Top German Growth Companies With High Insider Ownership In May 2024

Amidst a backdrop of robust gains across major European stock indices, including a notable 4.28% rise in Germany's DAX, investors are showing renewed optimism. This positive sentiment is particularly relevant when considering growth companies in Germany with high insider ownership, as these firms often benefit from aligned interests between shareholders and management, fostering strong corporate governance and potentially enhancing shareholder value.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 73% |

Deutsche Beteiligungs (XTRA:DBAN) | 35.3% | 28.7% |

init innovation in traffic systems (XTRA:IXX) | 39.7% | 23% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

Exasol (XTRA:EXL) | 25.3% | 107.4% |

Beyond Frames Entertainment (DB:8WP) | 10.9% | 81.9% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stemmer Imaging (XTRA:S9I) | 26.4% | 18.2% |

HomeToGo (XTRA:HTG) | 11.4% | 60.8% |

elumeo (XTRA:ELB) | 25.8% | 78.8% |

Underneath we present a selection of stocks filtered out by our screen.

Deutsche Beteiligungs

Simply Wall St Growth Rating: ★★★★★☆

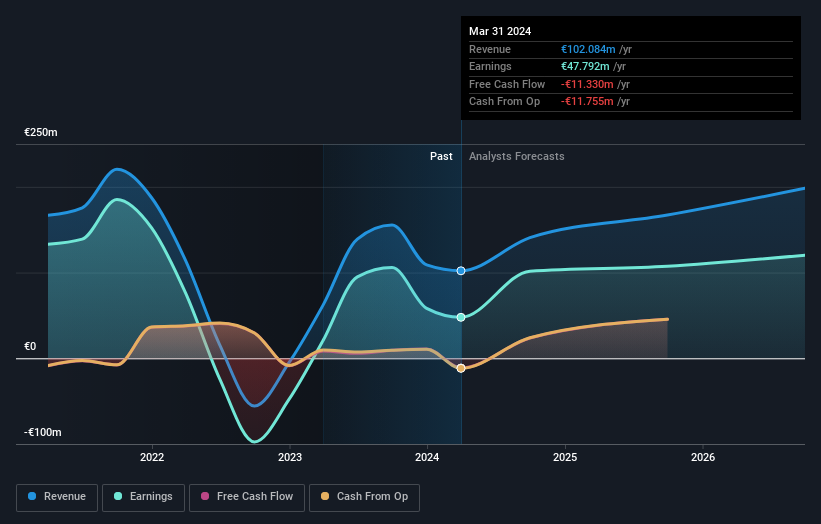

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm focusing on direct and fund of funds investments, with a market capitalization of approximately €520 million.

Operations: The firm operates primarily in private equity and venture capital, focusing on both direct investments and fund of funds.

Insider Ownership: 35.3%

Earnings Growth Forecast: 28.7% p.a.

Deutsche Beteiligungs (DBAN) stands out in the German market with its anticipated earnings growth of 28.72% per year, significantly surpassing the market's average. This growth is mirrored in its revenue projections, expected to increase by 24.7% annually, also well above market norms. Despite trading at 72.7% below estimated fair value and analysts predicting a substantial price rise of 57.9%, challenges remain such as a low forecasted Return on Equity at 17.5% and dividends that are poorly covered by cash flow.

Redcare Pharmacy

Simply Wall St Growth Rating: ★★★★☆☆

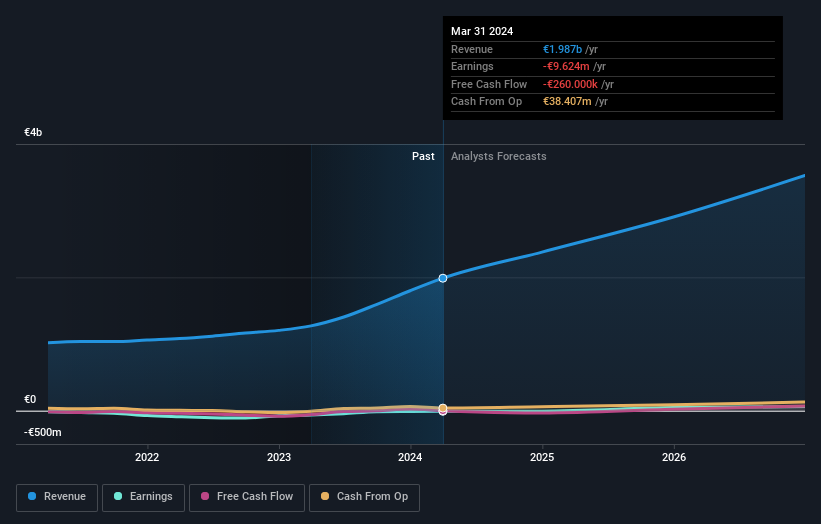

Overview: Redcare Pharmacy NV is an online pharmacy operating across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market capitalization of approximately €2.43 billion.

Operations: The company generates revenue primarily from two segments: the DACH region, contributing €1.62 billion, and other international markets adding €0.37 billion.

Insider Ownership: 18.4%

Earnings Growth Forecast: 47.4% p.a.

Redcare Pharmacy NV, a German growth company with high insider ownership, reported a significant sales increase to EUR 560.22 million in Q1 2024 from EUR 372.05 million the previous year, alongside a reduced net loss. Annually, sales rose to EUR 1.8 billion with net losses narrowing significantly from the prior year. The company anticipates robust sales growth between EUR 2.3 billion and EUR 2.5 billion for 2024, reflecting an optimistic outlook despite its shares trading at a substantial discount to estimated fair value and recent executive board changes suggesting strategic shifts ahead.

Friedrich Vorwerk Group

Simply Wall St Growth Rating: ★★★★☆☆

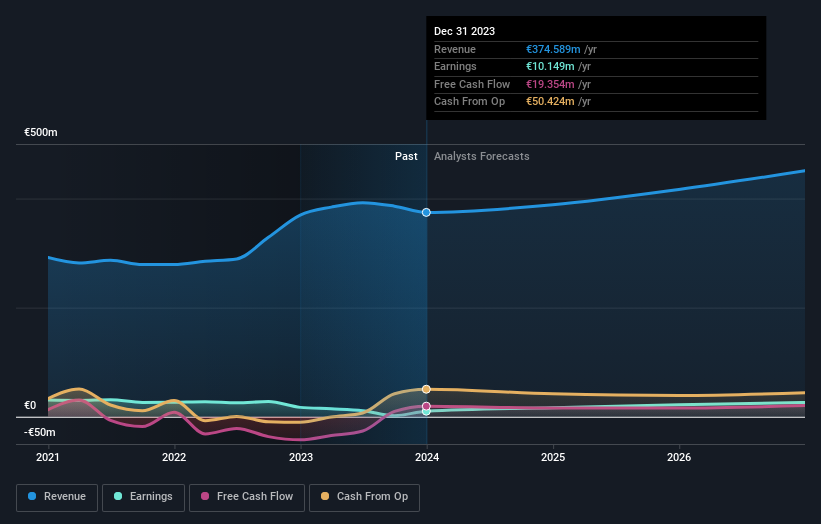

Overview: Friedrich Vorwerk Group SE specializes in solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €0.33 billion.

Operations: The company's revenue is generated from various segments, including Electricity (€62.91 million), Natural Gas (€165.14 million), Clean Hydrogen (€26.07 million), and Adjacent Opportunities (€119.24 million).

Insider Ownership: 18%

Earnings Growth Forecast: 28.6% p.a.

Friedrich Vorwerk Group SE, a German growth company with high insider ownership, is currently trading at 14.5% below its estimated fair value. Despite a decrease in profit margins from last year and a modest revenue growth forecast of 6.1% per year, the company's earnings are expected to rise significantly by 28.57% annually over the next three years. However, its return on equity is projected to remain low at 11.3%. Recently, the firm reaffirmed its dividend at €0.12 per share and reported a decline in net income for the full year ended December 31, 2023.

Summing It All Up

Unlock our comprehensive list of 22 Fast Growing German Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:DBAN XTRA:RDC and XTRA:VH2.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance