TPI Composites (TPIC) Inks Deal to Sell Automotive Business

TPI Composites TPIC announced that it has entered into a definitive agreement to divest its automotive business to Clear Creek Investments, LLC (“CCI”), which will be renamed Senvias. This move is expected to result in an estimated $1.7 million monthly cash flow improvement for TPIC in the remaining half of 2024. The company will now be able to focus on growing its core wind blade business. The transaction is expected to close on Jun 30, 2024.

Clear Creek Investments is a multi-stage investor that puts capital in companies across the Food, Water and Energy (transition & transformation) sectors that focus on driving climate solutions and climate resiliency. TPI Composite’s Automotive business will be a strategic fit for CCI, given its success in developing innovative solutions for the transportation market. CCI will provide capital to Senvias to serve customers in the electric vehicle market.

In fiscal 2023, the Automotive business contributed 2% to TPI Composite’s total revenues. The company’s major portion of revenues (around 96%) was generated from the wind blade and precision molding and assembly systems manufacturing businesses. Field service inspection and repair services contributed 3% to its total revenues.

TPIC is the only independent manufacturer of composite wind blades for the wind energy market with a global manufacturing footprint.

In 2023, TPI Composites witnessed a decline in demand for its wind turbine blades, which was mainly attributed to regulatory uncertainties. Customers and wind farm developers have been deferring investments and awaiting the easing of inflationary pressures and stabilization of global economies, as well as clearer regulatory guidance concerning the Inflation Reduction Act of 2022 and actions proposed by the EU under the REPowerEU plan. The company anticipates demand for wind turbine blades to remain impacted in 2024.

For 2024, TPI Composite expects net sales from continuing operations to be in the range of $1.3-$1.4 billion. Adjusted EBITDA margin from continuing operations is expected to be between 1% and 3%.

Despite the current odds, the long-term outlook for global demand for renewable energy, particularly for wind, remains strong. This is backed by the cost competitiveness of wind energy compared with fossil fuels and increasing preference from companies and utility providers for renewable energy. Also, the need for energy independence and security, and recent international policies formulated to promote the growth of renewable energy will be a significant catalyst. The company, therefore, remains focused on growing its customer base and relationships, adding capacity and evaluating strategic acquisitions to capitalize on this growth.

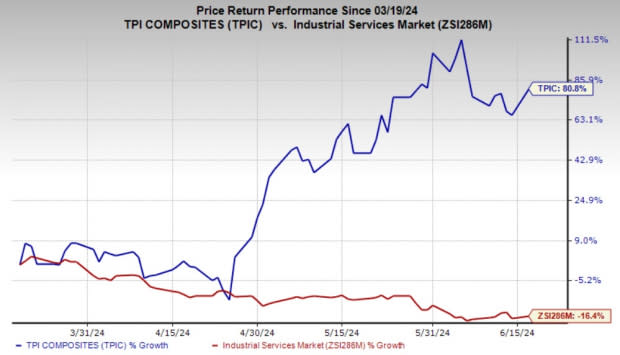

Price Performance

Shares of TPI Composites have gained 80.8% in the past three months against the industry’s 16.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

TPI Composites currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Kaiser Aluminum KALU, Zebra Technologies ZBRA and Brady BRC. While KALU and ZBRA sport a Zacks Rank #1 (Strong Buy) each, BRC carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Kaiser Aluminium’s 2024 earnings is pegged at $4.12 per share, which indicates year-over-year growth of 50.4%. The consensus estimate for earnings has gone up 15% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 137%. KALU shares have gained 11.4% in the past three months.

The consensus estimate for Zebra Technologies’ 2024 earnings is pegged at $12.11 per share. The consensus estimate for earnings has moved up 9% in the past 60 days. The estimate indicates year-over-year growth of 23%. The company has a trailing four-quarter average earnings surprise of 8.56%. ZBRA shares have gained 6% in the past three months.

The Zacks Consensus Estimate for Brady’s 2024 earnings is pegged at $4.13 per share, which indicates year-over-year growth of 13.5%. The consensus estimate has moved up 3% in the past 30 days. The company has a trailing four-quarter average earnings surprise of 6.7%. BRC shares have gained 14% in the last three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kaiser Aluminum Corporation (KALU) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

Brady Corporation (BRC) : Free Stock Analysis Report

TPI Composites, Inc. (TPIC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance