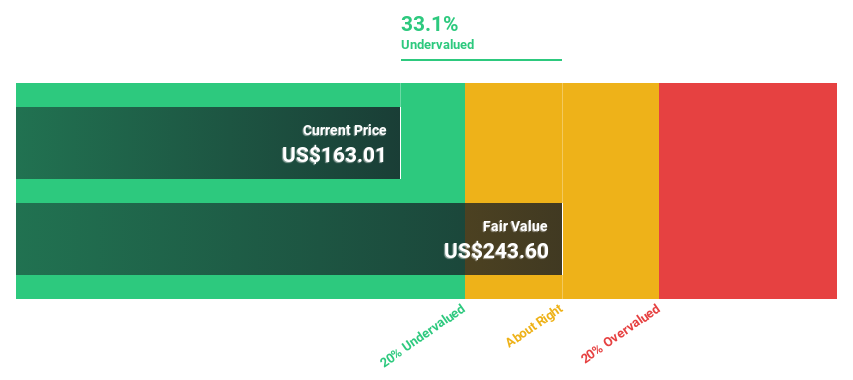

Estimated Discount To Fair Value: 33.1%

Wix.com is currently trading at US$163.01, significantly below its fair value estimate of US$243.6, reflecting a deep undervaluation based on discounted cash flow analysis. The company turned profitable this year and anticipates robust earnings growth of 34.1% annually over the next three years, outpacing the broader US market forecast of 14.8%. Recent strategic moves include a US$200 million share buyback program and new developer features to enhance its platform ecosystem, signaling strong future cash flows despite carrying high levels of debt.

The growth report we've compiled suggests that Wix.com's future prospects could be on the up.

Unlock comprehensive insights into our analysis of Wix.com stock in this financial health report.

Leidos Holdings

Overview: Leidos Holdings, Inc. operates as a provider of services and solutions in the defense, intelligence, civil, and health sectors globally, with a market capitalization of approximately $19.61 billion.

Operations: The company generates revenue primarily through its engagements in the defense, intelligence, civil, and health sectors, totaling approximately $15.71 billion.

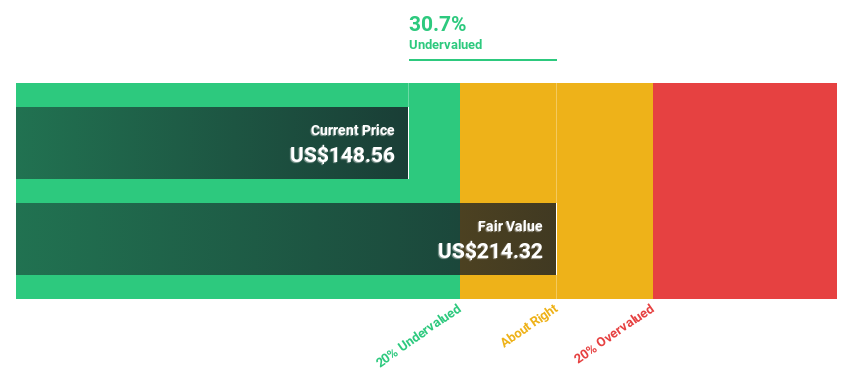

Estimated Discount To Fair Value: 32.5%

Leidos Holdings, priced at US$148.84, is valued well below its fair value of US$220.55, indicating a significant undervaluation based on discounted cash flow (DCF) metrics. While the company's revenue growth projections are modest at 4.3% annually, its earnings are expected to surge by 32.8% annually over the next three years, outstripping the broader market's growth rate. Recent contracts with North Dakota Health and Human Services and the U.S. Air Force underline its robust operational capabilities despite concerns over high debt levels and large one-off items impacting financial results.

Taking Advantage

Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 179 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:MEDP NasdaqGS:WIX and NYSE:LDOS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance