Top Indian Dividend Stocks To Consider In July 2024

Over the past year, the Indian market has shown remarkable growth with a 45% increase, despite remaining flat in the most recent week. In this context of strong annual performance and optimistic earnings forecasts, dividend stocks can be particularly appealing for investors looking for potential income combined with growth opportunities.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 3.93% | ★★★★★★ |

Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.24% | ★★★★★☆ |

D. B (NSEI:DBCORP) | 3.30% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.03% | ★★★★★☆ |

Bharat Petroleum (NSEI:BPCL) | 6.85% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.00% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.44% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

Oil and Natural Gas (NSEI:ONGC) | 4.02% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.48% | ★★★★★☆ |

Click here to see the full list of 15 stocks from our Top Indian Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

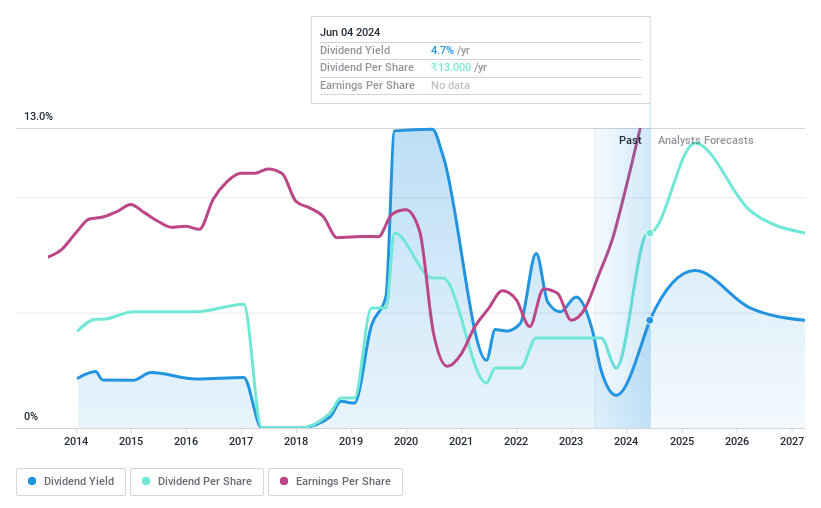

Bharat Petroleum

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited, operating in India, engages in refining crude oil and marketing petroleum products with a market capitalization of approximately ₹1.33 trillion.

Operations: Bharat Petroleum's revenue is primarily derived from its Downstream Petroleum segment, which generated ₹50.68 billion, and a smaller contribution from its Exploration & Production of Hydrocarbons segment at ₹1.88 billion.

Dividend Yield: 6.8%

Bharat Petroleum Corporation Limited (BPCL) offers a dividend yield of 6.85%, ranking in the top 25% in the Indian market. With a payout ratio of 33.3% and a cash payout ratio of 34.6%, BPCL's dividends are well-covered by both earnings and cash flows, indicating sustainability despite its high debt levels. However, the company has experienced volatility in dividend payments over the past decade and is expected to see earnings decline annually by 38.9% over the next three years, posing potential risks to future dividend stability. Additionally, recent management changes could impact operational continuity but also provide new strategic directions as seen with potential M&A activities involving city gas distribution sectors.

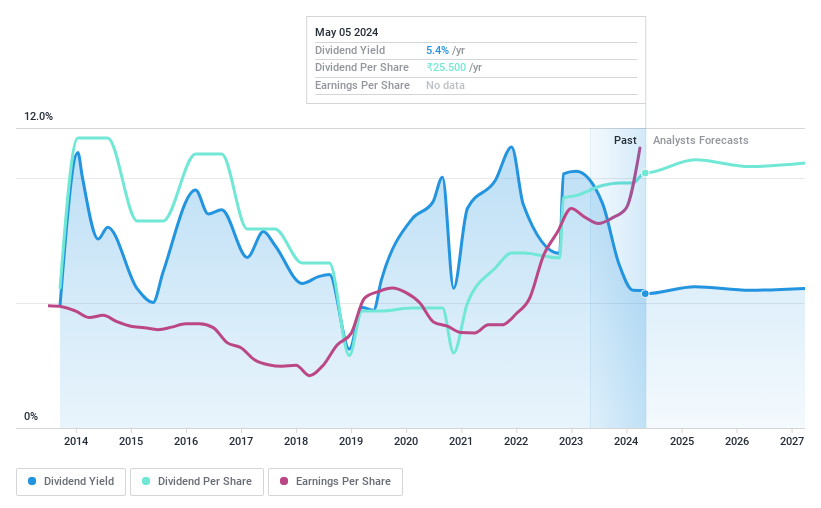

Coal India

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coal India Limited, along with its subsidiaries, engages in the production and marketing of coal and coal products across India, boasting a market capitalization of approximately ₹3.08 trillion.

Operations: Coal India Limited generates its revenue primarily from coal mining and services, totaling approximately ₹13.03 billion.

Dividend Yield: 5.1%

Coal India Limited, a major player in the Indian energy sector, offers a dividend yield of 5.1%, positioning it in the top 25% of dividend payers within the market. Despite this attractive yield, its dividends are not well-supported by cash flows, with a high cash payout ratio of 1226%. The company's earnings have increased by 32.8% over the past year and dividends have shown growth over the last decade. However, volatility in dividend payments and coverage issues raise concerns about sustainability. Trading at a price-to-earnings ratio of 8.2x, Coal India is valued below the broader Indian market average of 33.8x, suggesting relative affordability amidst its financial challenges.

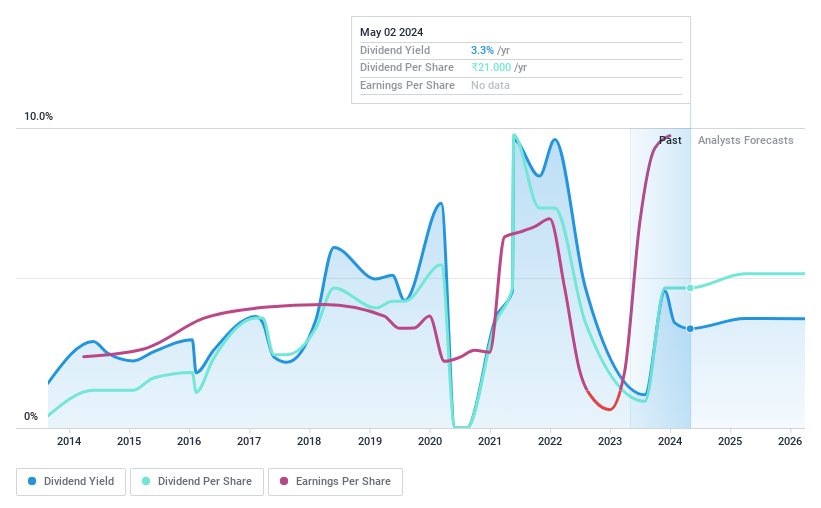

D. B

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms, with additional services in event management across India and globally, holding a market cap of approximately ₹70.23 billion.

Operations: D. B. Corp Limited generates revenue primarily through its printing and publishing business, which contributed ₹22.43 billion, and its radio segment, which added ₹1.59 billion.

Dividend Yield: 3.3%

D. B. Corp Limited, with a dividend yield of 3.3%, ranks in the upper quartile of Indian dividend stocks, significantly above the market average of 1.11%. Despite historical volatility in its dividends, recent earnings growth—151.7% over the past year—and forecasts suggest improvement. The company maintains a sustainable payout with its earnings and cash flows covering 54.4% and 43.6% respectively, indicating a stable financial base for future dividends amidst management changes and consistent interim dividends declarations like the recent INR 8 per share.

Click here to discover the nuances of D. B with our detailed analytical dividend report.

Upon reviewing our latest valuation report, D. B's share price might be too optimistic.

Where To Now?

Click here to access our complete index of 15 Top Indian Dividend Stocks.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCL NSEI:COALINDIA and NSEI:DBCORP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com