Top Dividend Stocks To Watch In July 2024

The Indian stock market has shown robust performance, with a significant 44% increase over the past year and a recent rise of 1.1% in just the last week. In this context of strong market growth and promising earnings forecasts, dividend stocks emerge as particularly attractive for their potential to provide investors with steady income alongside capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.15% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.11% | ★★★★★★ |

D. B (NSEI:DBCORP) | 3.82% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.46% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.20% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.53% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.35% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.67% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.23% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.75% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

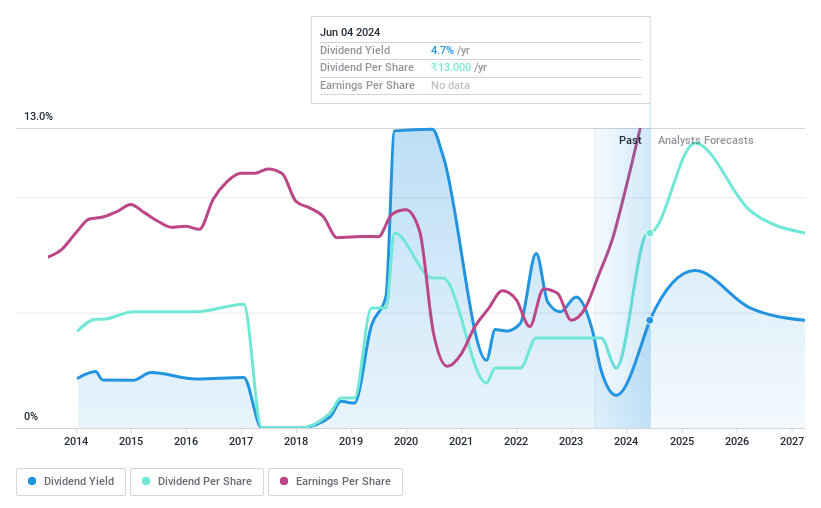

D. B

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with a market cap of ₹60.70 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business which contributes ₹22.43 billion, and its radio segment which adds another ₹1.59 billion.

Dividend Yield: 3.8%

DBCORP offers a dividend yield of 3.82%, placing it in the top quartile of Indian dividend stocks. Despite a volatile history, dividends have grown over the past decade, supported by earnings and cash flows with payout ratios at 54.4% and 43.6% respectively, indicating sustainability. Recent financials show robust growth with net income rising to ₹4,255.23 million from ₹1,690.85 million year-over-year; further bolstered by a recent board decision to pay an interim dividend of ₹8 per share.

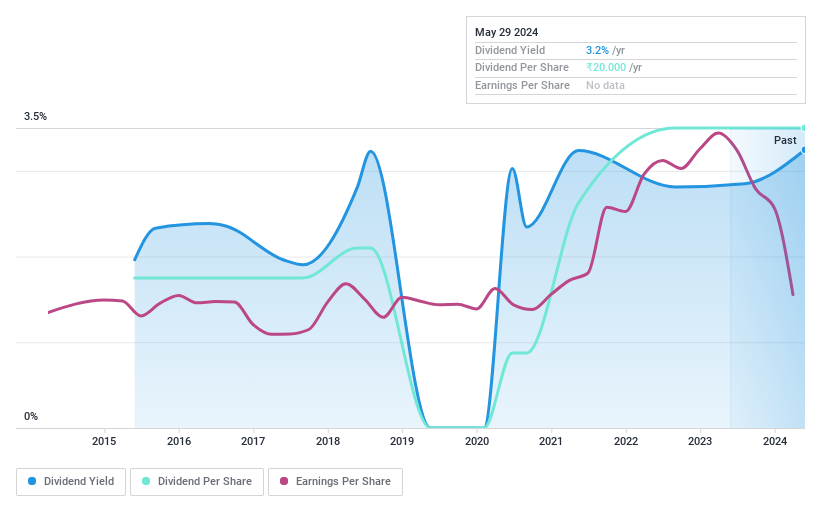

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is a company that manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market capitalization of approximately ₹61.49 billion.

Operations: Gulf Oil Lubricants India Limited generates its revenue primarily from the sale of lubricants, amounting to ₹33.01 billion.

Dividend Yield: 3.2%

Gulf Oil Lubricants India has demonstrated consistent dividend growth over the past decade, recently declaring a substantial dividend of INR 20 per share. The company's financial performance supports this, with a notable increase in annual revenue to INR 33.69 billion and net income rising to INR 3.08 billion. Despite high share price volatility and recent senior management changes, the dividends appear sustainable with a payout ratio of 57.4% and coverage by earnings growth projected at 11.64% annually.

Monte Carlo Fashions

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Monte Carlo Fashions Limited specializes in the production and sale of wool, cotton, and blended fabric garments both domestically and internationally, with a market capitalization of approximately ₹12.48 billion.

Operations: Monte Carlo Fashions Limited generates ₹10.62 billion primarily through the manufacturing and trading of textile garments.

Dividend Yield: 3.3%

Monte Carlo Fashions has shown a volatile dividend history over its 9-year payout period, with recent dividends covered by both earnings (69.2% payout ratio) and cash flows (88.8% cash payout ratio). Despite this coverage, the company reported a significant net loss in Q4 2024, contrasting sharply with the previous year's profit. The board recommended a final dividend of INR 20 per share for FY 2023-2024, pending shareholder approval at the upcoming AGM.

Turning Ideas Into Actions

Get an in-depth perspective on all 18 Top Dividend Stocks by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:DBCORP NSEI:GULFOILLUB and NSEI:MONTECARLO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance