Trans-Siberian Gold (LON:TSG) Seems To Use Debt Quite Sensibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Trans-Siberian Gold plc (LON:TSG) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Trans-Siberian Gold

What Is Trans-Siberian Gold's Net Debt?

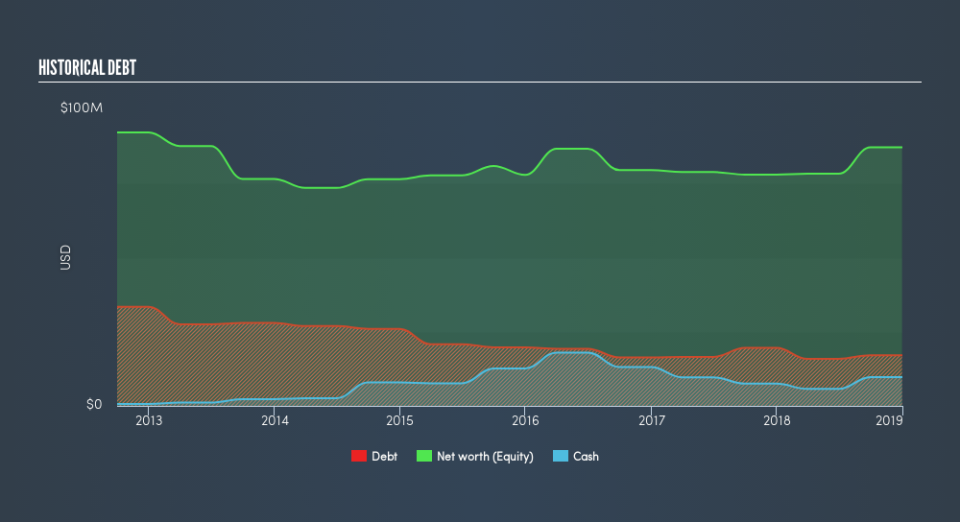

You can click the graphic below for the historical numbers, but it shows that Trans-Siberian Gold had US$17.0m of debt in December 2018, down from US$19.8m, one year before. However, it also had US$9.73m in cash, and so its net debt is US$7.24m.

How Strong Is Trans-Siberian Gold's Balance Sheet?

We can see from the most recent balance sheet that Trans-Siberian Gold had liabilities of US$12.5m falling due within a year, and liabilities of US$17.9m due beyond that. On the other hand, it had cash of US$9.73m and US$1.02m worth of receivables due within a year. So its liabilities total US$19.7m more than the combination of its cash and short-term receivables.

Given Trans-Siberian Gold has a market capitalization of US$113.6m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Trans-Siberian Gold has a low net debt to EBITDA ratio of only 0.29. And its EBIT covers its interest expense a whopping 15.9 times over. So we're pretty relaxed about its super-conservative use of debt. Better yet, Trans-Siberian Gold grew its EBIT by 147% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Trans-Siberian Gold's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Trans-Siberian Gold recorded free cash flow of 45% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Trans-Siberian Gold's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its EBIT growth rate also supports that impression! Taking all this data into account, it seems to us that Trans-Siberian Gold takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. Over time, share prices tend to follow earnings per share, so if you're interested in Trans-Siberian Gold, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance