Top German Dividend Stocks To Watch In August 2024

As global markets navigate a period of volatility, the German DAX has shown resilience, posting modest gains amid broader economic concerns. With industrial output on the rise and a shrinking trade surplus reflecting mixed signals, investors are keenly watching dividend stocks for stable returns. In such an environment, reliable dividend stocks can offer both income and potential growth, making them an attractive option for those seeking stability amidst market fluctuations.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.39% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 5.13% | ★★★★★★ |

Talanx (XTRA:TLX) | 3.53% | ★★★★★☆ |

Brenntag (XTRA:BNR) | 3.29% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.22% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 7.50% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 5.85% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.20% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.36% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.31% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top German Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

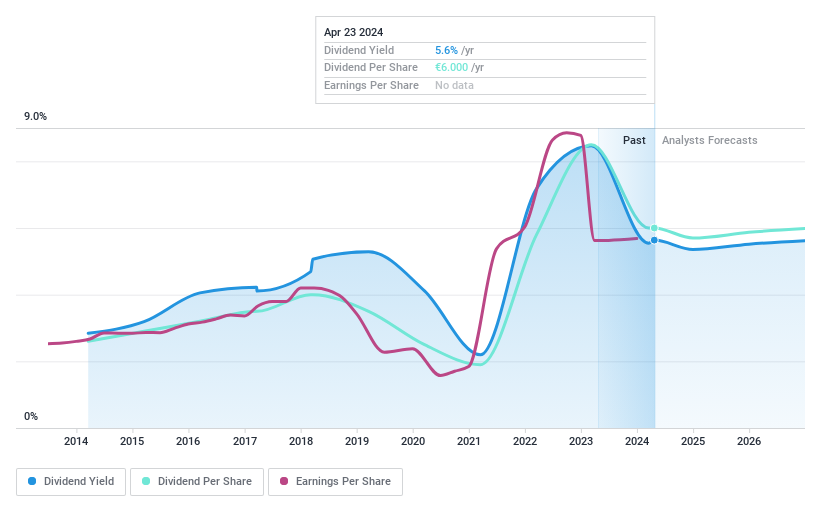

Bayerische Motoren Werke

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally, with a market cap of approximately €49.27 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft generates revenue from its Automotive segment (€132.39 billion), Motorcycles segment (€3.15 billion), and Financial Services segment (€37.87 billion).

Dividend Yield: 7.6%

BMW's dividend yield of 7.6% places it in the top 25% of German dividend payers, but its sustainability is questionable as dividends are not covered by free cash flow and have been volatile over the past decade. Despite a reasonable payout ratio of 36%, recent financial results show declining sales and net income, raising concerns about future stability. However, BMW trades at good value compared to peers and industry standards.

Dive into the specifics of Bayerische Motoren Werke here with our thorough dividend report.

Our valuation report here indicates Bayerische Motoren Werke may be undervalued.

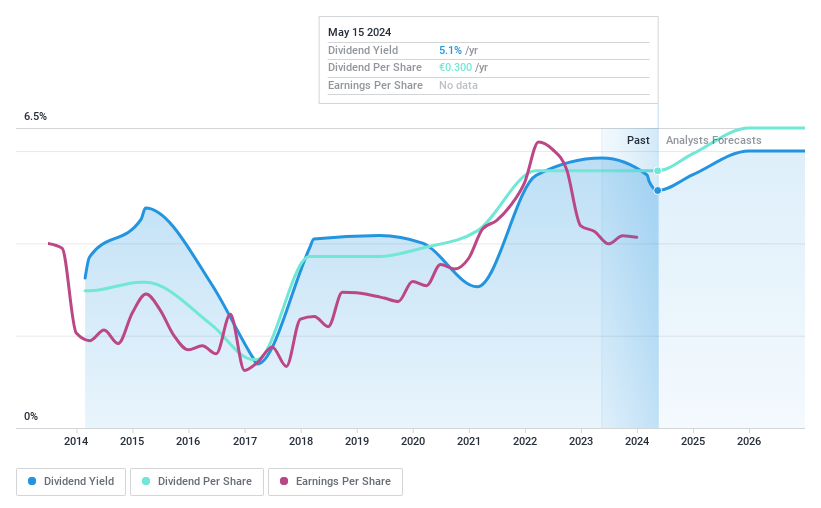

MLP

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €627.50 million, provides financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through various segments, including Financial Consulting (€426.19 million), FERI (€221.45 million), Banking (€195.50 million), DOMCURA (€131.71 million), Real Estate (€51.96 million), and Industrial Broker (€35.97 million).

Dividend Yield: 5.2%

MLP SE's dividend yield of 5.2% is among the top 25% in Germany, but its history of volatile payments raises concerns about reliability. The company's dividends are well-covered by both earnings (62.3% payout ratio) and cash flows (10.9% cash payout ratio). Recent Q1 results show increased sales (€277.75 million) and net income (€27.76 million), suggesting financial stability, further supported by a share buyback program totaling €6.2 million since January 2023.

Click here and access our complete dividend analysis report to understand the dynamics of MLP.

Upon reviewing our latest valuation report, MLP's share price might be too pessimistic.

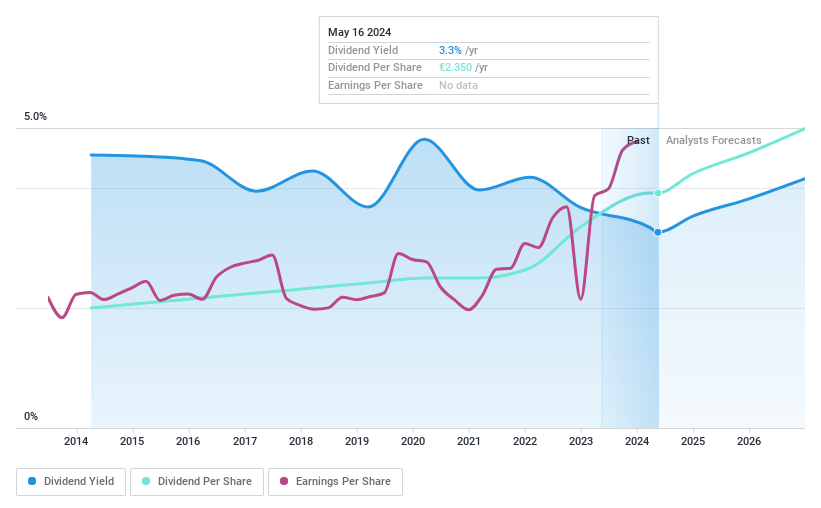

Talanx

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG offers insurance and reinsurance products and services globally, with a market cap of €17.16 billion.

Operations: Talanx AG generates revenue through the following segments: Industrial Lines (€5.88 billion), Retail Germany (€7.52 billion), Retail International (€6.23 billion), and Reinsurance (€24.76 billion).

Dividend Yield: 3.5%

Talanx AG's dividend payments have been stable and reliable over the past 10 years, with a current yield of 3.53%. The company's dividends are well-covered by earnings (34.7% payout ratio) and cash flows (7.5% cash payout ratio), ensuring sustainability. Despite trading at a significant discount to its estimated fair value, Talanx reported strong Q1 2024 results with net income rising to €572 million from €423 million in the previous year.

Take a closer look at Talanx's potential here in our dividend report.

The valuation report we've compiled suggests that Talanx's current price could be quite moderate.

Taking Advantage

Navigate through the entire inventory of 29 Top German Dividend Stocks here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:BMW XTRA:MLP and XTRA:TLX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com