Top 3 TSX Stocks Estimated To Be Below Market Value In July 2024

As central banks like the Fed and the Bank of Canada adjust interest rates in response to shifting economic indicators, investors are closely watching market trends and potential opportunities. In this context, identifying stocks that appear undervalued becomes particularly compelling, as these may offer growth potential in a moderating economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$181.00 | CA$314.01 | 42.4% |

Trisura Group (TSX:TSU) | CA$41.07 | CA$80.18 | 48.8% |

Calibre Mining (TSX:CXB) | CA$2.05 | CA$3.68 | 44.3% |

Kraken Robotics (TSXV:PNG) | CA$1.17 | CA$2.24 | 47.9% |

Endeavour Mining (TSX:EDV) | CA$31.07 | CA$53.40 | 41.8% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Jamieson Wellness (TSX:JWEL) | CA$29.31 | CA$48.82 | 40% |

Green Thumb Industries (CNSX:GTII) | CA$15.75 | CA$28.17 | 44.1% |

Kits Eyecare (TSX:KITS) | CA$9.00 | CA$15.45 | 41.8% |

Capstone Copper (TSX:CS) | CA$10.43 | CA$17.88 | 41.7% |

Let's take a closer look at a couple of our picks from the screened companies

Alamos Gold

Overview: Alamos Gold Inc. is a company that specializes in the acquisition, exploration, development, and extraction of precious metals in Canada and Mexico, with a market capitalization of approximately CA$9.01 billion.

Operations: The company generates revenue from three primary mines: Mulatos (CA$442.80 million), Island Gold (CA$254.90 million), and Young-Davidson (CA$351.70 million).

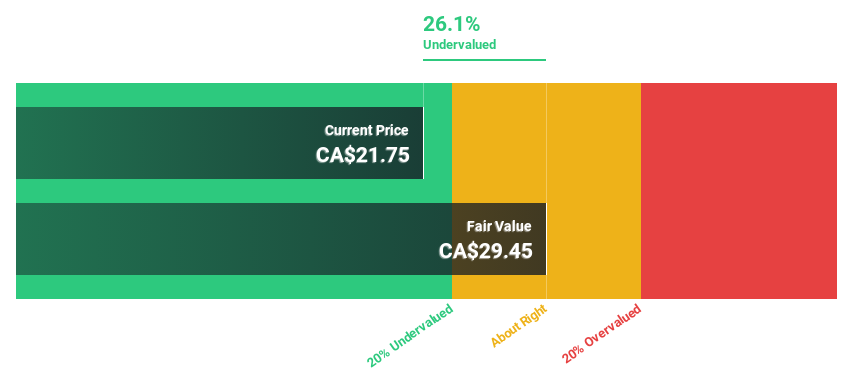

Estimated Discount To Fair Value: 14.2%

Alamos Gold, trading at CA$22.59, presents an opportunity as it is valued below the estimated fair value of CA$26.32, indicating a 14.2% undervaluation based on discounted cash flow analysis. Despite this modest undervaluation, the company's earnings have surged by 116.7% over the past year with expectations of continued growth at 36.87% annually, outpacing the Canadian market's forecast of 14.9%. Recent exploration success and consistent dividend payments underscore its potential amidst operational expansions and robust gold production forecasts for upcoming years.

The growth report we've compiled suggests that Alamos Gold's future prospects could be on the up.

Dive into the specifics of Alamos Gold here with our thorough financial health report.

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe with a market capitalization of approximately CA$84.33 billion.

Operations: The company's revenue from software and programming activities totals CA$8.84 billion.

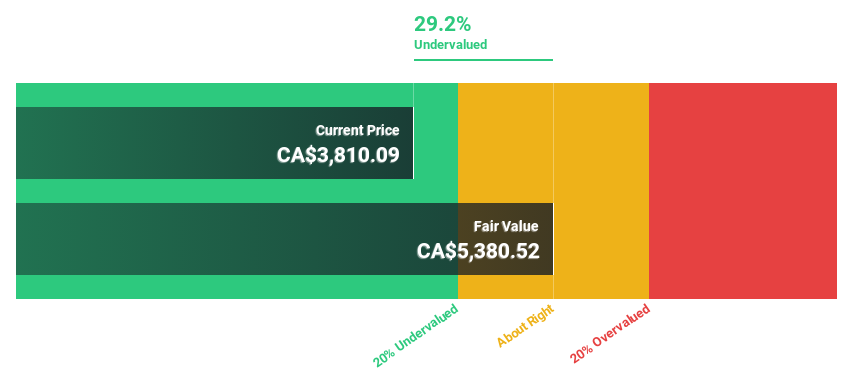

Estimated Discount To Fair Value: 28.6%

Constellation Software, priced at CA$3979.22, is significantly undervalued with a fair value estimate of CA$5570.35, reflecting a 28.6% discount. Its earnings expanded by 13.4% last year and are projected to grow by 24.43% annually, outstripping the Canadian market's 14.9%. Despite high debt levels and notable insider selling recently, revenue growth forecasts at 16.1% annually surpass the market expectation of 7.3%. Recent executive changes and the launch of Omegro indicate strategic realignments aimed at bolstering global software operations.

Docebo

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market capitalization of approximately CA$1.57 billion.

Operations: The company generates CA$190.78 million from its educational software segment.

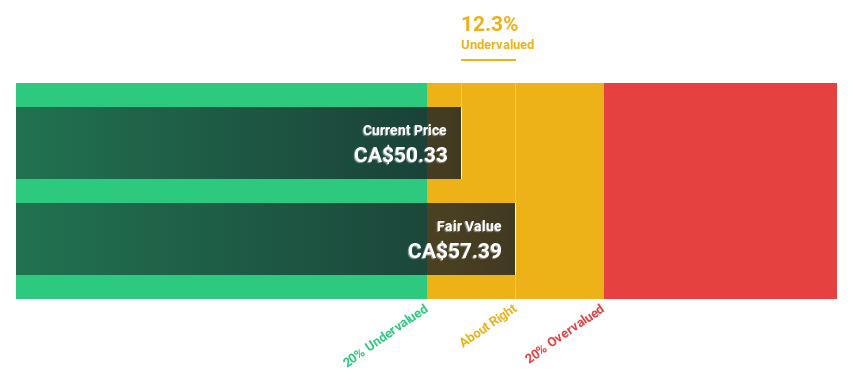

Estimated Discount To Fair Value: 12.5%

Docebo, currently valued at CA$51.92, trades below its calculated fair value of CA$59.36. While the company's profit margins have dipped from 10% to 3.5% over the past year, its earnings are expected to surge by approximately 50.63% annually over the next three years, significantly outpacing average market growth. Recent financial reports show a robust increase in quarterly sales and net income, supporting optimistic revenue projections for upcoming quarters and a vigorous share buyback program underlining confidence in future performance.

Key Takeaways

Click this link to deep-dive into the 24 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AGI TSX:CSU and TSX:DCBO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com