Will Tractor Supply (TSCO) Sustain its Earnings Beat in Q1?

Tractor Supply Company TSCO is slated to release first-quarter 2018 results on Apr 26. Last quarter, the company reported a positive earnings surprise of 4.6%.

Moreover, Tractor Supply delivered an average positive earnings surprise of 2.2% in the trailing four quarters. Notably, the company has been witnessing sales and earnings growth for more than two years now. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question popping up in investors’ minds is whether Tractor Supply will be able to deliver a positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the first quarter is pegged at 59 cents, reflecting growth of 28.3% year over year. Moreover, earnings estimate for the current quarter has climbed in the last seven days, reflecting a positive momentum ahead of earnings. Also, analysts polled by Zacks expect revenues of $1.70 billion, up about 8.4% from the year-ago quarter.

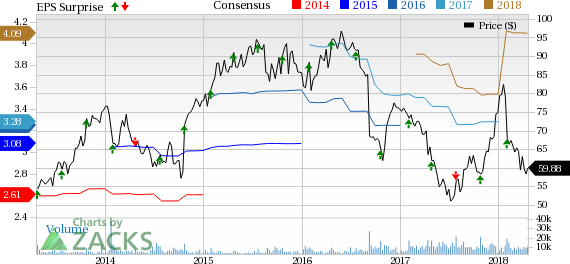

Tractor Supply Company Price, Consensus and EPS Surprise

Tractor Supply Company Price, Consensus and EPS Surprise | Tractor Supply Company Quote

Factors at Play

Tractor Supply remains focused on store-growth initiatives, ONETractor plan and investment in everyday businesses. Evidently, it remains on track to attain the long-term domestic-store growth target of 2,500 stores. Further, the company is focusing on integrating its physical and digital operations to offer consumers a seamless shopping experience.

The company remains on track with its “ONETractor” initiative that is aimed at connecting store and online shopping. In this regard, the company is reaping significant benefits from its Buy Online Pick Up in Store program while it continues to expand its Neighbor’s Club customer rewards program. Management expects both strategies to play a major role in boosting the top line. It also expects long-term results to benefit from its mobile POS and stockyard initiatives.

Moreover, the company is benefiting from solid comps, driven by strength across all regions and major product categories, which fueled its fourth-quarter 2017 results.

Going into 2018, Tractor Supply expects to balance investments between new-store growth and ONETractor strategic initiative, alongside investing in everyday businesses, to provide a seamless experience to customers. This will provide significant growth opportunities as the company will gain market share and leverage its physical stores while expanding digital capabilities. Consequently, it provided an encouraging guidance for the first quarter and full-year 2018.

The company anticipates stronger comps and earnings per share in the first half of the year compared with the second half. Hence, it forecasts comps for the first half at or above 2-3% for 2018 while the second half comps are likely to be below this range.

Further, the company revealed that the first quarter will include one extra comp day as its stores were open on New Year’s Day for the first time. This extra day is likely to add about 60-70 bps to comps for the first quarter and 10-15 bps to full-year comps. Additionally, the company projects highest comps growth and lowest operating-margin compression in the first quarter.

However, the company expects continued cost pressures from rising freight rates, due to a shortage of drivers and higher diesel prices as well as inflationary wage pressures across retail locations and the supply chain. These headwinds, along with the company’s investments to grow business, are likely to keep operating margin for 2018 under pressure. Consequently, operating margin is anticipated to be nearly 8.8%, the mid-point of the company’s guidance range. Additionally, gross margin is anticipated to be flat to marginally down in 2018, with significant impact on SG&A expense.

Further, the shares of Tractor Supply have declined 26.9% in the last three months, wider than the industry’s decline of 12.4%. However, the company’s focus on growth initiatives helped it to outperform the industry in the past year.

Given the above iterations, let’s wait and see if the company’s strategic efforts can offset the margin-related constraints.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Tractor Supply is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

While Tractor Supply has a Zacks Rank #3, an Earnings ESP of -5.50% lowers the chances of a beat in the ensuing release.

Stocks With Favorable Combination

Here are some companies that you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat:

KAR Auction Services Inc. KAR has an Earnings ESP of +1.35% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Columbia Sportswear Company COLM currently has an Earnings ESP of +1.32% and a Zacks Rank #2.

Nordstrom Inc. JWN currently has an Earnings ESP of +12.31% and a Zacks Rank #2.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

KAR Auction Services, Inc (KAR) : Free Stock Analysis Report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance