TriNet Group Inc (TNET) Q1 2024 Earnings: Misses EPS Estimates, Reports Modest Revenue Growth

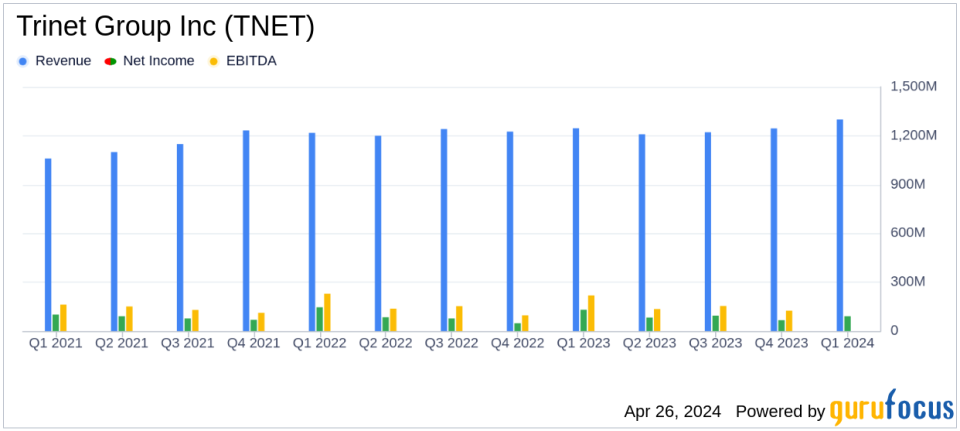

Total Revenues: Reached $1.3 billion, marking a 1% increase year-over-year, and slightly exceeded the estimated $1.267 billion.

Professional Service Revenues: Grew by 4% year-over-year to $214 million.

Net Income: Reported at $91 million, or $1.78 per diluted share, falling short of the estimated $125.97 million and $2.46 per share.

Adjusted Net Income per Diluted Share: Was $2.16, below the previous year's $2.49 and also below the estimated $2.46 per share.

Adjusted EBITDA: Decreased to $180 million from $223 million in the same period last year.

Cash and Cash Equivalents: Stood at $298 million as of March 31, 2024.

Total Debt: Amounted to $1.1 billion as of the end of the first quarter.

On April 26, 2024, TriNet Group Inc (NYSE:TNET) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company, a pivotal provider of human resources solutions for small and medium-sized businesses, reported a 1% increase in total revenues reaching $1.3 billion, aligning closely with analyst expectations of $1.267 billion. However, the earnings per share (EPS) of $1.78 fell short of the estimated $2.46, reflecting challenges in the broader economic environment.

Company Overview

TriNet offers comprehensive HR solutions through a professional employer organization (PEO) model. This approach allows small and midsize businesses to outsource critical HR functions like payroll, tax administration, and regulatory compliance, leveraging TriNets expertise and scale to access competitive employee benefits and share employment risk liabilities. Following its acquisitions of Zenefits and Clarus R+D in 2022, TriNet has also expanded into self-service HCM software and R&D tax credit services.

Financial Highlights and Challenges

The company's professional service revenues saw a 4% increase to $214 million. Despite this growth, TriNet faced a decline in net income, which stood at $91 million compared to $131 million in the prior year, and adjusted net income also decreased from $150 million to $111 million. The adjusted EBITDA of $180 million this quarter also marked a decrease from $223 million in the same period last year. These figures underscore the impact of ongoing economic pressures on TriNets operational efficiency and profitability.

Strategic Execution and Market Position

According to TriNets President and CEO, Mike Simonds, the company has maintained a strong focus on customer-centric initiatives and efficient expense management amidst challenging market conditions. TriNet's strategy of enhancing its service offerings and technology has been crucial in navigating the current economic landscape, which is reflected in the 6% growth in average worksite employees (WSEs).

Detailed Financial Analysis

The balance sheet shows a healthy liquidity position with $298 million in cash and cash equivalents, although total debt stands at $1.1 billion. The insurance cost ratio, a critical metric for TriNet given its business model, is projected to fluctuate between 87.0% and 90.0% for the upcoming quarters, indicating the companys ongoing management of claim costs and premiums.

Looking Ahead

For the second quarter and full-year 2024, TriNet provided guidance anticipating fluctuations in total revenues and professional service revenues, with potential decreases and modest increases across different segments. The EPS guidance for the full year ranges from $3.94 to $5.46, with adjusted figures slightly higher, suggesting cautious optimism about improving operational efficiencies and market conditions.

In conclusion, while TriNet faces economic headwinds that have impacted its profitability metrics, its strategic focus on enhancing service capabilities and maintaining robust customer relationships positions it well for potential growth as market conditions improve. Investors and stakeholders will likely watch closely how the company's strategies unfold in the coming quarters amidst ongoing economic uncertainties.

Explore the complete 8-K earnings release (here) from Trinet Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance