Can TransDigm Maintain Impressive Momentum Amid Risks?

TransDigm Group Inc. TDG has managed to impress investors with its recent earnings streak, wherein the company’s bottom line has trumped estimates thrice in the trailing four quarters. TransDigm’s impressive business model actively works toward strengthening and enhancing its position in highly-engineered proprietary aerospace components’ niche markets.

We believe that the company’s strong operational execution, solid portfolio of products as well as complementary acquisitions should continue boosting growth, moving ahead.

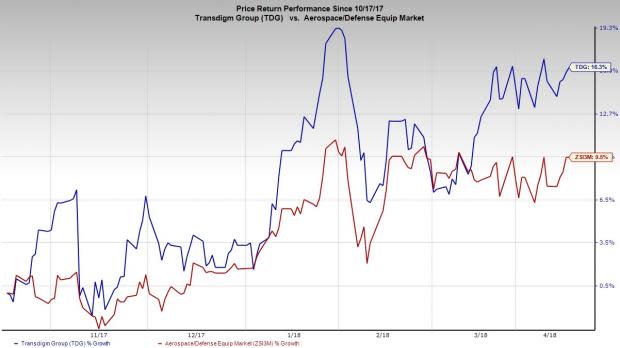

Consequently, TransDigm’s shares have had an impressive run on the bourse over the past six months. The stock has gained 16.3%, compared with the industry’s rally of 9.5%. We expect the company’s remarkable traction across markets to continue in the upcoming quarters as well.

Given this backdrop, let’s delve deeper to find out key drivers for the company right now.

Factors to Consider

TransDigm’s business operation model is driven by three value driver concepts has helped the company generate sufficient organic and inorganic growth, and drive operating margin expansion over the past few quarters. Also, it designs, produces and supplies highly engineered proprietary aerospace components and certain systems with a significant aftermarket presence. In this regard, 90% of TransDigm’s net sales are generated from proprietary engineered products, for which the company enjoys the intellectual property right, thus enhancing its competitive strength meaningfully.

Moreover, the company’s penchant for acquisitions of proprietary aerospace businesses with significant aftermarket content has helped it to bolster footprint in core market and grab a higher market share. In fiscal 2017, TransDigm acquired three add-on aerospace product lines, for a total consideration of roughly $100 million.

These acquisitions should add to its product range with the proprietary products, which already enjoy strong positions on high use of platforms and robust aftermarket content. Further, its Defense business has been experiencing stability, thus adding to the company’s strength.

Also, decentralized organizational structure and a unique compensation system for senior management have created a potent workforce that acts as one of the company’s major assets. This apart, a diversified revenue base reduces TransDigm’s dependence on any particular product, platform or market channel, thus playing a crucial role in maintaining its financial performance.

However, the company is suffering from escalating debt burden and consequent higher interest expenses. Its interest expenses have also been trending upward for the past few quarters. For instance, TransDigm recorded an interest expense of about $15 million, up 10% from the previous quarter, mainly on account of increase in its total debt. We believe that rising interest expenses will continue restraining its profits, going ahead.

This apart, the Zacks Rank #3 (Hold) company has been suffering from prolonged weakness in some of its major end market that has thwarted the company’s growth momentum. Softening discretionary retrofits, interior retrofits and weakness in jet and helicopter markets have also impacted its top-line performance in recent times.

Key Picks

Some better-ranked stocks from the same space include Curtiss-Wright Corp. CW, Raytheon Company RTN and Rockwell Collins, Inc. COL. While Curtiss-Wright sports a Zacks Rank #1 (Strong Buy), Raytheon and Rockwell Collins carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Curtiss-Wright surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 15.1%.

Raytheon surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 6.4%.

Rockwell Collins outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 2.5%.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Collins, Inc. (COL) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

Curtiss-Wright Corporation (CW) : Free Stock Analysis Report

Raytheon Company (RTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance