Top Ranked Income Stocks to Buy for March 13th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 13th:

Just Energy Group Inc. (JE): This renewable energy solutions provider has witnessed the Zacks Consensus Estimate for its current year earnings rising more than 100% over the last 60 days.

Just Energy Group, Inc. Price and Consensus

Just Energy Group, Inc. Price and Consensus | Just Energy Group, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 8.31%, compared with the industry average of 2.91%. Its five-year average dividend yield is 9.68%.

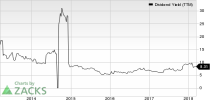

Just Energy Group, Inc. Dividend Yield (TTM)

Just Energy Group, Inc. dividend-yield-ttm | Just Energy Group, Inc. Quote

BT Group plc (BT): This communications services provider has witnessed the Zacks Consensus Estimate for its current year earnings rising 7.1% over the last 60 days.

BT Group PLC Price and Consensus

BT Group PLC price-consensus-chart | BT Group PLC Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 5.92%, compared with the industry average of 0.87%. Its five-year average dividend yield is 3.23%.

BT Group PLC Dividend Yield (TTM)

BT Group PLC dividend-yield-ttm | BT Group PLC Quote

Watsco, Inc. (WSO): This distributor of air conditioning and refrigeration equipment has witnessed the Zacks Consensus Estimate for its current year earnings rising 7.1% over the last 60 days.

Watsco, Inc. Price and Consensus

Watsco, Inc. price-consensus-chart | Watsco, Inc. Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 2.75%, compared with the industry average of 0.70%. Its five-year average dividend yield is 2.25%.

Watsco, Inc. Dividend Yield (TTM)

Watsco, Inc. dividend-yield-ttm | Watsco, Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp. and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

Just Energy Group, Inc. (JE) : Free Stock Analysis Report

BT Group PLC (BT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance