Transocean's Driller III Contract Win to Add $91M to Backlog

Transocean Limited RIG announced the receipt of a one-year contract off the coast of Trinidad and Tobago for its semisubmersible Development Driller III at an estimated dayrate of approximately $250,000. The contract will likely add $91 million to the company’s backlog. The amount excludes mobilization and reimbursable charges. Notably, as of Oct28, the company had a total backlog of $10.8 billion.

This Vanuatu-flagged Development Driller III is an ultra-deepwater semisubmersible unit, which can drill to a depth of 37,500 feet. Online since 2009, this drilling unit can operate up to 10,000 feet of water and has the capacity for up to 200 people.

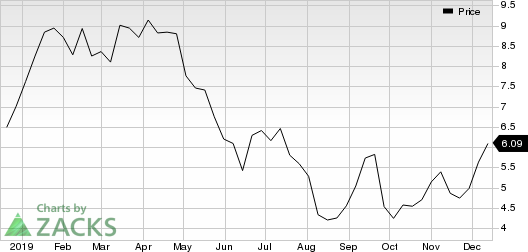

Transocean Ltd. Price

Transocean Ltd. price | Transocean Ltd. Quote

Switzerland-based Transocean, Inc. is one of the world’s leading offshore drilling contractors and providers of drilling management services. The new contract, scheduled to start in the second quarter of next year, will help the company progress both in terms of backlog and cash flow. Per the company’s October fleet status report, Development Driller III is currently bound by contract to ExxonMobil Corporation’s XOM offshore Equatorial Guinea until February 2020 at a dayrate of $192,000.

With U.S. offshore industry witnessing early signs of revival, evidenced by the increasing project sanctions, Transocean is poised to capitalize on this trend effectively, riding on its technologically-advanced and versatile drilling fleet. With more than 100 offshore projects expected to be green-lighted in 2019, demand for rigs is likely to improve benefiting this offshore drilling giant. The company has been taking necessary steps to enhance its fleet with modern and competitive rigs while scrapping old and incompetent drillships to make its operations more technically sound.

Zacks Rank & Key Picks

Transocean currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the energy space are Phillips 66 PSX and Valero Energy Corporation VLO, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Phillips 66 (PSX) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Transocean Ltd. (RIG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance