TransDigm's (TDG) Q4 Earnings Beat Estimates, Sales Miss

TransDigm Group Incorporated TDG reported fourth-quarter fiscal 2021 adjusted earnings of $4.25 per share, which surpassed the Zacks Consensus Estimate of $3.72 by 14.3%. The bottom line also improved a solid 47.1% from $2.89 reported a year ago.

Barring one-time items, the company reported GAAP earnings of $3.58 per share compared with $1.76 generated in the year-ago quarter.

This year-over-year improvement can be attributed to an increase in net sales, a favorable sales mix and lower COVID-19 restructuring costs.

During fiscal 2021, the company reported adjusted earnings of $12.13 per share, which surpassed the Zacks Consensus Estimate of $11.59 by 4.7%. The bottom line however declined 16% from $14.47 reported a year ago.

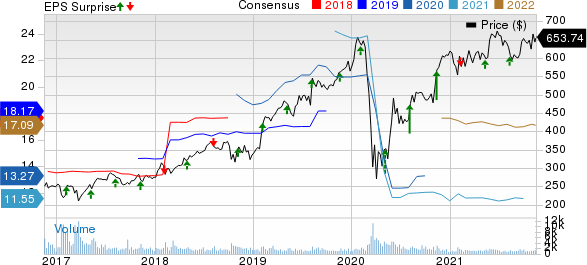

Transdigm Group Incorporated Price, Consensus and EPS Surprise

Transdigm Group Incorporated price-consensus-eps-surprise-chart | Transdigm Group Incorporated Quote

Sales

Net sales amounted to $1,279 million in the fiscal fourth quarter, increasing 9% from $1,173 million in the prior-year quarter. The reported figure however missed the Zacks Consensus Estimate of $1,335 million by 4.2%.

During fiscal 2021, TransDigm reported net sales worth $4,798 million, which decreased 6% from $5,103 million in the prior year. The reported figure also missed the Zacks Consensus Estimate of $4,840 million by 0.9%.

Operating Results

Gross profit for the quarter surged 35.3% to $725 million from $536 million in the comparable quarter a year ago.

Consequently, income from operations increased 70.9% year over year to $535 million.

Financial Position

TransDigm ended fiscal 2021 with cash and cash equivalents of $4,787 million, up from $4,717 million as of Sep 30, 2020.

At the end of fiscal 2021, the company’s long-term debt was $19.37 billion, almost in line with the long-term debt level as of Sep 30, 2020.

Cash from operating activities amounted to $913 million as of Sep 30, 2021, compared with $1,213 million as of Sep 30, 2020.

Given the continued disruptions in TransDigm’s primary commercial end markets, thanks to the impact of the COVID-19 pandemic, the company did not provide fiscal 2022 guidance this time.

Zacks Rank

TransDigm currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Defense Releases

Curtiss-Wright CW reported third-quarter 2021 adjusted earnings of $1.88 per share, which surpassed the Zacks Consensus Estimate of $1.80 by 4.4%. Its total sales exceeded the Zacks Consensus Estimate of $601 million by 3.3%.

Curtiss-Wright updated its financial guidance for 2021 and now expects adjusted earnings in the range of $7.20-$7.35 per share, compared with the prior guidance range of $7.15-$7.35 per share. In the past six months, shares of Curtiss-Wright have returned 2.6%.

Raytheon Technologies’ RTX third-quarter 2021 adjusted earnings per share of $1.26 outpaced the Zacks Consensus Estimate of $1.07 by 17.8%. The company’s third-quarter sales of $16,213 million missed the Zacks Consensus Estimate of $16,494 million by 1.7%.

Raytheon Technologies raised the earnings guidance range for 2021 and tweaked revenue expectations. It currently projects adjusted earnings in the range of $4.10-$4.20 per share, compared with the prior range of $3.85-$4.00. The company expects to record revenues worth approximately $64.50 billion compared with the earlier projection of $64.4-$65.4 billion. In the past six months, shares of Raytheon Technologies have risen 3.2%.

Hexcel Corporation HXL reported third-quarter 2021 adjusted earnings of 13 cents per share, which outpaced the Zacks Consensus Estimate of 8 cents by 62.5%. Net sales for Hexcel totaled $333.8 million, which missed the Zacks Consensus Estimate of $353 million by 5.3%.

Hexcel continues to withhold its financial guidance citing market uncertainties stemming from the pandemic. The Zacks Consensus Estimate for 2021 has increased 13.6% to 25 cents per share in the past 60 days. Hexcel’s shares have gained 21.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

CurtissWright Corporation (CW) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance