Top NasdaqCM Companies To Buy For Cheap

Companies that trade at market prices below their actual values, such as Gravity and CNX Midstream Partners, are perceived to be undervalued. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

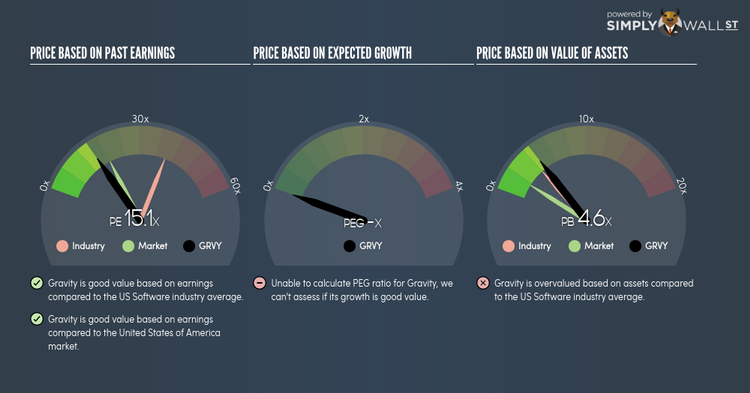

Gravity Co., Ltd. (NASDAQ:GRVY)

Gravity Co., Ltd. develops, publishes, and distributes online games in South Korea, Japan, the United States, Canada, Taiwan, the Philippines, Thailand, Hong Kong, Macau, China, and internationally. Established in 2000, and headed by CEO Hyun Park, the company currently employs 353 people and with the company’s market cap sitting at USD $198.22M, it falls under the small-cap stocks category.

GRVY’s shares are now hovering at around -60% lower than its true level of KRW143.06, at a price of US$57.05, based on its expected future cash flows. The difference between value and price signals a potential opportunity to buy GRVY shares at a discount. Also, GRVY’s PE ratio is currently around 15.09x against its its Software peer level of, 38.01x meaning that relative to its peers, you can purchase GRVY’s stock for a lower price right now. GRVY also has a healthy balance sheet, as short-term assets amply cover upcoming and long-term liabilities. GRVY has zero debt on its books as well, meaning it has no long term debt obligations to worry about. More detail on Gravity here.

CNX Midstream Partners LP (NYSE:CNXM)

CNX Midstream Partners LP owns, operates, develops, and acquires natural gas gathering and other midstream energy assets in the Marcellus Shale and Utica Shale in Pennsylvania and West Virginia. CNX Midstream Partners was formed in 2014 and with the company’s market capitalisation at USD $1.30B, we can put it in the small-cap category.

CNXM’s shares are now hovering at around -21% beneath its real value of $25.88, at the market price of US$20.45, based on my discounted cash flow model. This discrepancy gives us a chance to invest in CNXM at a discount. Furthermore, CNXM’s PE ratio is around 12.25x against its its Oil and Gas peer level of, 13.31x suggesting that relative to its peers, CNXM’s shares can be purchased for a lower price. CNXM is also a financially robust company, as current assets can cover liabilities in the near term and over the long run.

More on CNX Midstream Partners here.

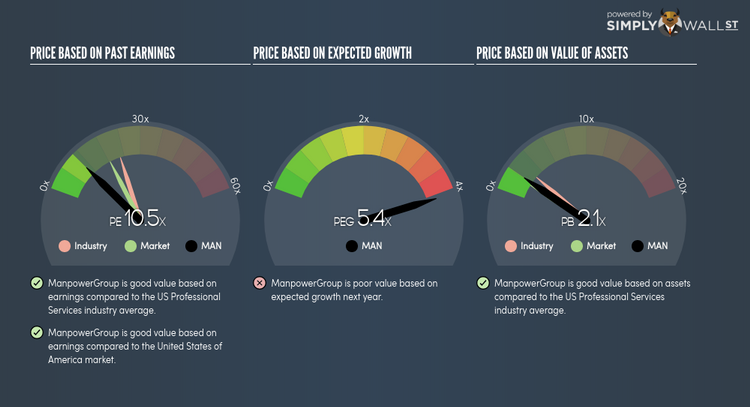

ManpowerGroup Inc. (NYSE:MAN)

ManpowerGroup Inc. provides workforce solutions and services in the Americas, Southern Europe, Northern Europe, and the Asia Pacific Middle East region. Founded in 1948, and currently lead by Jonas Prising, the company provides employment to 29,000 people and with the market cap of USD $5.89B, it falls under the mid-cap group.

MAN’s shares are now trading at -22% less than its actual level of $114.5, at the market price of US$89.50, based on my discounted cash flow model. This mismatch signals an opportunity to buy MAN shares at a discount. In addition to this, MAN’s PE ratio is currently around 10.52x while its Professional Services peer level trades at, 22.55x indicating that relative to its comparable set of companies, MAN’s stock can be bought at a cheaper price. MAN is also a financially healthy company, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Interested in ManpowerGroup? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance