Top AIM High Growth Stock

Companies such as Frontier Smart Technologies Group and Taptica International have a significantly positive future outlook on the basis of their profitability and returns. Investors seeking to enhance their portfolio should consider these financially stable, high-growth stocks. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

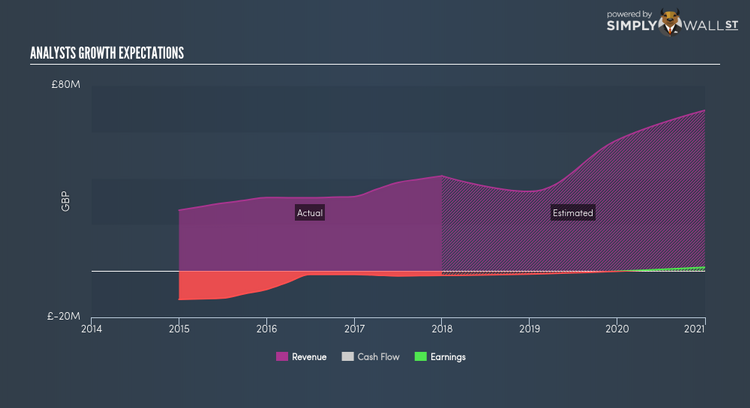

Frontier Smart Technologies Group Limited (AIM:FST)

Frontier Smart Technologies Group Limited, a technology company, engages in the commercial exploitation of wireless technologies and systems in the radio and smart audio sectors in the United States, North America, Europe, and Asia. Founded in 2001, and now led by CEO Anthony Sethill, the company employs 180 people and with the company’s market cap sitting at GBP £32.32M, it falls under the small-cap group.

FST is expected to deliver an extremely high earnings growth over the next couple of years of 95.49%, driven by a positive revenue growth of 37.65% and cost-cutting initiatives. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with top-line expansion. FST ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Should you add FST to your portfolio? Check out its fundamental factors here.

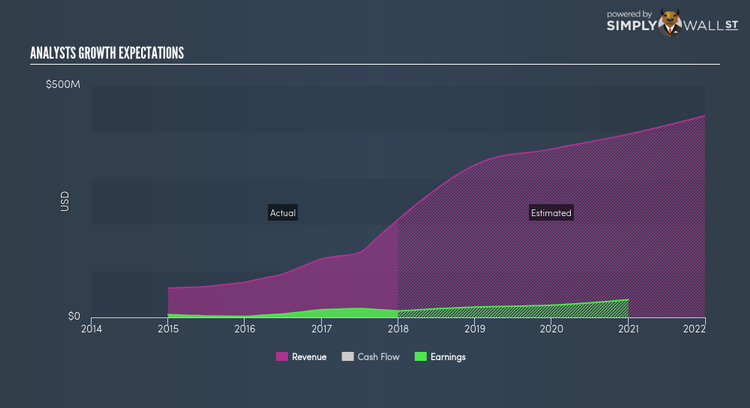

Taptica International Ltd (AIM:TAP)

Taptica International Ltd., together with its subsidiaries, operates a mobile advertising platform. Established in 2007, and currently headed by CEO Hagai Tal, the company now has 122 employees and with the market cap of GBP £208.06M, it falls under the small-cap category.

TAP’s forecasted bottom line growth is an optimistic double-digit 29.19%, driven by the underlying 72.12% sales growth over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 25.00%. TAP ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Should you add TAP to your portfolio? I recommend researching its fundamentals here.

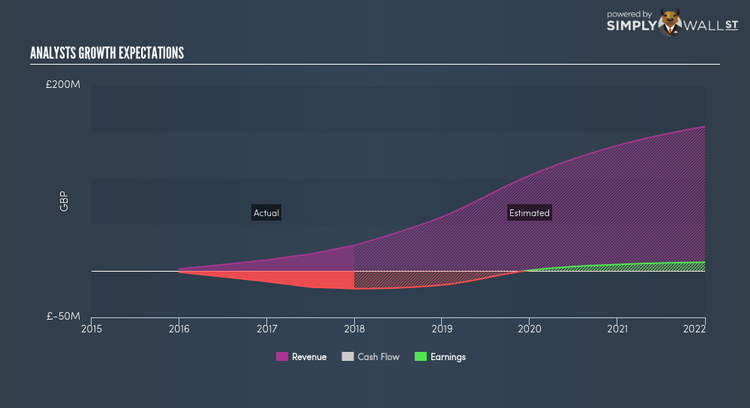

Eve Sleep Plc (AIM:EVE)

Eve Sleep Plc operates as an e-commerce focused direct to consumer sleep brand worldwide. Started in 2014, and now led by CEO Jas Bagniewski, the company size now stands at 96 people and with the stock’s market cap sitting at GBP £118.40M, it comes under the small-cap category.

Extreme optimism for EVE, as market analysts projected an outstanding earnings growth rate of 76.96% for the stock, supported by an equally strong sales. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. EVE’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add EVE to your portfolio? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance