Top LSE High Growth Stock

Want to add more growth to your portfolio but not sure where to look? Companies such as Ashmore Group and DS Smith are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

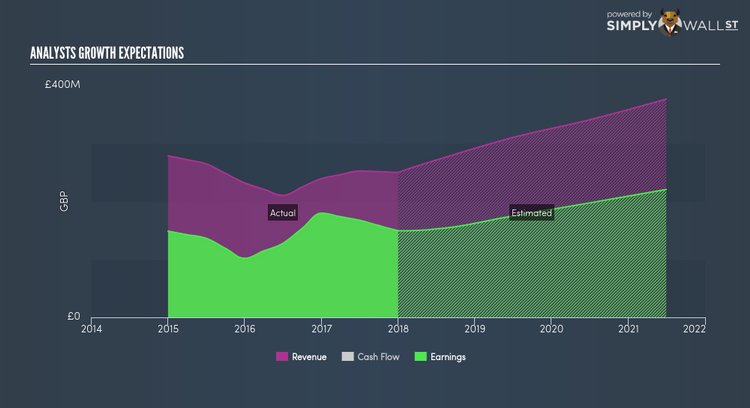

Ashmore Group PLC (LSE:ASHM)

Ashmore Group plc is a publicly owned investment manager. Established in 1992, and currently headed by CEO Mark Coombs, the company currently employs 257 people and with the company’s market cap sitting at GBP £2.53B, it falls under the mid-cap stocks category.

Driven by the positive double-digit sales growth of 30.15% over the next few years, ASHM is expected to deliver an excellent earnings growth of 12.21%. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 22.18%. ASHM’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in ASHM? I recommend researching its fundamentals here.

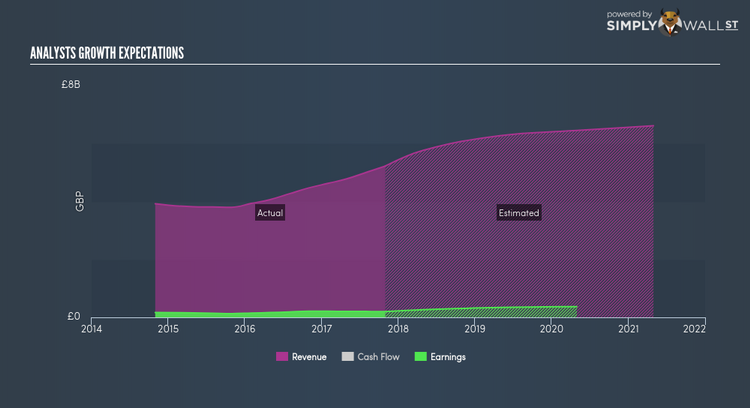

DS Smith Plc (LSE:SMDS)

DS Smith Plc designs and manufactures corrugated packaging and plastic packaging for consumer goods worldwide. Established in 1940, and now led by CEO Miles Roberts, the company employs 26,000 people and with the company’s market cap sitting at GBP £6.00B, it falls under the mid-cap stocks category.

SMDS’s forecasted bottom line growth is an optimistic 20.58%, driven by the underlying double-digit sales growth of 21.80% over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 19.35%. SMDS’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in SMDS? Other fundamental factors you should also consider can be found here.

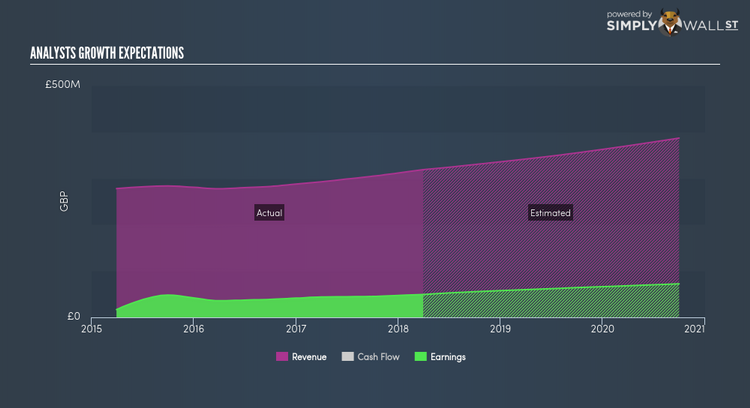

Brewin Dolphin Holdings PLC (LSE:BRW)

Brewin Dolphin Holdings PLC, together with its subsidiaries, provides wealth management services in the United Kingdom, the Channel Islands, and the Republic of Ireland. Started in 1762, and now led by CEO David Nicol, the company employs 1,646 people and has a market cap of GBP £1.04B, putting it in the small-cap category.

BRW’s forecasted bottom line growth is an optimistic double-digit 14.81%, driven by the underlying double-digit sales growth of 16.28% over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 24.24%. BRW ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering BRW as a potential investment? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance