Top Picks For Dividend Rockstars

Castings is one of companies on my list of top dividend stocks. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

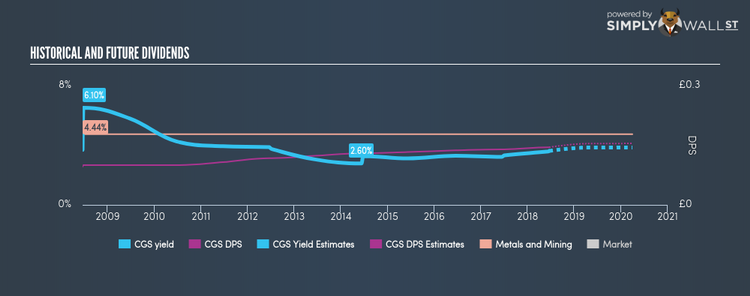

Castings P.L.C. (LSE:CGS)

Castings P.L.C. engages in iron casting and machining activities. Established in 1907, and headed by CEO Adam Vicary, the company now has 1,042 employees and with the company’s market cap sitting at GBP £186.53M, it falls under the small-cap group.

CGS has a solid dividend yield of 3.39% and has a payout ratio of 64.57% . CGS’s dividends have increased in the last 10 years, with DPS increasing from UK£0.097 to UK£0.14. The company has been a dependable payer too, not missing a payment in this 10 year period. Over the next year, analysts are estimating a double digit EPS growth of 37.60%. Interested in Castings? Find out more here.

Wilmington plc (LSE:WIL)

Wilmington plc provides information, education, and networking services to professional markets worldwide. Founded in 1995, and currently headed by CEO Pedro Ros, the company now has 856 employees and with the company’s market capitalisation at GBP £222.79M, we can put it in the small-cap stocks category.

WIL has a good dividend yield of 3.33% and is distributing 73.42% of earnings as dividends . Over the past 10 years, WIL has increased its dividends from UK£0.063 to UK£0.085. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Dig deeper into Wilmington here.

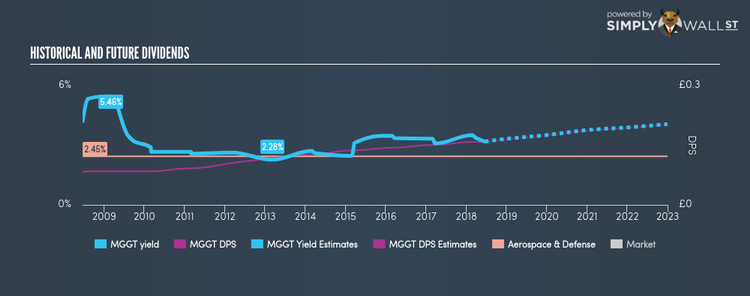

Meggitt PLC (LSE:MGGT)

Meggitt PLC designs and manufactures components and sub-systems for aerospace, defense, energy, medical, industrial, test, and automotive markets in the United Kingdom, rest of Europe, the United States, and internationally. Formed in 1947, and now run by Anthony Wood, the company employs 11,226 people and with the stock’s market cap sitting at GBP £3.84B, it comes under the mid-cap group.

MGGT has a solid dividend yield of 3.19% and the company has a payout ratio of 35.06% , with an expected payout of 51.26% in three years. MGGT’s last dividend payment was UK£0.16, up from it’s payment 10 years ago of UK£0.082. It should comfort existing and potential future shareholders to know that MGGT hasn’t missed a payment during this time. Meggitt’s earnings growth over the past 12 months has exceeded the gb aerospace & defense industry, with the company reporting an EPS growth of 104.44% while the industry totaled 19.68%. Continue research on Meggitt here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance