Tradeweb Markets Inc. (TW) Q1 2024 Earnings: Solid Performance with Revenue and EPS Beating ...

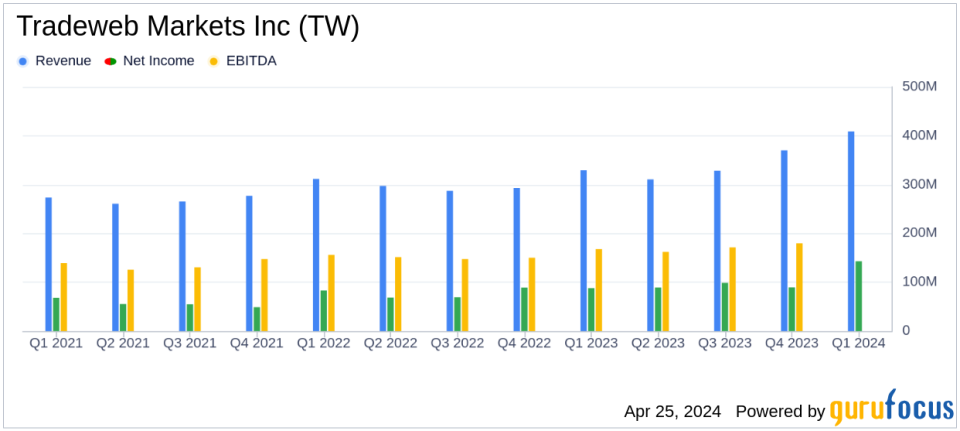

Quarterly Revenue: Reported at $408.7 million, marking a 24.1% increase year-over-year, slightly below the estimate of $411.33 million.

Net Income: Reached $143.4 million, up 40.3% compared to the previous year, exceeding the estimated $168.33 million.

Earnings Per Share (EPS): Diluted EPS was $0.59, with adjusted diluted EPS at $0.71, meeting the estimated EPS of $0.71.

Adjusted EBITDA: Increased to $219.5 million from $172.2 million last year, with the margin expanding to 53.7% from 52.3%.

Average Daily Volume (ADV): Climbed 39.1% to a record $1.9 trillion, with significant growth across multiple trading platforms.

Dividend: Announced a quarterly cash dividend of $0.10 per share, payable on June 17, 2024.

Acquisitions and Growth: Completed the acquisition of r8fin and announced an agreement to acquire ICD for $785 million, expected to close in the second half of 2024.

On April 25, 2024, Tradeweb Markets Inc. (NASDAQ:TW) released its 8-K filing, revealing a robust financial performance for the first quarter ended March 31, 2024. The company reported quarterly revenues of $408.7 million, surpassing the estimated $411.33 million, and showcasing a significant 24.1% increase from the previous year. This growth was driven by a record average daily volume (ADV) of $1.9 trillion, marking a 39.1% rise year-over-year.

Tradeweb, a global leader in electronic marketplaces for rates, credit, equities, and money markets, continued to expand its footprint with strategic acquisitions and technological advancements. The quarter also saw Tradeweb finalize the acquisition of r8fin and announce an agreement to acquire ICD, enhancing its offerings and client base.

Financial Highlights and Operational Achievements

Net income for the quarter stood at $143.4 million, a 40.3% increase from the prior year, with diluted earnings per share (EPS) at $0.59. Adjusted net income reached $167.9 million, up 30.1%, aligning with the adjusted diluted EPS of $0.71, which met analyst expectations. The adjusted EBITDA margin improved to 53.7%, reflecting efficient operational management and profitability.

CEO Billy Hult highlighted the quarter's success, emphasizing the broad-based organic growth and record-setting performance across multiple asset classes. Tradeweb's strategic focus on innovation and multi-asset class trading solutions has positioned it strongly in the competitive financial markets landscape.

Strategic Developments and Market Expansion

Tradeweb's market position was further strengthened by strategic initiatives, including the acquisition of technology providers and expansion into new client channels. The company's commitment to innovation was evident in the integration of advanced algorithmic-based execution for U.S. Treasuries and interest rate futures through r8fin, and the planned acquisition of ICD, set to close in the second half of 2024.

Tradeweb also marked significant milestones such as the celebration of its five-year IPO anniversary and the expansion of its global footprint with new offices in Miami and Dubai. These developments underscore Tradeweb's ongoing commitment to enhancing its service offerings and expanding its market reach.

Outlook and Forward Guidance

Looking ahead, Tradeweb remains focused on leveraging its technological capabilities to drive further growth and efficiency. The company has updated its full-year 2024 guidance, projecting adjusted expenses to trend toward the higher end of the $755 - $805 million range. This reflects ongoing investments in technology and strategic initiatives aimed at sustaining long-term growth.

Tradeweb's robust start to 2024, characterized by record trading volumes and strategic expansions, sets a positive tone for the year. As the company continues to innovate and expand, it remains well-positioned to capitalize on the evolving opportunities within the global financial markets.

Explore the complete 8-K earnings release (here) from Tradeweb Markets Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance