Top Ranked Value Stocks to Buy for April 17th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 17th:

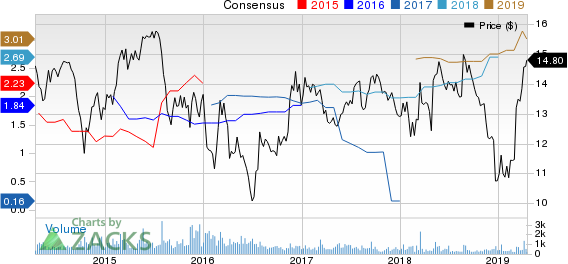

Fly Leasing Limited (FLY): This company that buys and leases commercial aircrafts has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 7.1% over the last 60 days.

Fly Leasing Limited Price and Consensus

Fly Leasing Limited price-consensus-chart | Fly Leasing Limited Quote

Fly Leasing has a price-to-earnings ratio (P/E) of 4.92, compared with 10.00 for the industry. The company possesses a Value Score of B.

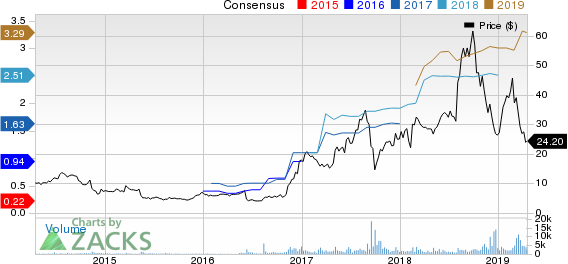

Health Insurance Innovations, Inc. (HIIQ): This cloud-based technology platform and distributor of health insurance plans has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 9.3% over the last 60 days.

Health Insurance Innovations, Inc. Price and Consensus

Health Insurance Innovations, Inc. price-consensus-chart | Health Insurance Innovations, Inc. Quote

Health Insurance Innovations has a price-to-earnings ratio (P/E) of 7.36, compared with 9.20 for the industry. The company possesses a Value Score of B.

Affiliated Managers Group, Inc. (AMG): This asset management company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.9% over the last 60 days.

Affiliated Managers Group, Inc. Price and Consensus

Affiliated Managers Group, Inc. price-consensus-chart | Affiliated Managers Group, Inc. Quote

Affiliated Managers has a price-to-earnings ratio (P/E) of 7.91, compared with 55.80 for the industry. The company possesses a Value Score of A.

Atlas Air Worldwide Holdings, Inc. (AAWW): This outsourced aircraft and aviation operating services provider has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 4.7% over the last 60 days.

Atlas Air Worldwide Holdings Price and Consensus

Atlas Air Worldwide Holdings price-consensus-chart | Atlas Air Worldwide Holdings Quote

Atlas Air Worldwide has a price-to-earnings ratio (P/E) of 6.64, compared with 17.60 for the industry. The company possesses a Value Score of A.

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Is your investment advisor fumbling your financial future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.” Click to get your free report.

Health Insurance Innovations, Inc. (HIIQ) : Free Stock Analysis Report

Fly Leasing Limited (FLY) : Free Stock Analysis Report

Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance