Top Ranked Income Stocks to Buy for December 4th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, December 4th:

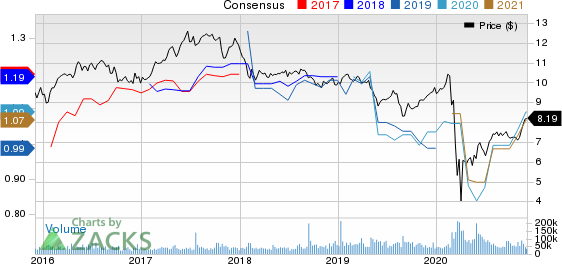

Annaly Capital Management, Inc. (NLY): This diversified capital manager has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9% over the last 60 days.

Annaly Capital Management Inc Price and Consensus

Annaly Capital Management Inc price-consensus-chart | Annaly Capital Management Inc Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 14.7%, compared with the industry average of 6.4%. Its five-year average dividend yield is 12.4%.

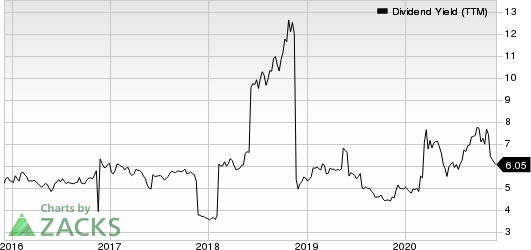

Annaly Capital Management Inc Dividend Yield (TTM)

Annaly Capital Management Inc dividend-yield-ttm | Annaly Capital Management Inc Quote

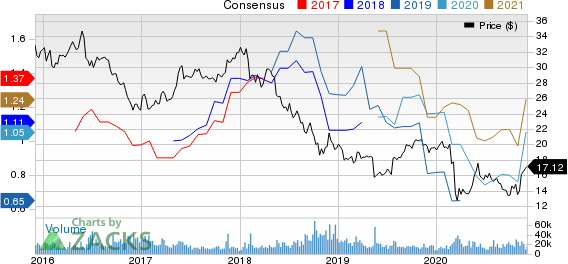

Vodafone Group Plc (VOD): This telecommunication services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 38.2% over the last 60 days.

Vodafone Group PLC Price and Consensus

Vodafone Group PLC price-consensus-chart | Vodafone Group PLC Quote

This Zacks Rank #2 company has a dividend yield of 6.1%, compared with the industry average of 2.5%. Its five-year average dividend yield is 6.1%.

Vodafone Group PLC Dividend Yield (TTM)

Vodafone Group PLC dividend-yield-ttm | Vodafone Group PLC Quote

Landmark Infrastructure Partners LP (LMRK): This real property interests and infrastructure assets developer has witnessed the Zacks Consensus Estimate for its current year earnings increasing 27.8% over the last 60 days.

Landmark Infrastructure Partners LP Price and Consensus

Landmark Infrastructure Partners LP price-consensus-chart | Landmark Infrastructure Partners LP Quote

This Zacks Rank #2 company has a dividend yield of 7.6%, compared with the industry average of 0.0%. Its five-year average dividend yield is 9.2%.

Landmark Infrastructure Partners LP Dividend Yield (TTM)

Landmark Infrastructure Partners LP dividend-yield-ttm | Landmark Infrastructure Partners LP Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vodafone Group PLC (VOD) : Free Stock Analysis Report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

Landmark Infrastructure Partners LP (LMRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance