Top Rated Dividend Stocks

NorthWestern is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

NorthWestern Corporation (NYSE:NWE)

NorthWestern Corporation, doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and industrial customers. Established in 1923, and currently headed by CEO Robert Rowe, the company employs 1,557 people and with the company’s market capitalisation at USD $2.61B, we can put it in the mid-cap stocks category.

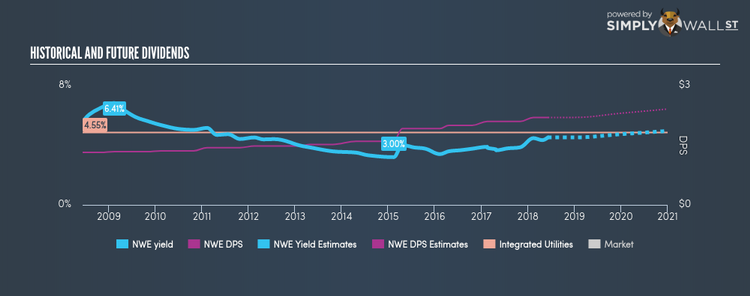

NWE has a substantial dividend yield of 4.24% and pays out 63.01% of its profit as dividends , with an expected payout of 66.09% in three years. NWE’s dividends have increased in the last 10 years, with DPS increasing from US$1.32 to US$2.20. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Interested in NorthWestern? Find out more here.

AmTrust Financial Services, Inc. (NASDAQ:AFSI)

AmTrust Financial Services, Inc. provides property and casualty insurance in the United States and internationally. Established in 1998, and now run by Barry Zyskind, the company employs 9,300 people and has a market cap of USD $2.71B, putting it in the mid-cap stocks category.

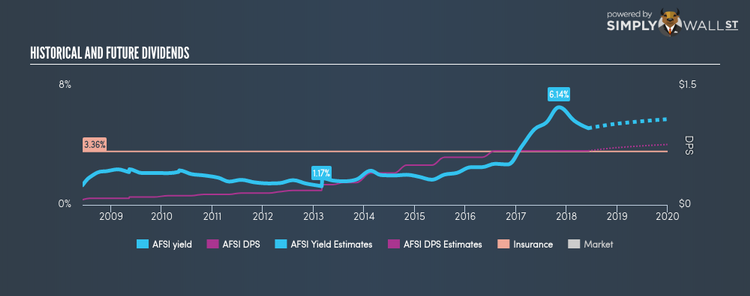

AFSI has a great dividend yield of 4.82% and pays 58.37% of its earnings as dividends . Over the past 10 years, AFSI has increased its dividends from US$0.066 to US$0.68. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Continue research on AmTrust Financial Services here.

Magellan Midstream Partners, L.P. (NYSE:MMP)

Magellan Midstream Partners, L.P. engages in the transportation, storage, and distribution of refined petroleum products and crude oil in the United States. Formed in 2000, and now run by Michael Mears, the company currently employs 1,802 people and has a market cap of USD $16.12B, putting it in the large-cap category.

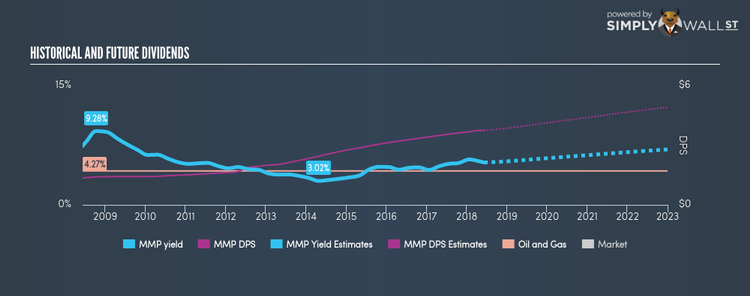

MMP has an alluring dividend yield of 5.33% and is distributing 97.19% of earnings as dividends . The company’s DPS has increased from US$1.35 to US$3.75 over the last 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Interested in Magellan Midstream Partners? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance