Is Tredegar (NYSE:TG) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Tredegar Corporation (NYSE:TG) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Tredegar

What Is Tredegar's Net Debt?

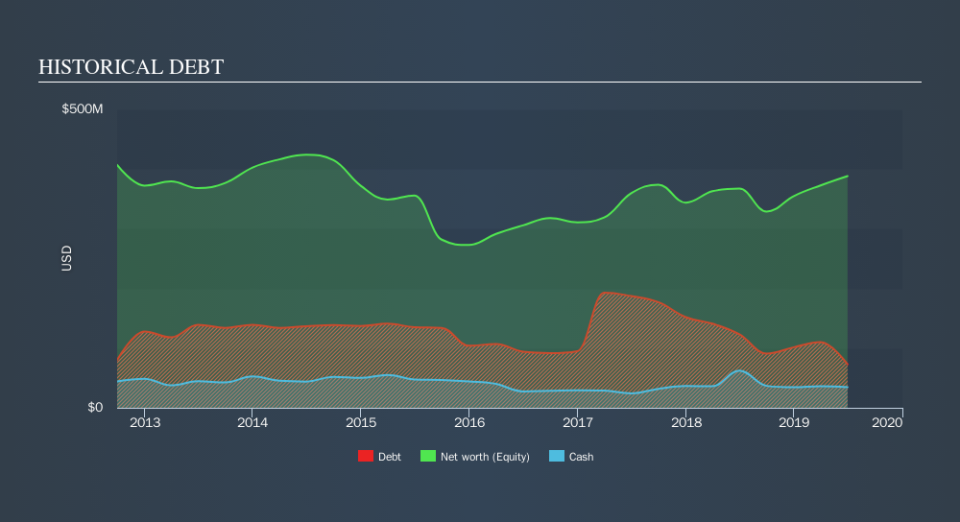

As you can see below, Tredegar had US$73.0m of debt at June 2019, down from US$123.0m a year prior. On the flip side, it has US$34.7m in cash leading to net debt of about US$38.3m.

A Look At Tredegar's Liabilities

We can see from the most recent balance sheet that Tredegar had liabilities of US$156.0m falling due within a year, and liabilities of US$185.8m due beyond that. On the other hand, it had cash of US$34.7m and US$119.3m worth of receivables due within a year. So its liabilities total US$187.9m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Tredegar has a market capitalization of US$586.7m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Tredegar has a low debt to EBITDA ratio of only 0.42. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hot shot teppanyaki chef handles cooking. But the other side of the story is that Tredegar saw its EBIT decline by 7.5% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tredegar's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Tredegar generated free cash flow amounting to a very robust 89% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Happily, Tredegar's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its EBIT growth rate does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Tredegar can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. We'd be motivated to research the stock further if we found out that Tredegar insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance