Treasury eyes tax raid as support grows for assault on the rich

Fears are growing that the Treasury has political cover for a tax raid on the rich after a new poll found that Britons overwhelmingly back an assault on wealth to plug the budget shortfall.

The public supports raising taxes instead of a return to austerity by a 15-point margin as ministers eye ways to bring the country's finances under control after debt rocketed above 100pc of GDP, according to the survey by pollster Ipsos Mori.

Some 44pc back tax hikes, as opposed to 29pc in favour of more spending cuts.

A wealth tax was the most popular revenue-raising measure, listed by 41pc of respondents as their favourite option.

A tax hitting those with total wealth of more than £500,000 had the strongest support and would cover around 10pc of the population, Ipsos Mori estimates.

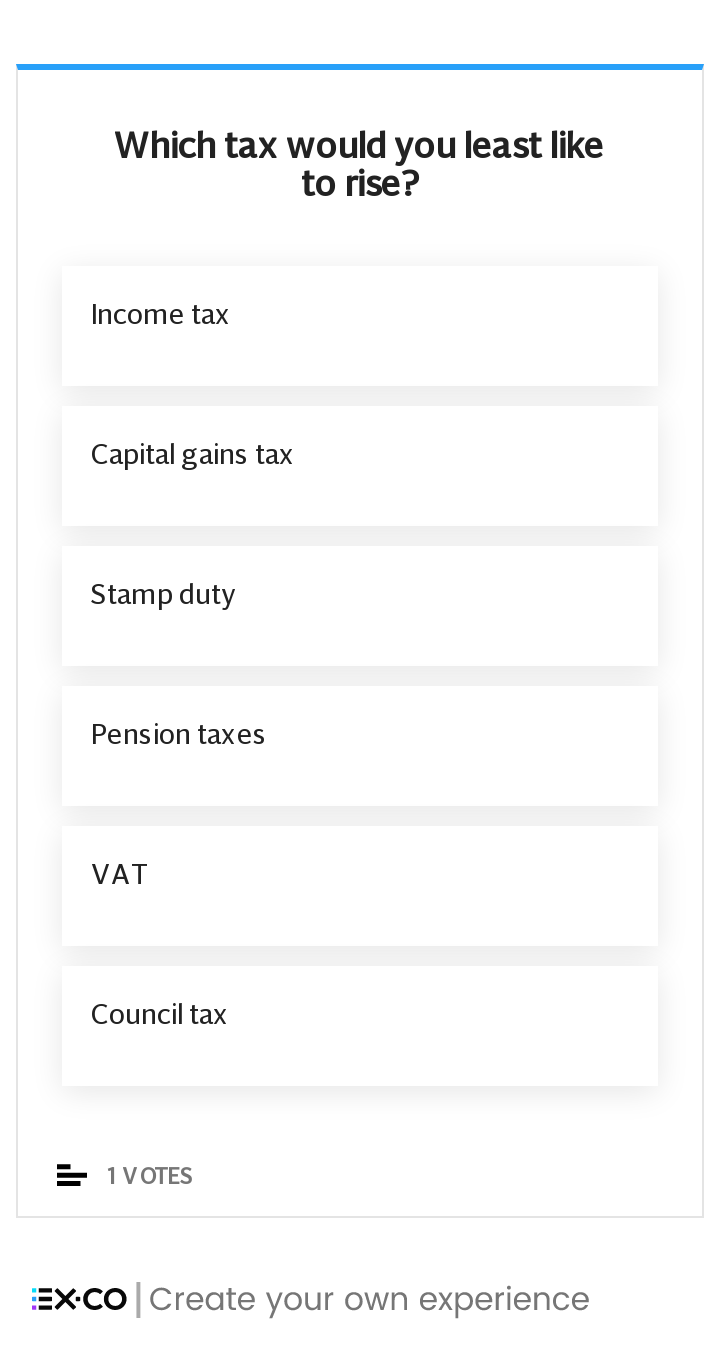

Increasing council tax on properties worth more than £1m and a hike in capital gains tax were the second and third most popular options. Rises in income tax and VAT were the least popular.

The findings came as Rishi Sunak vowed to balance the books to “protect the public finances” for future generations in his Conservative Party conference speech.

The Chancellor sought to lay the groundwork for reining in the borrowing binge by arguing there is “a sacred responsibility to future generations to leave the public finances strong”.

He said: “If instead we argue there is no limit on what we can spend, that we can simply borrow our way out of any hole, what is the point in us?

“We will protect the public finances. Over the medium term getting our borrowing and debt back under control.”

Economists have warned tax rises or austerity will be needed to pay for the pandemic after it caused a surge in borrowing. However, there are fears tax hikes too soon could dampen the economy’s recovery.

The Office for Budget Responsibility warned in July that £60bn in tax rises or spending cuts will be needed to stabilise public finances after the pandemic. Debt has surged past 100pc of GDP this year as the Government has fought the economic damage caused by Covid-19.

Yahoo Finance

Yahoo Finance