Trinity (TRN) Q3 Earnings Meet Estimates, Revenues Beat

Trinity Industries’ TRN third-quarter 2019 adjusted earnings of 39 cents per share were in line with the Zacks Consensus Estimate. Moreover, the bottom line was flat year over year. Meanwhile, total revenues came in at $813.6 million, which surpassed the Zacks Consensus Estimate of $809.7 million.

Until third-quarter 2018, Trinity reported through five segments, namely Rail Group, Construction Products Group, Inland Barge Group, Energy Equipment Group and Railcar Leasing and Management Services Group. Post the completion of a spin-off transaction with its infrastructure-related businesses (Acrosa) on Nov 1, 2018, the company primarily reports via the three segments of Railcar Leasing and Management Services Group, Rail Products Group and All Other Group.

The Railcar Leasing and Management Services Group generated revenues of $326.4 million, up 29.9% year over year. This upside was primarily owing to growth in lease fleet, higher volume of railcars sold and favorable average lease rates.

Segmental operating profit summed $115.7 million, up 25.5% from the year-ago quarterly figure owing to factors like higher profits from sale of railcars and lease fleet growth. Moreover, the company’s lease fleet came in at 102,900 units as of Sep 30, 2019. The fleet size grew 7.6% compared with the figure at the end of third-quarter 2018.

Revenues at the Rail Products Group (before eliminations) totaled $723 million, up 45.3% from the prior-year number. Segmental operating profit was $65.4 million compared with $28 million a year ago. Operating profit improved primarily on the back of higher railcar deliveries, favorable railcar pricing and product mix changes. Notably, the group delivered 5,320 railcars and received orders for 2,530 railcars compared with 3,990 and 7,725, respectively, in the year-earlier quarter.

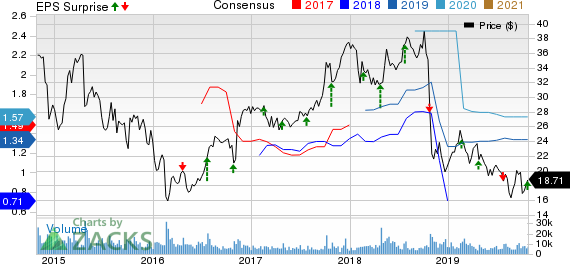

Trinity Industries, Inc. Price, Consensus and EPS Surprise

Trinity Industries, Inc. price-consensus-eps-surprise-chart | Trinity Industries, Inc. Quote

Revenues at the All Other Group were $90.4 million, down 11.7% year over year. The decline was due to sluggish demand and lower shipping volumes in Trinity’s highway products operations. Segmental operating profit came in at $3.9 million compared with $9.5 million a year ago.

This Zacks Rank #3 (Hold) company exited the third quarter with cash and cash equivalents of $97.6 million compared with $179.2 million at 2018 end. Meanwhile, debt totaled $4,685.2 million as of Sep 30, 2019 compared with $4,029.2 million at 2018 end. Trinity repurchased 5.2 million shares worth approximately $100.9 million in the period.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook Tweaked

For 2019, Trinity now anticipates earnings per share in the $1.17-$1.27 range (earlier guidance: $1.15-$1.35). The mid-point of the newly guided range is $1.22, below the Zacks Consensus Estimate of $1.34. Lower guidance is due to the anticipation of fewer railcar deliveries in 2019, some of which were expected to be added to the lease fleet. Additionally, Leasing and Management revenues are estimated in the band of $760-$765 million while operating profit for the segment is projected between $320 million and $325 million.

Meanwhile, Rail Products Group revenues are expected to be $3 billion. Operating margin for the segment is estimated to be 9%. Railcar deliveries for the year are now envisioned in the 21,500-22,000 bracket (previous guidance: 23,000-24,500). Further, operating profit at the All Other Group is anticipated in the $10-$15 million range.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter earnings reports from key players like Hertz Global Holdings, HTZ, Expeditors International of Washington EXPD and Air Lease Corporation AL. While Hertz will report third-quarter earnings numbers on Nov 4, Expeditors and Air Lease will announce the same on Nov 5 and Nov 7, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Lease Corporation (AL) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance