Top TSX Dividend Stocks To Watch In July 2024

As central banks like the Bank of Canada initiate rate cuts in response to softening economic indicators and cooling inflation, investors may find this evolving landscape influential on market dynamics. In such an environment, dividend stocks could be particularly appealing for their potential to offer steady income streams and relative stability amidst broader market fluctuations.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.87% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.19% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.34% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.42% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.36% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.94% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.18% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.64% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.28% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Evertz Technologies

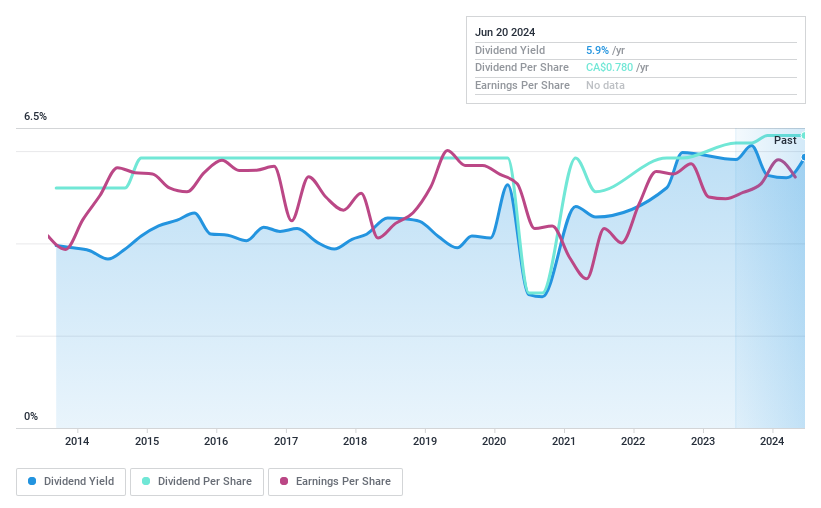

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited specializes in designing, manufacturing, and distributing video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications sectors globally, with a market cap of approximately CA$951.29 million.

Operations: Evertz Technologies Limited generates CA$514.62 million from its television broadcast equipment segment.

Dividend Yield: 6%

Evertz Technologies has demonstrated a mixed performance in dividends, with a history of volatility and unreliability over the past decade. Despite this, its current payout ratio at 84% suggests earnings sufficiently cover dividend payments, complemented by a cash payout ratio of 44%. Recent financials show a dip in quarterly net income and EPS, but annual figures indicate growth in sales and net income. The company recently affirmed its regular quarterly dividend at CA$0.195 per share.

IGM Financial

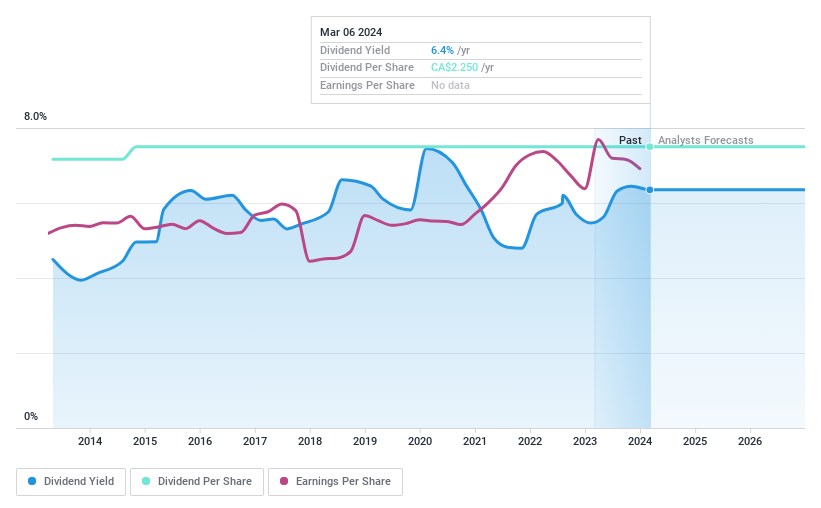

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$8.84 billion.

Operations: IGM Financial Inc. generates its revenue primarily through two segments: Asset Management, which brought in CA$1.19 billion, and Wealth Management, contributing CA$2.26 billion.

Dividend Yield: 6%

IGM Financial maintains a consistent dividend yield of 6%, slightly below the top Canadian payers. Its dividends are well-supported by both earnings and cash flow, with payout ratios of 69.5% and 75% respectively, indicating sustainability. Despite trading at a significant discount to its estimated fair value, recent financials show a decline in revenue and net income, suggesting potential challenges ahead. Stability in dividend payments over the past decade adds an element of reliability for investors.

Unlock comprehensive insights into our analysis of IGM Financial stock in this dividend report.

Our valuation report unveils the possibility IGM Financial's shares may be trading at a discount.

Russel Metals

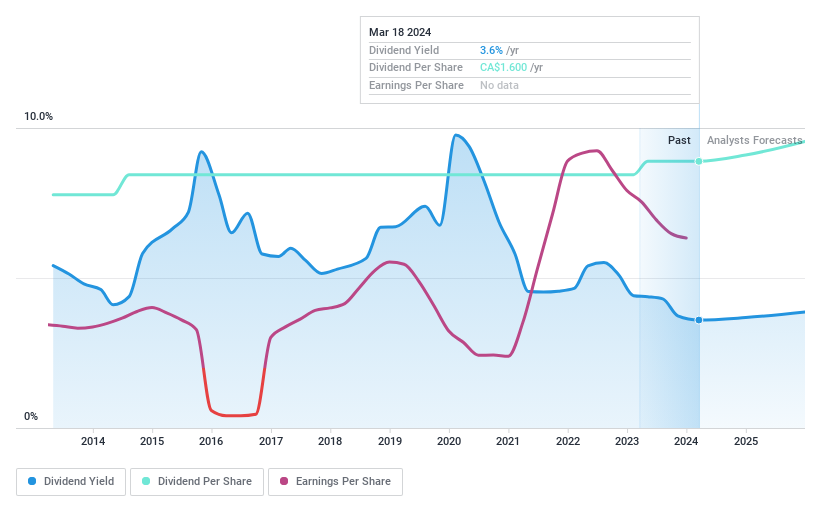

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Russel Metals Inc. is a metal distribution and processing company with operations in Canada and the United States, boasting a market capitalization of approximately CA$2.11 billion.

Operations: Russel Metals Inc. generates its revenue primarily through three segments: Metals Service Centers at CA$2.95 billion, Energy Field Stores at CA$982.20 million, and Steel Distributors at CA$429 million.

Dividend Yield: 4.6%

Russel Metals offers a stable dividend yield of 4.64%, supported by a low payout ratio of 40.3% and cash flow coverage at 31.4%, indicating sustainability despite being lower than the top Canadian dividend payers. With a P/E ratio of 8.8x, it trades below the market average, suggesting potential value. Recent developments include a strategic acquisition set to close in Q3 2024 and a modest dividend increase to CA$0.42 per share as of June 2024, reflecting ongoing financial commitment to shareholders amidst fluctuating earnings reported in Q1 2024.

Taking Advantage

Delve into our full catalog of 33 Top TSX Dividend Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ET TSX:IGM and TSX:RUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com