Top TSX Dividend Stocks For July 2024

The Canadian market has shown robust performance recently, with a 2.5% increase over the past week and an impressive 12% climb over the last year. With earnings expected to grow by 15% annually, investors might consider dividend stocks that potentially offer both stability and growth in this optimistic economic environment.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.61% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.12% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.45% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.21% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.29% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.75% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.82% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.09% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.55% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.27% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bank of Nova Scotia

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Bank of Nova Scotia, operating internationally with a focus on the Americas, offers a wide range of banking products and services, with a market capitalization of CA$78.88 billion.

Operations: The Bank of Nova Scotia generates revenue through several key segments: Canadian Banking (CA$11.46 billion), International Banking (CA$9.60 billion), Global Wealth Management (CA$5.43 billion), and Global Banking and Markets (CA$5.35 billion).

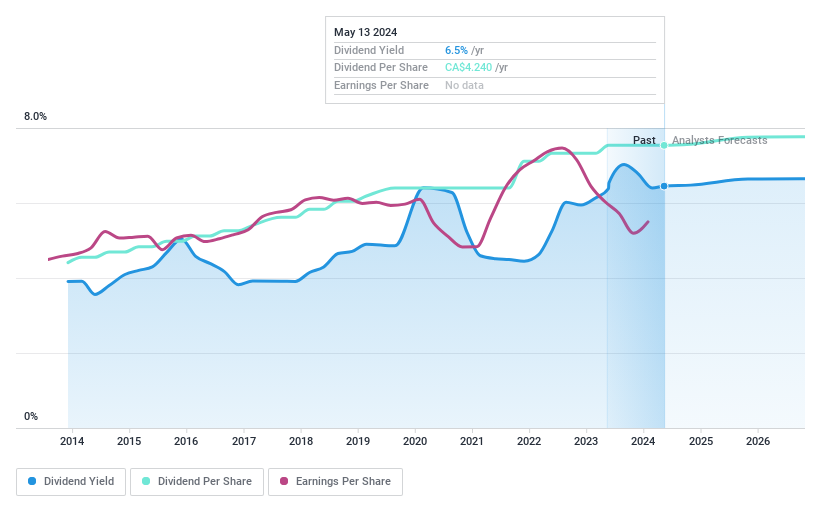

Dividend Yield: 6.6%

Bank of Nova Scotia's dividend sustainability is supported by a payout ratio of 69.7%, indicating that dividends are well-covered by earnings. This figure is projected to slightly decrease to 61.1% over the next three years, maintaining adequate coverage. The bank's dividend yield stands at a competitive 6.61%, placing it in the top quartile of Canadian dividend payers. Additionally, it has maintained a consistent increase in dividend payments over the past decade, underscoring its reliability as a dividend stock despite recent extensive activities in fixed-income offerings and strategic corporate actions like debenture redemptions aimed at managing capital efficiently.

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. operates in providing horizontal and directional drilling services, renting performance drilling motors, and selling motor equipment and parts to oil and natural gas companies across Canada, the United States, Albania, the Middle East, and internationally, with a market cap of CA$443.49 million.

Operations: PHX Energy Services Corp. generates CA$656.44 million from horizontal oil and natural gas well drilling services.

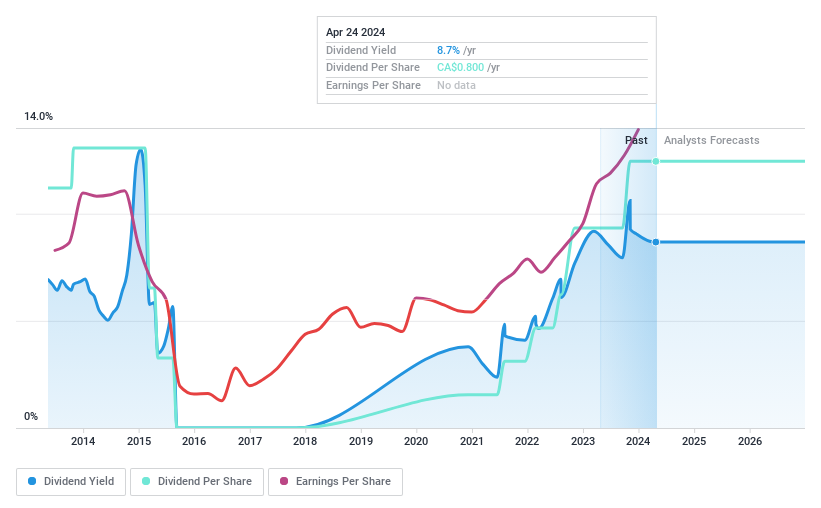

Dividend Yield: 8.5%

PHX Energy Services Corp. declared a quarterly cash dividend of C$0.20 per share, payable on July 15, 2024, highlighting its commitment to returning value to shareholders. Despite a robust dividend yield of 8.51%, which ranks in the top 25% for Canadian dividend stocks, concerns linger regarding the sustainability of these payments due to a high cash payout ratio of 138.2%. Additionally, while earnings have grown by 35.6% over the past year, forecasts suggest an average decline in earnings by about 4.3% annually over the next three years, potentially impacting future dividends.

Power Corporation of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in financial services across North America, Europe, and Asia with a market capitalization of approximately CA$25.64 billion.

Operations: Power Corporation of Canada generates CA$23.51 billion from its Lifeco segment, CA$3.67 billion from Power Financial - IGM, and CA$1.59 billion through its Alternative Asset Investment Platforms and Other segment.

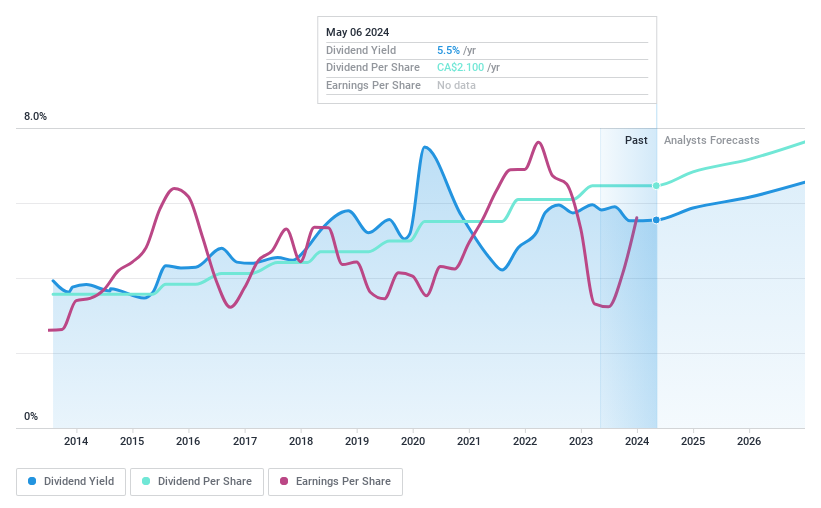

Dividend Yield: 5.6%

Power Corporation of Canada offers a stable dividend yield of 5.64%, supported by a payout ratio of 49.9% and cash flow coverage at 28.3%, indicating reliable dividend sustainability. Despite trading below its estimated fair value, its dividend yield remains lower than the top quartile in the Canadian market at 6.58%. Recent significant earnings growth and modest future earnings growth projections suggest potential for continued dividend reliability, though recent shareholder proposals related to ESG measures were not approved, reflecting possible governance concerns among investors.

Where To Now?

Dive into all 33 of the Top TSX Dividend Stocks we have identified here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BNS TSX:PHX and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com