TSB customers fear payments crunch as online banking outage heads towards payday

TSB’s catastrophic IT crisis shows few signs of abating as customers continue to struggle to access their accounts and the bank indicated the problem was wider ranging than it first thought.

The lender is still limiting the numbers of people who can use its online services as it scrambles to get them up and running again. Up to a million customers have been locked out of their accounts.

Yesterday TSB updated its service status website to include new problems customers were having, such as being unable to view or access mortgage accounts online.

Numerous people took to social media to complain of being unable to see their accounts balances and needing to make payments as they approach payday. Some employers said they were worried they would not be bale to pay their staff on time.

One customer, called Liz, tweeted: "I finally got in, tried to pay a bill, it asked me to re -enter my password as it normally does, then it said it wasn't long enough so I added a random number and it accepted it worked with any number."

Another customer, with the Twitter name Exillior, said: "It has been eight days since I could access my bank account. The CEO and official TSB Twitter accounts are still pretending that there is no problem anymore. Personally, I am done. I was with them for 12 years but this is unbelievable."

Zac Williams, 23, from Basingstoke said his direct debits had not been working and he had not been able to make card payments online.

"I need to be able to pay my bills. My phone bill was meant to go out on the 24th but it didn't get through. I got a message to say my payment had been declined

"Tesco Credit Card phoned me to say they were applying a late payment charge of £15. It's not much but it goes on my credit rating.

"The lack of explanation has been the biggest frustration. I will most likely move to another bank," he added,

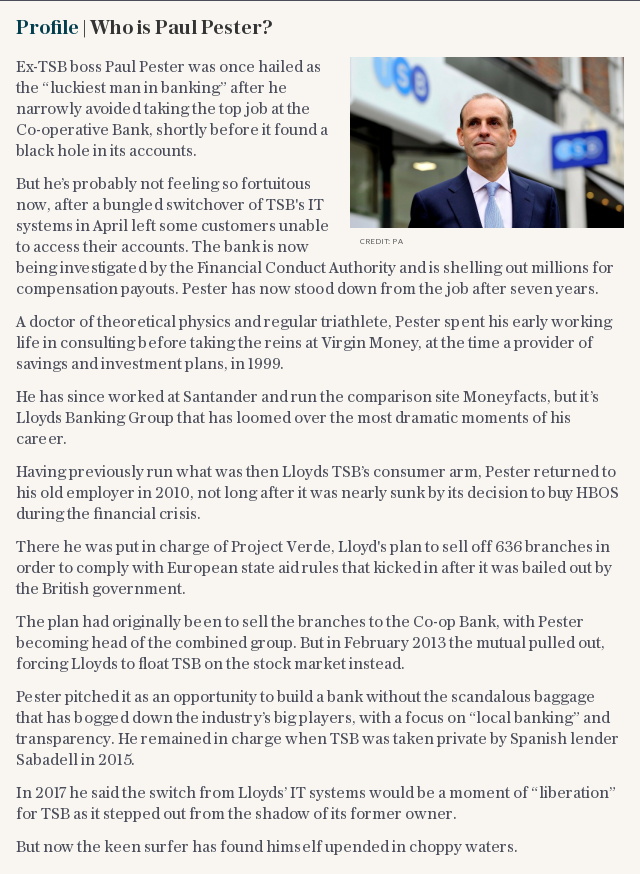

Yesterday Paul Pester, chief executive, admitted TSB was “on its knees” and said he expected emergency engineers brought in from IBM to fix the problems by tomorrow, but the bank’s owner Sabadell warned they could drag on into next week.

He also took to Twitter to reassure customers that "no one will be left out of pocket" as a result of the fiasco.

The influential Treasury select committee of MPs has demanded a letter from Mr Pester explaining the outage by lunchtime today.

@tsb its great to see were up and running and not able to receive a payment in on payday pic.twitter.com/VpFvgkaTww

— Simon kent (@simon249jk) April 27, 2018

Chrisstttt @TSB whyyy is the app not working again?! It’s payday and I need to transfer money! ��

— Nikitta Louise (@foodibsandme) April 27, 2018

@tsb@TSB_News when are you going to show a duty of care to your clients and sort this mess out. Is payday for millions today and this is the sorry state of a message on your app... not good enough #tsb#tsbdown pic.twitter.com/YdjCgQDCn3

— aposhbird1995 (@poshbird1995) April 27, 2018

Customers who have managed to log in have complained of being unable to pay bills, receive payments or see their mortgage accounts.

The bank has struggled to cope with a deluge of complaints, with some protesting that they have been unable to get through on its customer service phone line or being cut off after waiting on hold for hours.

The IT failure has prompted many people to consider switching banks, according to data from comparison website GoCompare. It said the number of people using its current account comparison service this week doubled following the TSB chaos, increasing rapidly on Monday and then peaking on Tuesday and has stayed at that level since.

Georgie Frost, consumer advocate at GoCompare, said: “With the disruption at TSB there will be a large number of very disgruntled customers thinking about switching to another bank, while the well-publicised problems may well have made other bank customers consider their options too."

TSB has offered to waive all overdraft fees for the months of April and increased the interest rate on its most popular Classic Plus account from 3pc to 5pc in a desperate bid to hang on to customers tempted to switch banks.

Meanwhile, the bank has advertised for a new head of infrastructure in its IT department. The ad appeared on the bank's website on Wednesday.

A spokesman for TSB said it was in no way related to the IT crisis at the bank and that TSB "recruits all the time".

Philip Augur, a former non-executive director at TSB, told the BBC that the bank could be facing fines "in the low tens of the millions".

"I would imagine that in addition to fining the institution and demanding that compensation be paid, regulators might be asking questions about the role played by Paul and other senior managers in this," he said.

Customers have raised a host of complaints with the Telegraph that have not been acknowledged by the bank, including not being able to use cards, incorrect balances and mysterious overdrafts appearing.

Yahoo Finance

Yahoo Finance