Toyota (TM) Tops Q4 Earnings Estimates, Cautions on Road Ahead

Toyota Motor TM posted fiscal fourth-quarter 2020 earnings of 45 cents per share against the Zacks Consensus Estimate of a loss of a penny. However, the bottom line compared unfavorably with the year-ago earnings of $2.89 a share. Consolidated revenues came in at $65,190.6 million, surpassing the consensus mark of $63,257 million. Nonetheless, the top line declined 7.3% year over year. Depressed demand for vehicles and weak consumer sentiment amid the COVID-19 pandemic resulted in weaker year-over-year results for the Japan-based auto biggie. Sales and earnings of other auto biggies like Honda HMC, General Motors GM and Ford F also declined in the last reported quarter, hit by coronavirus woes.

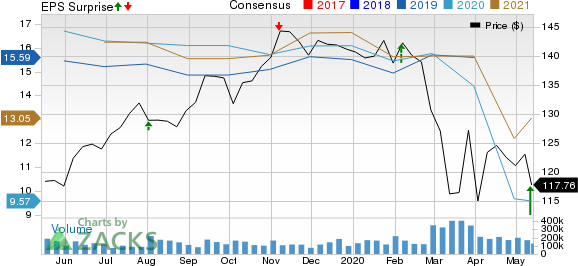

Toyota Motor Corporation Price, Consensus and EPS Surprise

Toyota Motor Corporation price-consensus-eps-surprise-chart | Toyota Motor Corporation Quote

Segmental Results

All the figures mentioned below are U.S. GAAP based.

The Automotive segment’s net revenues fell 7.2% year over year to ¥6.4 trillion ($58.8 billion) in fourth-quarter fiscal 2020. Operating income also decreased 10.3% year over year to ¥352 billion ($3.2 billion).

The Financial Services segment’s net revenues declined 0.3% from the prior-year quarter to ¥547.9 billion ($5.02 billion). The segment incurred operating loss of ¥8.3 billion ($76.1 million) against operating income of ¥85.1 billion recorded in fourth-quarter fiscal 2019.

All Other businesses’ net revenues slipped 41.7% from the year-ago period to ¥300 billion ($2.7 billion) in the quarter under review. Further, operating income declined 29.9% year over year to ¥35.5 billion.

Fiscal 2020 Highlights

In fiscal 2020, consolidated vehicle sales totaled 8,958,423 units, marking a decrease of 18,372 units from fiscal 2019. The automaker’s vehicle sales in North America and Asia also marked a decline. However, sales in Japan, Europe and Other regions (consisting of Central and South America, Oceania, Africa, and the Middle East) rose from the year-ago period.

During the fiscal year, Toyota’s revenues declined 1% year over year to ¥29.9 trillion. However, the company’s operating income declined 1% year over year to ¥2.4 trillion. Unfavorable currency translations and lower revenues amid coronavirus woes dented the results.

Financial Position

Toyota had cash and cash equivalents of ¥4.2 trillion ($39 billion) as of Mar 31, 2020. Long-term debt amounted to ¥10.7 trillion ($99.4 billion). At the end of fiscal 2020, operating cash flow was ¥3.6 trillion, down 4.6% year over year.

Fiscal 2021 Guidance

For fiscal 2021, Toyota expects consolidated vehicle sales of 7 million units, representing a decline from fiscal 2020 levels. The auto giant expects coronavirus to deal a major blow to earnings and sales in fiscal 2021. Toyota expects operating income to decline 79.5% year over year to ¥500 billion, which would mark the lowest profit in nine years. Sales are expected to total ¥24 billion, indicating a 19.8% decline from fiscal 2020 levels. Despite the gloomy scenario and bleak profit and sales forecast, the Zacks Rank #4 (Sell) company intends to spend more than ¥1.1 trillion in R&D expenses, which suggests almost no change from fiscal 2020 levels.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance