Trimble Sells Construction Logistics Business to Command Alkon

Trimble Inc. TRMB has signed a definitive agreement to sell its construction logistics business to Command Alkon, a provider of a supplier collaboration platform for the heavy construction community.

Notably, Trimble’s construction logistics business, which is part of its Building and Infrastructure segment, ensures seamless delivery of products with the help of tools that aid in tracking, scheduling, routing and communicating the fleet.

Consequently, the business under review will complement Command Alkon’sfleet and workforce management solutions for the heavy work community.

The deal is likely to be completed in the ongoing quarter.

Divestment Rationale

We believe the latest decision of Trimble is expected to provide it an opportunity to diversify resources to explore promising growth avenues.

Moreover, the divestment of the construction logistics business is likely to shift the company’s focus toward further development of its building construction and civil engineering businesses, which contribute well to the revenues within the Building and Infrastructure segment.

Notably, this segment accounts for the majority of Trimble’s total revenues. In second-quarter 2020, the segment contributed 40.2% to the company’s revenues.

Further, the shifting focus is anticipated to help the company in achieving optimal usage of its wealth, skill and expertise, which were engaged in the construction logistics business till now.

Apart from theBuilding and Infrastructure segment, the company will also be able to focus on the advancement of its other segments namely Geospatial, Resources and Utilities and Transportation segments.

Additionally, the resources out of the recently announced divestiture are expected to aid Trimble’s shift toward software and automation, and help in the execution of its Connect and Scale 2025 strategy.

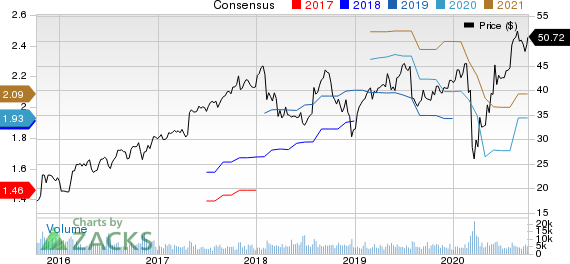

Trimble Inc. Price and Consensus

Trimble Inc. price-consensus-chart | Trimble Inc. Quote

Wrapping Up

Strategic decisions, including acquisitions and divestitures, have been contributing well toward the shaping up of Trimble’s growth trajectory.

The decisions have been adding strength to the company’s technology-driven robust product and solutions portfolio, which is centered on the integration of real-time positioning or location technologies with wireless communications and software or information technologies.

We believe that Trimble’s portfolio strength will continue to aid its position as an original equipment manufacturer (OEM) of surveying, machine control and positioning products.

This in turn is likely to drive earnings growth and improve revenue visibility in the long term.

Zacks Rank & Stocks to Consider

Currently, Trimble carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader computer and technology sector are Square, Inc. SQ, Zoom Video Communications, Inc. ZM and Qorvo, Inc. QRVO. While Square and Zoom Video currently sport a Zacks Rank #1 (Strong Buy), Qorvo carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rates for Square, Zoom Video and Qorvo are pegged at 40.9%, 25% and 12.35%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trimble Inc. (TRMB) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance