Toronto-Dominion (TD) Stock Gains 2.8% as Q4 Earnings Improve

Shares of Toronto-Dominion Bank TD have rallied 2.8% since the release of its fourth-quarter and fiscal 2022 (ended Oct 31) results last week. Quarterly adjusted net income of C$4.07 billion ($3.06 billion) increased 5.1% from the prior-year quarter.

The company recorded a rise in net interest income on the back of higher interest rates and rising loan demand. Also, the company’s balance sheet position was solid during the quarter. However, an increase in expenses and higher provision for credit losses were major headwinds.

After considering several non-recurring items, net income was C$6.67 billion ($5.01 billion), increasing 76.4% year over year.

Adjusted Revenues & Expenses Rise

Quarterly adjusted revenues were C$12.25 billion ($9.21 billion), increasing 11.9% on a year-over-year basis.

Net interest income jumped 21.8% year over year to C$7.63 billion ($5.74 billion). Non-interest income of C$7.93 billion ($5.96 billion) increased 69.5% year over year.

Adjusted non-interest expenses rose 9% year over year to C$6.43 billion ($4.83 billion).

The adjusted efficiency ratio was 52.5% as of Oct 31, 2022, down from 53.9% recorded in the prior-year period.

In the reported quarter, Toronto-Dominion recorded a provision of credit losses of C$617 million ($463.8 million) against a recovery for credit losses recorded in the year-ago quarter.

Balance Sheet Strong, Capital Ratios Improve, Profitability Ratios Weaken

Total assets were C$1.92 trillion ($1.41 trillion) as of Oct 31, 2022, up 4.2% from the end of the third quarter of fiscal 2022. Net loans rose 5.1% on a sequential basis to C$831 billion ($609.5 billion) and deposits increased 2.4% to C$1.23 trillion ($0.90 trillion).

As of Oct 31, 2022, the common equity Tier I capital ratio was 16.2%, up from 15.2% on Oct 31, 2021. The total capital ratio was 20.7% compared with the prior year’s 19.1%.

Toronto-Dominion’s return on common equity (on an adjusted basis) was 16%, down from 16.1% as of Oct 31, 2021.

Key Developments During the Quarter

In August, TD entered an agreement to acquire Cowen Inc. COWN in an all-cash deal worth $1.3 billion or $39 for each share of Cowen’s common stock. The closing of the deal, subject to customary closing conditions, including approvals from Cowen’s shareholders and certain U.S., Canada, and foreign regulatory authorities, is expected in the first quarter of 2023.

In relation to the deal, Toronto-Dominion sold 28.4 million non-voting common shares of The Charles Schwab Corporation SCHW for $1.9 billion. This reduced TD’s ownership interest in Schwab from 13.4% to 12%.

Notably, TD’s strategy with respect to its investment in SCHW has not changed and it has no intention to divest additional shares.

When combined with the share sale, the acquisition of Cowen is expected to be neutral to Toronto-Dominion’s common equity tier 1 ratio, which is expected to be above 11% at closing.

The deal is expected to be modestly accretive to TD’s 2023 adjusted earnings per share on a fully-synergized basis. Also, it will generate approximately 14% adjusted return on invested capital on a fully-synergized run-rate basis.

Our Take

Supported by a diverse geographical presence, Toronto-Dominion’s efforts toward improving revenues and market share, both organically and inorganically, seem impressive. Also, rising interest rates will support the company’s financials.

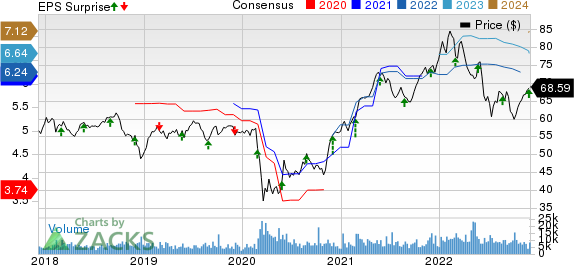

Toronto Dominion Bank The Price, Consensus and EPS Surprise

Toronto Dominion Bank The price-consensus-eps-surprise-chart | Toronto Dominion Bank The Quote

Toronto-Dominion currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Toronto Dominion Bank The (TD) : Free Stock Analysis Report

Cowen Group, Inc. (COWN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance