Top TSX Growth Companies With High Insider Ownership For September 2024

The Canadian market has climbed 1.2% in the last 7 days and is up 16% over the past 12 months, with earnings forecast to grow by 15% annually. In this favorable environment, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 70.7% |

Allied Gold (TSX:AAUC) | 21.9% | 73.5% |

Almonty Industries (TSX:AII) | 17.7% | 117.6% |

goeasy (TSX:GSY) | 21.2% | 17.1% |

Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

Propel Holdings (TSX:PRL) | 40% | 37.2% |

Aritzia (TSX:ATZ) | 18.9% | 60.4% |

Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

Alpha Cognition (CNSX:ACOG) | 17% | 69.5% |

ROK Resources (TSXV:ROK) | 16.6% | 161.8% |

We'll examine a selection from our screener results.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$24.33 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals primarily in Africa.

Insider Ownership: 12.3%

Revenue Growth Forecast: 83% p.a.

Ivanhoe Mines, a growth company with high insider ownership in Canada, has recently signed an MOU with Zambia's Ministry of Mines to co-develop mineral projects. The Kamoa-Kakula Copper Complex achieved record production levels in August, and the Phase 3 concentrator is nearing steady-state production. Despite recent earnings showing a decline compared to last year, analysts forecast substantial annual profit and revenue growth for Ivanhoe Mines, significantly outpacing the Canadian market.

Click to explore a detailed breakdown of our findings in Ivanhoe Mines' earnings growth report.

Our valuation report unveils the possibility Ivanhoe Mines' shares may be trading at a discount.

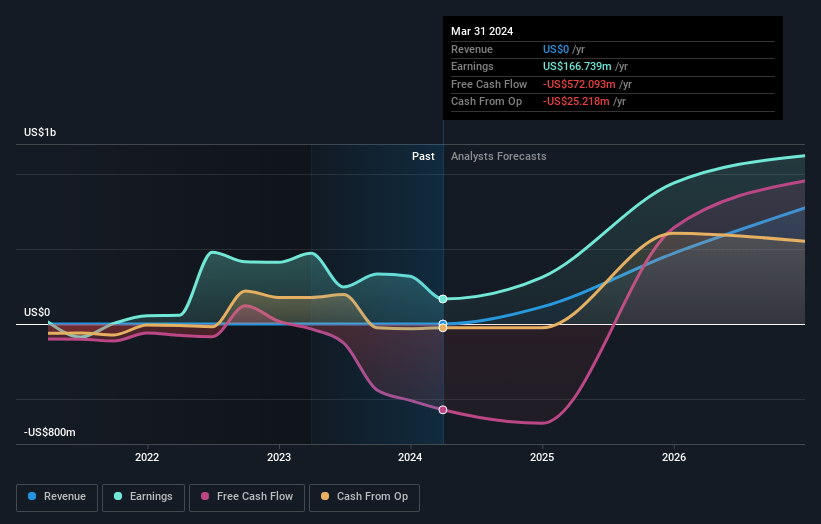

Nuvei

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuvei Corporation offers payment technology solutions to merchants and partners across various regions including North America, Europe, the Middle East and Africa, Latin America, and the Asia Pacific, with a market cap of CA$6.42 billion.

Operations: Nuvei generates revenue of $1.31 billion from providing payment technology solutions to merchants and partners globally.

Insider Ownership: 20.1%

Revenue Growth Forecast: 12.5% p.a.

Nuvei, expected to become profitable within three years with annual earnings growth forecasted at 96.72%, has seen significant insider buying over the past quarter. Although its Return on Equity is projected to be low (18.2%), revenue is set to grow faster than the Canadian market at 12.5% annually. Recent partnerships, such as those with Fintech360 and Scanco Software, enhance its payment processing capabilities and global reach in the fintech sector.

Get an in-depth perspective on Nuvei's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility Nuvei's shares may be trading at a premium.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc., a gold development company, focuses on the identification, acquisition, and development of gold properties with a market cap of CA$2.97 billion.

Operations: Artemis Gold Inc. concentrates on identifying, acquiring, and developing gold properties with a market cap of CA$2.97 billion.

Insider Ownership: 29.9%

Revenue Growth Forecast: 45.9% p.a.

Artemis Gold is forecast to achieve 45.9% annual revenue growth, significantly outpacing the Canadian market's 6.9%. Despite reporting a CAD 5.73 million net loss in Q2 2024, it remains on track for profitability within three years. The Blackwater Mine project is fully funded and scheduled for its first gold pour in Q4 2024, with construction milestones progressing well despite recent wildfire disruptions. Artemis trades at a substantial discount to its estimated fair value.

Turning Ideas Into Actions

Take a closer look at our Fast Growing TSX Companies With High Insider Ownership list of 39 companies by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:IVN TSX:NVEI and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com