TripAdvisor (TRIP) Q2 Earnings Beat Mark, Revenues Rise Y/Y

TripAdvisor TRIP reported adjusted second-quarter 2022 earnings of 37 cents per share, which surpassed the Zacks Consensus Estimate by 37%. TRIP reported a loss per share of 9 cents and 7 cents in the prior quarter and the year-ago quarter, respectively.

Revenues of $417 million surged 77% year over year and 59%, sequentially. The same also surpassed the consensus mark by 6.1%.

Top-line growth was driven by increased consumer travel demand owing to the continued relaxation of government restrictions.

For the second quarter, average monthly unique users on Tripadvisor-branded sites increased 19% from the year-ago quarter’s level.

Strong performance across experiences offerings, recovery across Tripadvisor Core, Viator and TheFork segments, and increased bookings to European destinations remained tailwinds.

However, inflationary pressure and the coronavirus-pandemic related headwinds affected the quarterly performance.

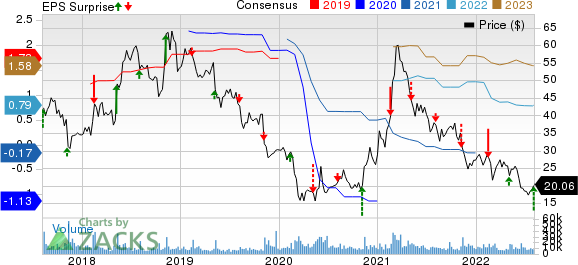

TripAdvisor, Inc. Price, Consensus and EPS Surprise

TripAdvisor, Inc. price-consensus-eps-surprise-chart | TripAdvisor, Inc. Quote

Quarterly Details

TripAdvisor reports revenues under three segments: Tripadvisor Core, Viator and TheFork.

Tripadvisor Core: The segment generated revenues of $274 million (accounting for 66% of revenues), up 49% year over year. Revenues from Tripadvisor-branded hotels, including hotel auction and B2B subscription offerings, increased 44% from the prior-year quarter’s level to $188 million. Tripadvisor-branded display and platform revenues jumped 42% year over year to $37 million. Revenues from Tripadvisor experiences and dining (includes intersegment eliminations of $25 million) were $35 million, skyrocketing 119% year over year. Other revenues consisting of rentals, flights, cars and cruise revenues were up 27% from the prior-year quarter’s level to $14 million.

Viator: The segment generated revenues of $136 million (33% of total revenues). The figure skyrocketed 240% from the year-ago quarter’s level, driven by seasonality, pent-up travel demand and expansion of the experiences travel category.

TheFork: Revenues from this segment came in at $32 million (8% of revenues), increasing 78% year over year. The uptick was attributed to easing of restrictions and the return of dining to the pre-pandemic levels.

Operating Results

TripAdvisor’s selling and marketing costs increased 76% year over year to $217 million, induced by higher spending on search engine marketing and other online traffic acquisitions across all segments and businesses to meet rising consumer travel demand amid the travel-sector recovery period.

General and administrative costs were down 39% from the year-ago quarter’s level to $28 million.

Technology and content costs of $53 million decreased 2% on a year-over-year basis.

TRIP reported an operating income of $63 million for the second quarter against a $35-million loss in the first quarter.

In the reported quarter, total adjusted EBITDA was $109 million compared with $25 million in the same quarter last year.

Balance Sheet & Cash Flow

As of Jun 30, 2022, cash and cash equivalents were $1.05 billion, up from $781 million reported on Mar 31, 2022.

Long-term debt as of Jun 30, 2022, was $835 million. TRIP’s long-term debt was $834 million as of Mar 31, 2022.

Cash provided by operating activities was $295 million for the reported quarter compared with $86 million in the prior quarter.

Additionally, free cash flow was $282 million in the second quarter.

Zacks Rank & Stocks to Consider

TripAdvisor currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the retail-wholesale sector are Dollar General DG, Costco Wholesale COST and Dollar Tree DLTR, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar General has gained 6.4% on a year-to-date basis. The long-term earnings growth rate for the DG stock is currently projected at 12.2%.

Costco Wholesale has lost 5.2% on a year-to-date basis. The long-term earnings growth rate for the COST stock is currently projected at 9.2%.

Dollar Tree has returned 16.6% on a year-to-date basis. The long-term earnings growth rate for the DLTR stock is currently projected at 15.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance