Top US Growth Companies With High Insider Ownership In July 2024

As the U.S. stock market continues to reach new heights, with the Nasdaq and S&P 500 setting fresh records, investors are keenly observing trends and opportunities that align with these robust market conditions. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's dive into some prime choices out of from the screener.

Robinhood Markets

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States, with a market capitalization of approximately $20.12 billion.

Operations: The company generates revenue primarily through its brokerage services, totaling approximately $2.04 billion.

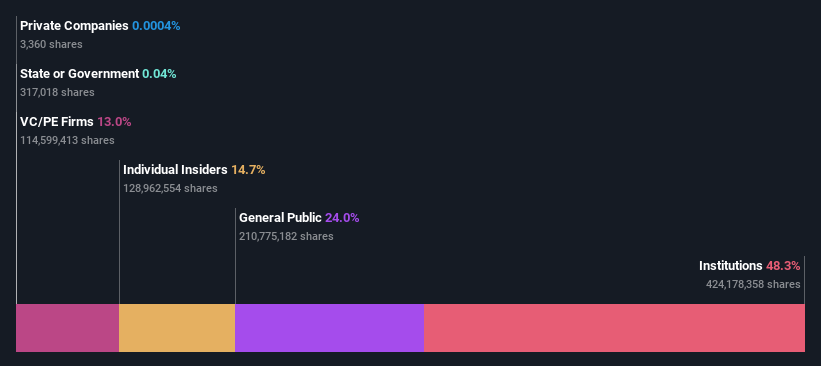

Insider Ownership: 14.7%

Robinhood Markets has recently transitioned to profitability, reporting a net income of US$157 million for Q1 2024, a significant recovery from a net loss the previous year. The company's earnings are expected to grow by 31.57% annually, outpacing the general US market. Despite this robust profit growth forecast, its revenue growth at 9.5% per year is modest but still exceeds average market projections. Additionally, Robinhood announced a substantial share repurchase program valued at up to US$1 billion, underscoring confidence in its future performance and commitment to shareholder value despite a forecasted low return on equity of 4.7% in three years.

Paylocity Holding

Simply Wall St Growth Rating: ★★★★☆☆

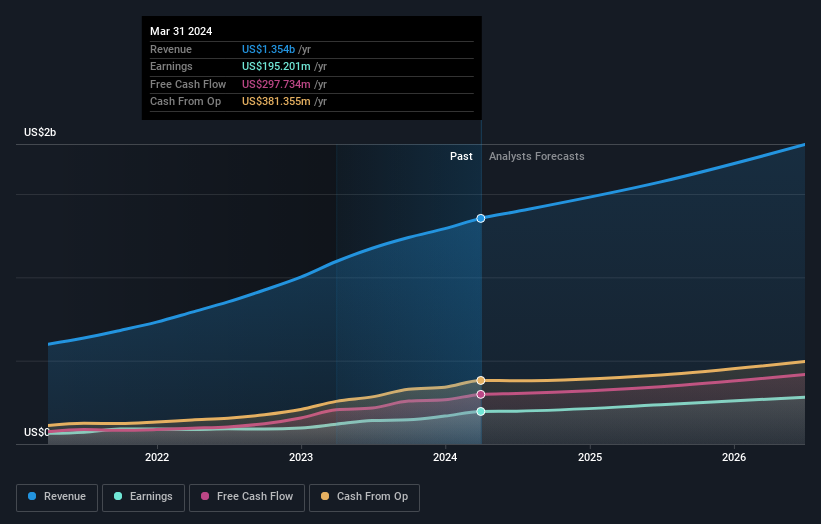

Overview: Paylocity Holding Corporation offers cloud-based human capital management and payroll software solutions in the United States, with a market capitalization of approximately $7.46 billion.

Operations: The company generates its revenue primarily from cloud-based software solutions, totaling approximately $1.35 billion.

Insider Ownership: 20.3%

Paylocity Holding, a growth-oriented company with high insider ownership, is trading at 65.3% below its estimated fair value, signaling potential undervaluation. The firm's recent financial results show strong performance with third-quarter revenue up to US$401.28 million from US$339.86 million the previous year and net income rising to US$85.31 million from US$57.62 million. Analysts predict Paylocity's earnings will grow by 16.7% annually, outpacing the U.S market forecast of 14.7%. Additionally, Paylocity has launched a share repurchase program valued at up to US$500 million, reflecting confidence in its financial health and commitment to shareholder returns.

Peoples Financial Services

Simply Wall St Growth Rating: ★★★★★☆

Overview: Peoples Financial Services Corp., serving as the bank holding company for Peoples Security Bank and Trust Company, offers a range of commercial and retail banking services with a market cap of approximately $308.54 million.

Operations: The company generates its revenue primarily from banking services, totaling $96.88 million.

Insider Ownership: 11.4%

Peoples Financial Services, recently added to multiple Russell indexes, is experiencing robust growth with earnings forecasted to rise by 65.79% annually and revenue growth projected at 29.9% per year—surpassing U.S. market expectations. Despite a recent dip in net income and interest income as reported in Q1 2024, the company maintains a steady dividend payout of US$0.41 per share and trades at 59.6% below its estimated fair value, highlighting potential undervaluation amidst stable shareholder returns.

Make It Happen

Reveal the 184 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:HOOD NasdaqGS:PCTY and NasdaqGS:PFIS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance