Top Ranked Value Stocks to Buy for May 23rd

Here are three stocks with buy rank and strong value characteristics for investors to consider today, May 23rd:

SYNNEX Corporation (SNX): This business process services provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.9% over the last 60 days.

SYNNEX Corporation Price and Consensus

SYNNEX Corporation price-consensus-chart | SYNNEX Corporation Quote

SYNNEX has a price-to-earnings ratio (P/E) of 8.12, compared with 16.20 for the industry. The company possesses a Value Score of A.

SYNNEX Corporation PE Ratio (TTM)

SYNNEX Corporation pe-ratio-ttm | SYNNEX Corporation Quote

Reliance Steel & Aluminum Co. (RS): This metals service center company has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 6.3% over the last 60 days.

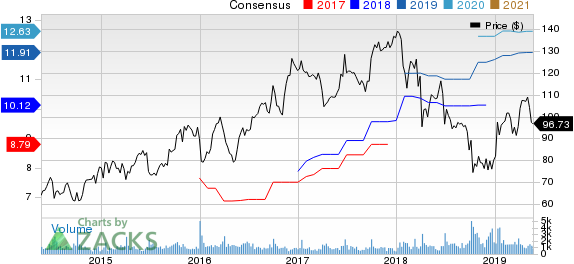

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Reliance Steel has a price-to-earnings ratio (P/E) of 9.40, compared with 19.30 for the industry. The company possesses a Value Score of A.

Reliance Steel & Aluminum Co. PE Ratio (TTM)

Reliance Steel & Aluminum Co. pe-ratio-ttm | Reliance Steel & Aluminum Co. Quote

Textainer Group Holdings Limited (TGH): This company that engages in the purchasing and leasing of a fleet of intermodal containers has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 0.7% over the last 60 days.

Textainer Group Holdings Limited Price and Consensus

Textainer Group Holdings Limited price-consensus-chart | Textainer Group Holdings Limited Quote

Textainer has a price-to-earnings ratio (P/E) of 6.69 compared with 9.90 for the industry. The company possesses a Value Score of A.

Textainer Group Holdings Limited PE Ratio (TTM)

Textainer Group Holdings Limited pe-ratio-ttm | Textainer Group Holdings Limited Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Textainer Group Holdings Limited (TGH) : Free Stock Analysis Report

SYNNEX Corporation (SNX) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance