Top 5 Industrial Product Stocks Set to Beat on Earnings

We are in the first busy week of the first-quarter 2024 earnings season, and results are so far in line with expectations. Several industrial product companies are gearing up for their earnings releases next week, and some are set to beat. These companies currently carry a favorable Zacks Rank. The combination of a favorable Zacks Rank and an earnings beat should drive their stock prices in the near term.

Industrial Product in Q1 at a Glance

Industrial production declined 1.8% year over year in the first quarter of 2024, as reported by the Federal Reserve, but rose 0.4% month over month in March. Year over year, total industrial production remained unchanged in March.

U.S. manufacturing activities surprisingly rebounded in March, giving yet another example of the solid fundamentals of the economy. The Institute of Supply Management (ISM) reported that its U.S. manufacturing index came in at 50.3%. Notably, any reading above 50% indicates expansion in manufacturing activities.

The manufacturing sector is the second-largest component of the U.S. economy, constituting around 10-12% of the GDP. During the pandemic era, in contrast to the other sectors, manufacturing activities expanded for 28 consecutive months.

However, as the economy reopened and inflation skyrocketed on the complete devastation of the global supply-chain system, manufacturing activities contracted for 16 successive months. Finally, the manufacturing purchasing managers’ index was back on the expansion trajectory in March 2024.

Our Top Picks

We have narrowed our search to five industrial product stocks that are poised to beat on earnings results next week. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings release. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

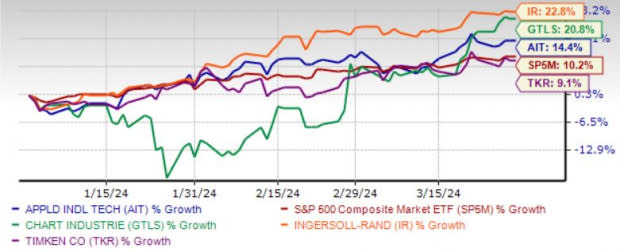

The chart below shows the price performance of stocks in the last quarter.

Image Source: Zacks Investment Research

Ingersoll Rand Inc. IR is set to gain from a healthy demand environment, solid product portfolio and innovation capabilities. Higher orders for compressors, and power tool and lifting are driving the growth of the Industrial Technologies & Services unit of IR. Benefits from acquired assets are aiding the Precision & Science Technologies segment. IR’s ability to generate strong cash flows supports its capital deployment strategy.

Ingersoll Rand has an Earnings ESP of +1.82%. It has an expected earnings growth rate of 8.5% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Ingersoll Rand recorded earnings surprises in the last four reported quarters, with an average beat of 15.9%. The company is set to release earnings results on May 2, after the closing bell.

Applied Industrial Technologies Inc. AIT is poised to benefit from an improving product line and value-added services. Strength across the food and beverage, lumber and wood, mining and refining end markets sparks optimism for AIT.

Growth in larger national accounts and fluid power aftermarket sales, as well as benefits from sales force effectiveness initiatives, are aiding the Service Center Based Distribution segment. Acquired assets are expected to have driven AIT’s top line in the first quarter. Focus on pricing and cross-selling actions, and growth initiatives augur well for AIT.

Applied Industrial Technologies has an Earnings ESP of +0.63%. It has an expected earnings growth rate of 8.5% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last 30 days.

Applied Industrial Technologies recorded earnings surprises in the last four reported quarters, with an average beat of 10.4%. The company is set to release earnings results on Apr 25, before the opening bell.

Chart Industries Inc. GTLS is engaged in the designing, engineering, and manufacturing of process technologies and equipment for gas and liquid molecules in the United States and internationally. GTLS’ equipment is used in the production, storage, distribution and end-use of atmospheric, hydrocarbon, and industrial gases.

GTLS is organized into three operating segments: Energy & Chemicals, Distribution and Storage, and BioMedical serving customers from a global manufacturing platform in North America, Europe and Asia.

Chart Industries has an Earnings ESP of +9.85%. It has an expected earnings growth rate of 96.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.6% over the last seven days.

Chart Industries recorded earnings surprises in three out of the last four reported quarters, with an average beat of 75.9%. The company is set to release earnings results on May 3, before the opening bell.

Atmus Filtration Technologies Inc. ATMU provides filtration and media solutions. ATMU serves customers across truck, bus, agriculture, construction, mining, marine and power generation vehicle and equipment markets. ATMU sales products under the Fleetguard brand name in North America, Europe, South America, Asia, Australia, Africa, and internationally.

Atmus Filtration Technologies has an Earnings ESP of +1.42%. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last seven days.

Atmus Filtration Technologies recorded earnings surprises in three out of the last four reported quarters, with an average beat of 20.3%. The company is set to release earnings results on May 3, before the opening bell.

The Timken Co. TKR expects 2024 adjusted earnings per share between $5.80 and $6.20. The guidance indicates a 15% year-over-year decline at the mid-point. Total revenues are projected to be down 3.5% at the mid-point from the 2023 reported levels. While volumes are expected to reflect the overall weakness in demand, the impact will be somewhat offset by TKR’s higher pricing strategy.

TKR’s cost reduction initiatives are expected to mitigate margin pressures. Despite these near-term hurdles, stable demand in food and beverage market, TKR’s strategic acquisitions to boost its presence and product portfolio, product innovations and investments in renewable energy position it well for growth.

The Timken has an Earnings ESP of +1.85%. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days. The Timken recorded earnings surprises in two out of the last four reported quarters, with an average beat of 4.6%. The company is set to release earnings results on Apr 30, before the opening bell.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Timken Company (The) (TKR) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Atmus Filtration Technologies Inc. (ATMU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance