Trump needs Dow 30,000 if he wants to get reelected

The Dow Jones Industrial Average will reach 30,000 before the next presidential election for the following reasons:

President Trump is the first president to frequently discuss the stock market in the media and on Twitter (TWTR). Specifically, he loves to refer to the most publicly watched index, the Dow Jones.

Dow just hit 27,000 for first time EVER!

— Donald J. Trump (@realDonaldTrump) July 11, 2019

I have no problem with this except that he is clearly allowing part of his presidency’s success to be judged by the performance of this index. Therefore, I think he will do everything in his power to help the Dow reach 30,000 before Election Day in 2020 and this includes finalizing a trade deal with China, putting non-stop pressure on the Fed to keep interest rates low, and possibly pushing for another tax cut next year.

Trump needs a trade deal with China

A trade deal with China will get done before November 2020. President Trump needs it to be finalized so he can leverage it as a significant accomplishment during his re-election campaign speeches and also in the debates against the Democratic nominee. I don’t think the specifics of the deal will be extremely favorable to either side, but it will do one thing that the stock market loves: eliminate uncertainty. From a technical perspective, the first two weeks of September have seen a vicious rotation out of sectors fairly immune to the trade war and into trade sensitive areas. Since the market tends to trade on what will happen 6-9 months from now, this could be the market anticipating a trade deal and earnings firming up in these under-invested trade sensitive groups.

Increased levels of fear

The Federal Reserve is expected to cut rates when they meet this week. As I have been saying for the past few months, we are back in this globally coordinated effort to keep interest rates low and the markets high. Almost every central bank around the world is either cutting interest rates and/or doing some form of quantitative easing. There’s an old expression on Wall Street “Don’t Fight the Fed!” Well good luck fighting all the central banks globally. This interest rate friendly environment provides a favorable backdrop for equities and justifies higher valuations.

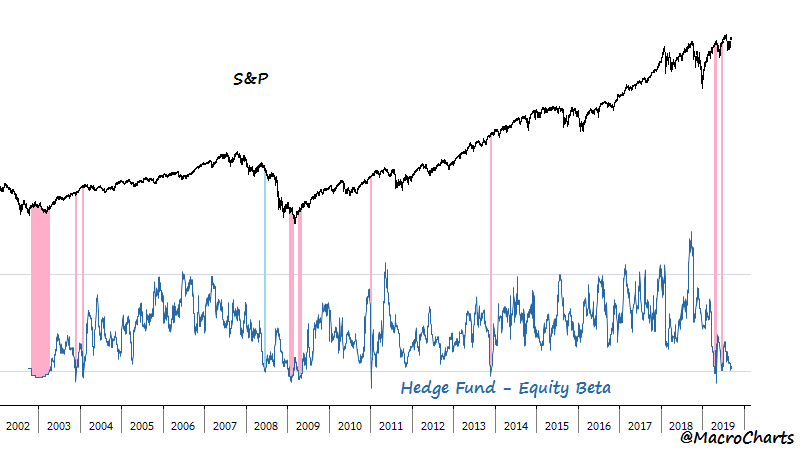

Sentiment remains extremely poor among most market participants. Many sentiment measures continue to show increased levels of fear, a jump in put buying on any little drop in the market, a high expectation for a recession soon, and many under-invested fund managers. This chart from @MacroCharts (see below) shows hedge fund equity beta at levels associated with market bottoms over the past 20 years. Sentiment is important to follow because the market tends to fool the majority.

Many people forget that we just had a bear market in Q4 of 2018 and that small and mid-cap indexes (such as IWM and MDY) could JUST BE EMERGING from one year bear markets.

At this point, everyone is frustrated with the back and forth trade deal headlines. One day we’re making progress and the next day we’re nowhere close to a deal. All this uncertainty will be resolved soon because it is in the interest of both the U.S. and China. Again, I don’t think anything meaningful will come out of a trade deal because there are huge egos involved on both sides and China doesn’t want to budge on intellectual property. However, the headline that a deal is done will put an end to the back and forth banter and eliminate one more uncertainty for the markets. In addition, earnings in the industrial and manufacturing sectors will get a lift going forward and many of these companies are components of the Dow Jones.

I realize Dow 30,000 is only about 10% away, but it is a psychological milestone and a big round number that makes for great headlines. Of course the move will not be straight up, as we will continue to see regular shakeouts, pullbacks, and corrections along the way, but President Trump needs Dow 30,000 if he wants to get re-elected and will do everything in his power to promote an equity friendly environment.

Read more:

Why the market will head higher into year end

The single biggest reason the market dropped so hard last year — interest rates

The first sign to look out for to tell if the market or a stock is healthy

I can be reached at: jfahmy@zorcapital.com

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Yahoo Finance

Yahoo Finance