Top Three Japanese Dividend Stocks For July 2024

As Japan's stock markets experienced notable gains this week, with the Nikkei 225 Index rising by 2.6% and the TOPIX Index increasing by 3.1%, investors are closely monitoring opportunities within this buoyant environment. In light of these developments, identifying dividend stocks that offer potential for steady returns could be particularly appealing for those looking to benefit from Japan's current economic dynamics.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.77% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.57% | ★★★★★★ |

Globeride (TSE:7990) | 3.77% | ★★★★★★ |

Nihon Tokushu Toryo (TSE:4619) | 3.85% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.43% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.02% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.07% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.42% | ★★★★★★ |

Innotech (TSE:9880) | 3.98% | ★★★★★★ |

Click here to see the full list of 377 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

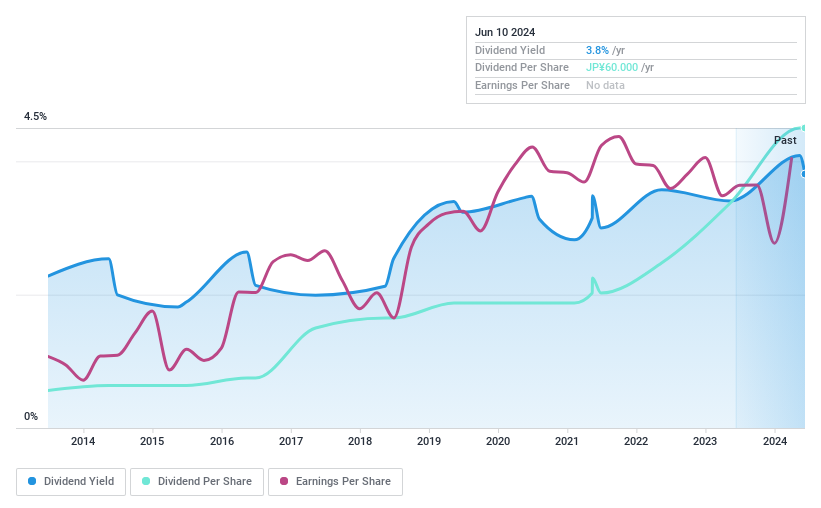

Tanabe Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tanabe Engineering Corporation specializes in plant construction and machinery production in Japan, with a market capitalization of ¥18.56 billion.

Operations: Tanabe Engineering Corporation generates ¥50.51 billion from facility installation works and ¥1.24 billion from its surface treatment business.

Dividend Yield: 3.4%

Tanabe Engineering, with a price-to-earnings ratio of 9.8x, sits below the Japanese market average. Despite a modest annual earnings growth of 0.7% over five years, its dividend sustainability is questionable as dividends are not well-covered by free cash flow or earnings. The firm has increased its dividend from JPY 40 to JPY 50 per share last year and plans a further increase to JPY 60 next year, suggesting confidence in future profitability despite current coverage issues.

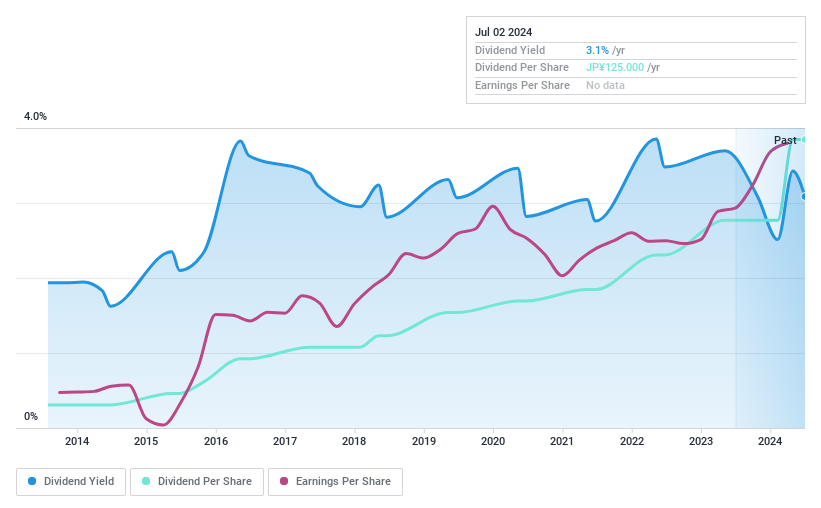

Ryoyu Systems

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ryoyu Systems Co., Ltd. offers information technology (IT) solutions across multiple industries in Japan, with a market capitalization of approximately ¥25.78 billion.

Operations: Ryoyu Systems Co., Ltd. generates ¥37.06 billion in revenue primarily from its Information Service segment.

Dividend Yield: 3.1%

Ryoyu Systems has demonstrated a solid track record with a stable dividend yield of 3.09%, underperforming slightly against the top quartile of Japanese dividend stocks at 3.4%. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 31.6% and 23.3% respectively, indicating sustainability. Despite trading at a significant discount to estimated fair value, its dividends have shown consistent growth over the past decade, reinforcing reliability in its payout policy.

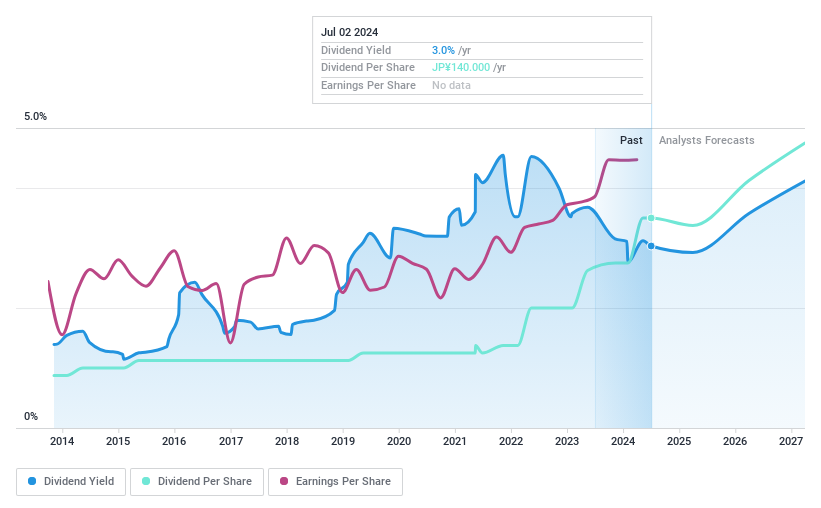

77 Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers a range of banking products and services to both corporate and individual customers in Japan, boasting a market capitalization of approximately ¥341.91 billion.

Operations: The 77 Bank, Ltd. generates revenue primarily through its banking business segment, which amassed ¥145.09 billion.

Dividend Yield: 3%

77 Bank offers a steady dividend yield of 3.03%, slightly below the top Japanese dividend payers. Its dividends have shown growth and stability over the past decade, supported by a low payout ratio of 30.4%, suggesting sustainability from earnings. The bank's recent performance includes an 18.9% earnings increase last year with projections for continued growth at 6.75% annually. However, it faces challenges with a high bad loans ratio of 2% and only 52% coverage for these loans, indicating potential risk in asset quality.

Seize The Opportunity

Get an in-depth perspective on all 377 Top Dividend Stocks by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:1828 TSE:4685 and TSE:8341.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance