Top easy-access account rates soar 26pc since January

Rates on the top easy-access savings accounts and variable-rate cash Isas have increased by up to 30pc and are at their highest levels for more than a year.

In January two providers offered market-leading variable-rate cash Isas that paid 1pc. Today Charter Savings Bank's new 95-day-notice Isa pays 1.3pc. The last time a variable Isa paid this rate or more was at the start of September 2016, according to Moneyfacts, the data firm.

Four providers offered easy-access accounts at the start of the year that paid 1pc. Now Charter Savings Bank has introduced a notice account that pays 1.26pc.

Reader Service: Find out how to significantly boost your savings income with The Telegraph Concierge Cash Service

The new accounts

Charter Savings Bank's notice cash Isa can be opened online with £1,000. Customers must give the bank 95 days' notice before accessing their cash or face a penalty of 95 days' interest on the amount withdrawn.

If your balance falls below £1,000 the rate drops to 0.1pc until you pay more in. Charter Savings Bank's Isa pays significantly more than Hinckley & Rugby Building Society's previously market-leading account, which offers 1.2pc.

Savers who don't want to wait for their money could consider Charter Savings Bank's easy-access Isa, which pays a lower rate of 1.1pc.

Charter Savings Bank also offers customers the chance to split their cash between its range of Isas, including fixed-rate accounts, using its "Mix and Match" platform.

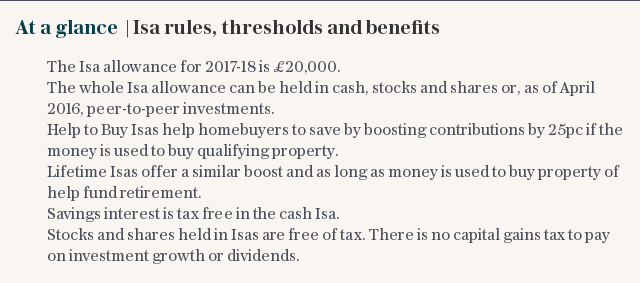

This allows customers to spread out their £20,000 allowance for 2017-18 and earn higher rates. For example, the bank offers new market-leading one and two-year cash Isas, which pay 1.4pc and 1.65pc respectively.

Charter Savings Bank has also launched a new easy-access account which pays 1.26pc. Balances must remain above £1,000 or the interest rate is reduced to 0.1pc. Charter's account pays marginally more than Ulster Bank, which offers 1.25pc, but customers may find it easier to open the Charter account, which can be done online.

The Ulster Bank account could prove more awkward. Its eSavings account can be applied for and managed online as long as customers can supply passport and debit card details, which are checked electronically.

However, if identification documents cannot be verified in this way, customers will have to upload a picture of their ID, such as passport or driving licence. In this case, the account will be opened in a few days.

Ulster Bank also conducts "hard" credit searches on customers who apply for the savings account, which is unusual and could make it more difficult for them to borrow in the future. Following feedback the bank said it would stop carrying out hard searches from September 29.

Yahoo Finance

Yahoo Finance