Travelers (TRV) Q2 Earnings and Revenues Beat, Rise Y/Y

The Travelers Companies TRV reported second-quarter 2021 core income of $3.45 per share, which beat the Zacks Consensus Estimate of $2.35. The bottom line rebounded from the year-ago loss of 20 cents.

The improvement was primarily driven by higher net investment income, lower catastrophe losses, higher net favorable prior year reserve development and a higher underlying underwriting gain.

Shares of the company gained 0.3% in the pre-market trading session to reflect the outperformance.

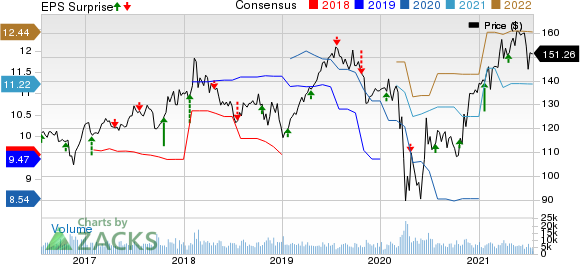

The Travelers Companies, Inc. Price, Consensus and EPS Surprise

The Travelers Companies, Inc. price-consensus-eps-surprise-chart | The Travelers Companies, Inc. Quote

Behind Q2 Headlines

Travelers’ total revenues increased 17% from the year-ago quarter to $8.6 billion, primarily due to higher premiums and net investment income. Moreover, the top-line figure beat the Zacks Consensus Estimate of $8.3 billion.

Net written premiums increased 11% year over year to $8.1 billion driven by continued strong renewal rate change and retention across all the segments.

Net investment income increased nearly threefold year over year to $682 million, primarily due to increase in income in non-fixed income investment portfolio.

Travelers witnessed underwriting gain of $324 million, which marked a rebound from the year- ago loss of $280 million, driven higher business volumes. Combined ratio improved 840 basis points (bps) year over year to 95.3 due to lower catastrophe losses and higher net favorable prior year reserve development.

At the end of the second quarter, statutory capital and surplus were $22.8 billion. Debt-to-capital ratio (excluding after-tax net unrealized investment gains included in shareholders’ equity) was 20, within the company’s target range of 15-25.

Adjusted book value per share was $103.88, up 13% year over year.

Core return on equity was 13.7%, better than negative 0.8% in the year-ago quarter.

Segment Update

Business Insurance: Net written premiums increased 5% year over year to about $4 billion, benefiting from reflecting strong renewal premium change and retention, as well as higher new business levels.

Combined ratio improved 1180 bps year over year to 95.3 attributable to lower catastrophe losses, a lower underlying combined ratio and net favorable prior year reserve development.

Segment income of $643 million rebounded from the year-ago loss of $58 million. The improvement was driven by higher net investment income, lower catastrophe losses, higher underlying underwriting gain and net favorable prior year reserve development.

Bond & Specialty Insurance: Net written premiums rose 16% year over year to $854 million, reflecting strong retention and renewal premium change in management liability.

Combined ratio improved 1570 bps year over year to 78.1 due to net favorable prior year reserve development in the current quarter compared to net unfavorable prior year reserve development in the prior-year quarter, a lower underlying combined ratio, and lower catastrophe losses.

Segment income more than doubled year over year to $187 million, primarily due to net favorable prior year reserve development, a higher underlying underwriting gain and higher net investment income.

Personal Insurance: Net written premiums of $3.3 billion increased 16% year over year due to solid performance at Domestic Automobile and Domestic Homeowners and Other.

Combined ratio improved 160 bps year over year to 99.7 due to lower catastrophe losses and higher net favorable prior year reserve development, partially offset by a higher underlying combined ratio.

Segment income of $121 million increased more than twelve-fold year over year, primarily driven by lower catastrophe losses, higher net investment income and higher net favorable prior year reserve development, partially offset by a lower underlying underwriting gain.

Dividend and Share Repurchase Update

This property & casualty insurer returned $625 million in the reported quarter. It bought back shares worth $401 million.

The company’s board also approved a 88 cents per share quarterly dividend. The dividend will be paid out on Sep 30 to shareholders of record at the close of business as of Sep 10, 2021.

Zacks Rank

Travelers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Another Insurer

The Progressive Corporation’s PGR second-quarter 2021 earnings per share of $1.51 beat the Zacks Consensus Estimate of $1.17.

Upcoming Releases

W.R. Berkley Corporation WRB is set to report second-quarter 2021 results on Jul 21. The Zacks Consensus Estimate for the second quarter is pegged at 95 cents, indicating an increase from 6 cents reported in the year-ago quarter.

First American Financial Corporation FAF is set to report second-quarter 2021 results on Jul 22. The Zacks Consensus Estimate for the second quarter is pegged at $1.63, suggesting an improvement of 55.2% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance