Top Dividend Stocks In Japan For July 2024

As Japan's stock markets experienced notable gains this past week, with the Nikkei 225 and TOPIX indices rising amid a weakening yen and expectations of monetary policy adjustments, investors are closely watching for opportunities in dividend stocks. In this context, understanding the characteristics that define resilient and potentially rewarding dividend stocks becomes crucial, especially as market dynamics continue to evolve.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.80% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.51% | ★★★★★★ |

Globeride (TSE:7990) | 3.75% | ★★★★★★ |

Yahagi ConstructionLtd (TSE:1870) | 3.57% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.47% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.04% | ★★★★★★ |

Japan Pulp and Paper (TSE:8032) | 4.06% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 376 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

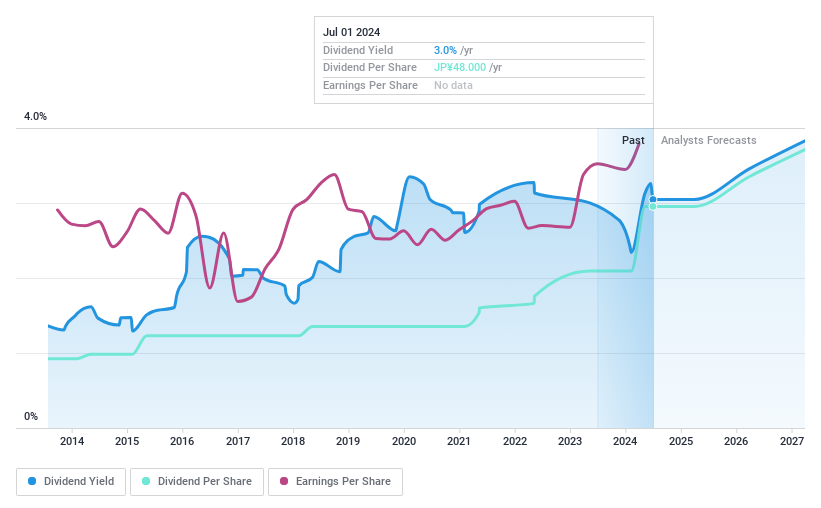

Shizuoka Financial GroupInc

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shizuoka Financial Group, Inc., along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately ¥866.43 billion.

Operations: Shizuoka Financial Group, Inc. engages primarily in the provision of diverse banking products and services.

Dividend Yield: 3%

Shizuoka Financial GroupInc. offers a modest dividend yield of 3.05%, slightly below the top quartile in Japan's market, yet its dividend payments are well-supported by a payout ratio of 37.4%. Over the past decade, dividends have shown stability and growth, indicating reliability. Recently, the company increased its annual dividend to JP¥22.00 per share and provided forward guidance suggesting further increases to JP¥24.00 per share next year, reflecting a positive outlook on sustaining and potentially enhancing shareholder returns despite earnings impacted by one-off items.

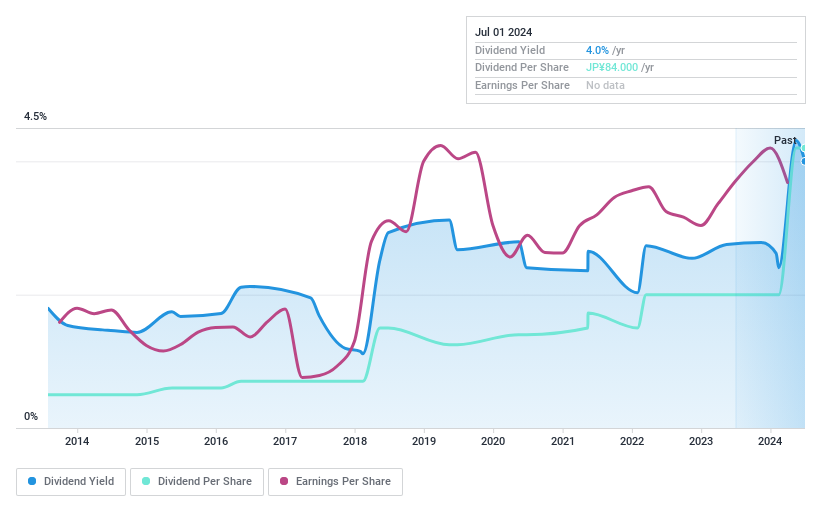

Seibu Electric & Machinery

Simply Wall St Dividend Rating: ★★★★★★

Overview: Seibu Electric & Machinery Co., Ltd. specializes in the manufacturing and sale of mechatronics products within Japan, with a market capitalization of approximately ¥31.71 billion.

Operations: Seibu Electric & Machinery Co., Ltd. generates revenue primarily through three segments: Conveyor Machine Business (¥11.33 billion), Precision Machinery Business (¥13.57 billion), and Industrial Machinery Business (¥6.58 billion).

Dividend Yield: 4%

Seibu Electric & Machinery has demonstrated consistent dividend growth over the last decade, with a current yield of 4%, placing it above the Japanese market average of 3.4%. Its dividends are well-supported by earnings, with a payout ratio of 30.6%, and by cash flows, evidenced by an 83.3% cash payout ratio. This financial stability ensures reliable shareholder returns, even as annual general meetings, like the one on June 27, 2024, provide further insights into company operations and future commitments.

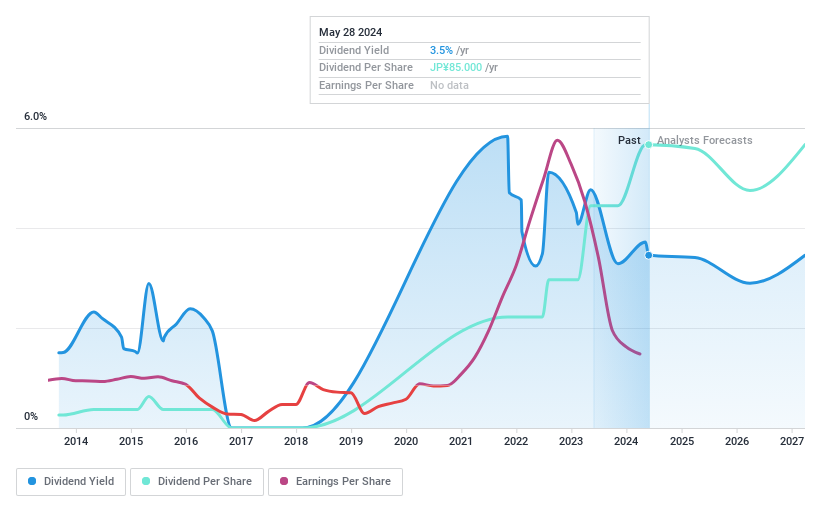

Kawasaki Kisen Kaisha

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawasaki Kisen Kaisha, Ltd. operates in marine, land, and air transportation across Japan, the United States, Europe, Asia, and other international markets with a market capitalization of approximately ¥1.71 trillion.

Operations: Kawasaki Kisen Kaisha, Ltd. generates revenue primarily through its Product Logistics segment at ¥554.52 billion, followed by Dry Bulk at ¥295.16 billion, and Resource at ¥107 billion.

Dividend Yield: 3.4%

Kawasaki Kisen Kaisha has shown a mixed performance in dividend reliability due to its volatile history over the past decade. Despite this, the dividends are currently supported by a reasonable payout ratio of 57.4% and cash flows, with a cash payout ratio of 49.1%. However, profit margins have declined significantly from last year's 73.7% to 10.9%, and earnings are expected to drop annually by 16.7% over the next three years, raising concerns about future dividend sustainability amidst recent aggressive share buybacks totaling ¥71,873.44 million.

Make It Happen

Get an in-depth perspective on all 376 Top Dividend Stocks by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:5831 TSE:6144 and TSE:9107.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance