The Trillion Dollar Club - Tesla (NASDAQ:TSLA) Rockets After Earnings

This article was originally published on Simply Wall St News

Tesla, Inc. (NASDAQ:TSLA) just reported the Q3 earnings, and shortly after, investors jumped on to buy more shares. The stock has exceeded expectations and joined the Trillion Dollar Club.

The company reported a strong third quarter result with improved earnings, revenues and profit margins.

Third quarter 2021 results:

Revenue: US$13.8b (up 57% from 3Q 2020).

Net income: US$1.62b (up 439% from 3Q 2020).

Profit margin: 12% (up from 3.4% in 3Q 2020). The increase in margin was driven by higher revenue.

Over the last 3 years on average, earnings per share has increased by 124% per year but the company’s share price has increased by 142% per year, which means it is tracking significantly ahead of earnings growth.

Looking at returns, Tesla shares gained more than 2,175% in the past 5 years. This just goes to show the unprecedented value investors place on innovation and technology.

It's also good to see the share price up 38% over the last quarter. You can catch up on the latest numbers and the fundamental structure by reading our company report. Anyone who held for that rewarding ride would probably be keen to talk about it.

In the last 5 years, Tesla saw its revenue grow at 33% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 87% per year in that time. Despite the strong run, top performers like Tesla have been known to go on winning for years.

Check out our latest analysis for Tesla

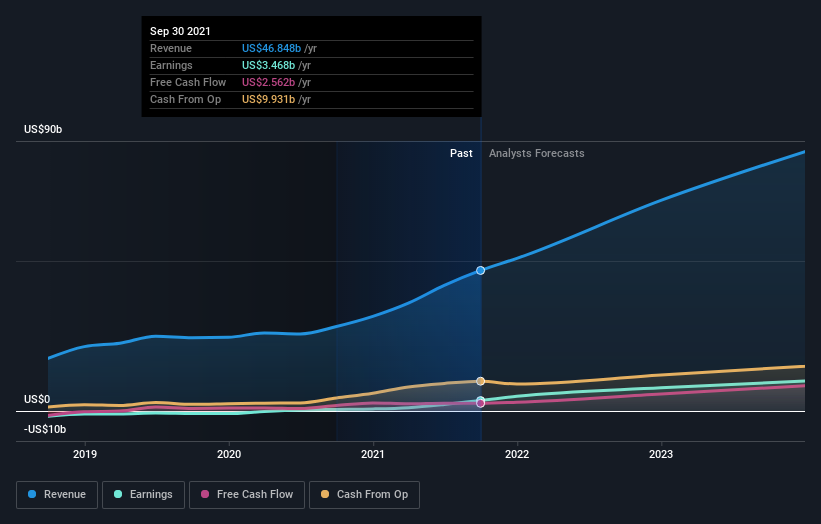

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Tesla is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

Analysts are clearly expecting strong growth to continue, and CapEx in production capacity, along with technological developments, may provide a baseline for the future of Tesla. It also seems that, the more bearish some investors turn against Tesla, the more other investors take the bullish side and profit from their trades.

Key Takeaways

Tesla reached the Trillion Dollar Club in record time and is one of the most surprising success stories for investors in the last few years.

We're pleased to report that Tesla shareholders have received a total shareholder return of 116% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 87% per year), it would seem that the stock's performance has improved in recent times.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance