Top 3 UK Dividend Stocks To Watch In July 2024

As the FTSE 100 continues to show resilience with a second consecutive weekly gain, investors are keenly observing the broader market dynamics and regulatory environment in the United Kingdom. Amidst these conditions, dividend stocks remain an attractive option for those seeking potential income in addition to capital appreciation.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.17% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.73% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 6.93% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.86% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.22% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.56% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.55% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

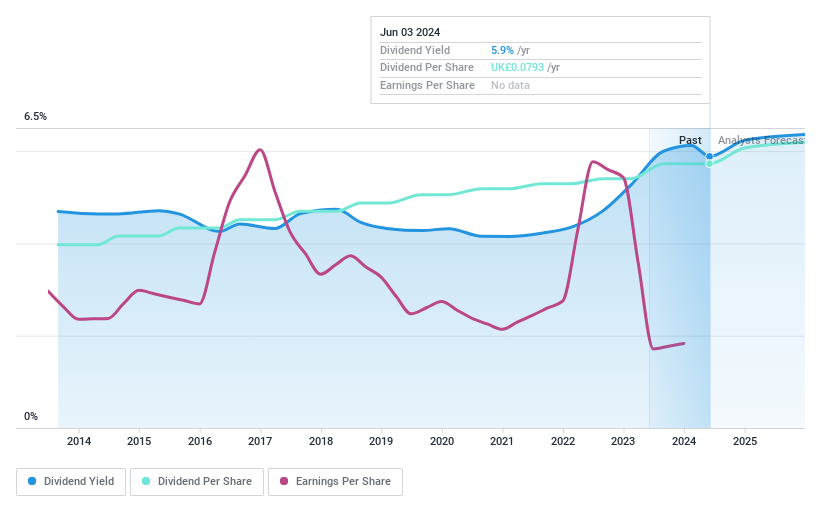

BBGI Global Infrastructure

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BBGI Global Infrastructure S.A. is an investment firm that focuses on infrastructure investments in operational or near operational assets, with a market capitalization of approximately £0.99 billion.

Operations: BBGI Global Infrastructure S.A. generates its revenue primarily from the financial services sector related to closed-end funds, totaling £48.10 million.

Dividend Yield: 5.7%

BBGI Global Infrastructure has demonstrated a stable dividend history over the past decade, with dividends per share remaining consistent and a top-tier yield of 5.7%, placing it among the top 25% of UK dividend payers. However, its high payout ratio of 140.6% and lack of free cash flows raise concerns about the sustainability of these payments. Recent actions include initiating a share repurchase program authorized on May 7, 2024, allowing for up to 14.99% of its issued share capital to be bought back, potentially impacting future dividend sustainability and shareholder value.

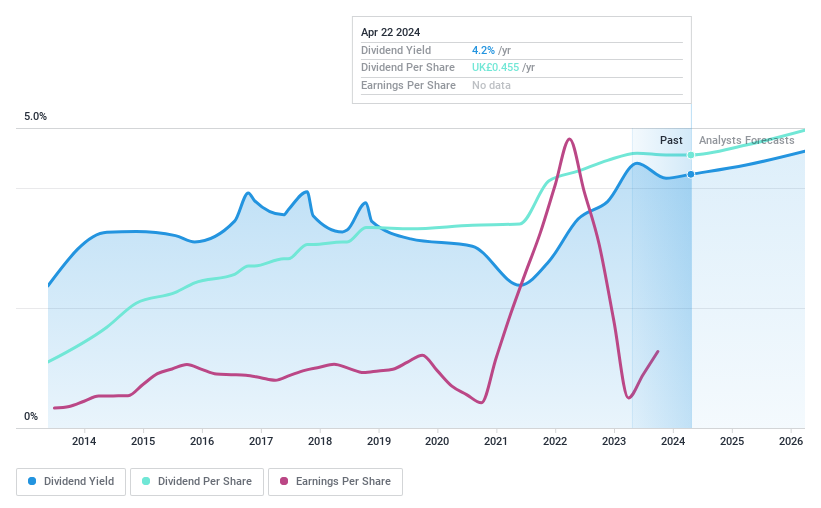

Big Yellow Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Big Yellow Group, recognized as the UK's brand leader in self-storage, operates with a market capitalization of approximately £2.37 billion.

Operations: Big Yellow Group generates its revenue primarily through the provision of self-storage and related services, totaling £199.62 million.

Dividend Yield: 3.7%

Big Yellow Group has maintained a stable dividend history, with a 3.73% yield, which is low compared to the top UK dividend payers. Despite recent earnings growth of 227.1% and revenue forecasted to grow by 5.56%, dividends are covered by both earnings (81.4% payout ratio) and cash flows (84.2% cash payout ratio). However, significant insider selling in the past three months and a static dividend amount year-over-year may raise concerns about future growth prospects and shareholder confidence.

Our valuation report unveils the possibility Big Yellow Group's shares may be trading at a discount.

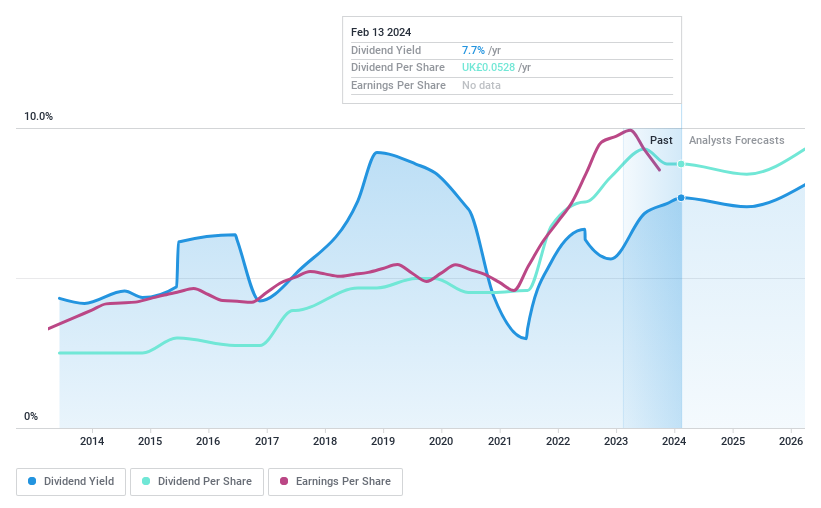

Record

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Record plc operates globally, offering currency and derivative management services across the UK, North America, Continental Europe, and Australia, with a market capitalization of approximately £133.11 million.

Operations: Record plc generates its revenue primarily from the provision of currency and derivatives management services, totaling £45.38 million.

Dividend Yield: 7.5%

Record plc's recent dividend affirmations and special dividend announcement highlight its commitment to shareholder returns, with a total payout of £9.9 million for FY-24, covering 93% of underlying earnings. Despite this, the dividends are not fully covered by earnings or free cash flow, indicating potential sustainability issues. The company's stock is trading below our fair value estimate by 22.9%, suggesting it might be undervalued. However, consistent dividend increases over the past decade and a stable payout history provide some reassurance to investors about the reliability of returns despite recent executive board changes and a decline in net income from £11.34 million to £9.27 million year-over-year.

Summing It All Up

Reveal the 54 hidden gems among our Top UK Dividend Stocks screener with a single click here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BBGI LSE:BYG and LSE:REC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com