TSMC’s $59 Billion Rally May Extend on AI Demand

(Bloomberg) -- A rally in Taiwan Semiconductor Manufacturing Company Ltd. may get a fresh push as renewed optimism over artificial intelligence offsets concerns on China relations after Taiwan’s presidential election.

Most Read from Bloomberg

China Weighs Stock Market Rescue Package Backed by $278 Billion

Hong Kong Stocks at 36% Discount Show True Depth of China Gloom

Florida Governor DeSantis Drops Out of 2024 Race, Endorses Trump

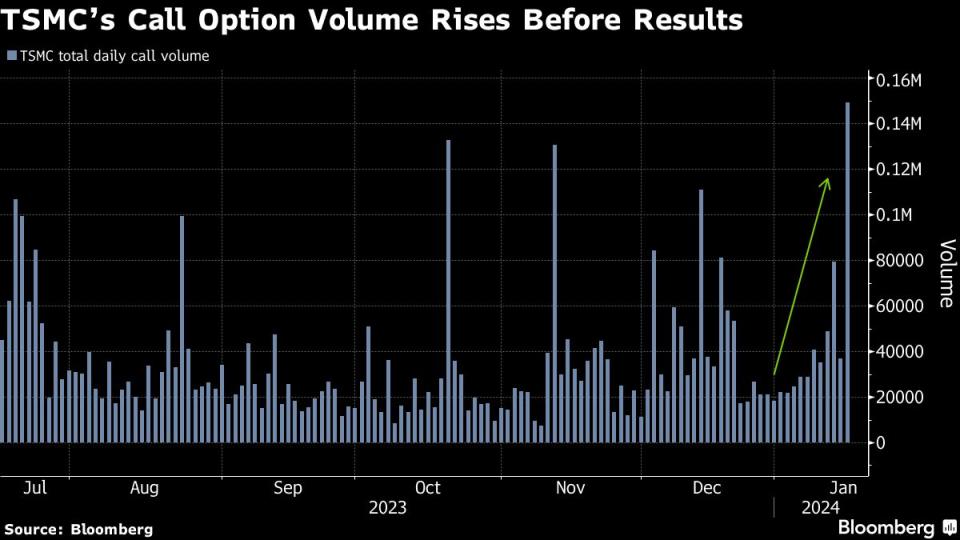

Shares of the world’s largest foundry have rallied 12% from a September low, adding $59 billion to its market value, as investors bet on a recovery in the global chip industry after more than a year of inventory correction. Daily call options volume on TSMC’s American depositary receipts has been building recently on bullish bets ahead of the company’s earnings report due Thursday.

Still, the shares remain 15% below their record level set two years ago, even as its global chip peers and A-list clients including Nvidia Corp. have regained all-time highs on AI hype and the gradual rebound in broader chip demand. Given the muted geopolitical reaction to the Taiwan leadership vote, some investors expect a catch-up in TSMC, with the average price target implying a gain of 20% over the next year.

“We hope this one issue is now out of the way and this name could finally break out given its unquestionable dominance in AI chip production,” said Amir Anvarzadeh, a strategist at Asymmetric Advisors Ltd. TSMC shares may rise further on low valuations combined with the company’s better-than-expected sales and likely price hikes, he added.

World Chip Sales Return to Growth in Sign of Improving Demand

The consensus forward earnings estimate for TSMC has climbed back to a record high, as the company beat fourth-quarter revenue expectations. The stock has 35 buy ratings versus two holds and no sells.

As the contract manufacturer of the 5-nanometer semiconductors designed by Nvidia, TSMC is seen as a prime beneficiary of the AI boom. While a recovery in smartphone demand has been slow to get off the ground, Apple Inc. is adopting the company’s more advanced, and higher priced, 3-nanometer chips in its latest iPhones.

TSMC rallied with global chip stocks since autumn before losing some steam since the start of the year on concerns over friction with China resulting from Taiwan’s election. The presidency was won by the ruling Democratic Progressive Party’s Lai Ching-te, who is seen as a “separatist” by China, though his party lost the control of the parliament.

Lai has supported TSMC’s decision to expand manufacturing overseas, saying it strengthens the company’s as well as Taiwan’s influence internationally. Beijing has so far had a muted reaction to Lai’s victory, reiterating its opposition to the island’s independence.

Why Making Computer Chips Has Become a New Arms Race: QuickTake

“I believe there will be minimal effect on TSMC” from the election, said Bloomberg Intelligence analyst Charles Shum. “Lai’s victory suggests a continuation of Taiwan government’s semiconductor-focused economic growth strategy.”

Upcoming results may highlight negative impacts from spending on factories in the US and elsewhere, as well as the strengthening of the Taiwan dollar and risings labor costs. But relative cheapness is seen supporting the stock, trading at 15 times forward earnings estimates compared with a five-year median of 18 times and Nvidia’s 28 times.

“We like TSMC as we think its solid technology leadership and execution better position it vs peers to capture the industry’s long-term structural growth, particularly in areas such as 5G or AI,” Goldman Sachs Inc. analysts including Bruce Lu wrote in a note, adding that its valuation remains attractive.

Tech Chart of the Day

An index that tracks volatility in the Nasdaq 100 Stock Index jumped to the highest in more than two months on Wednesday after a pair of strong US economic reports boosted speculation the Federal Reserve will be in no hurry to cut interest rates, weighing on tech stocks. The Cboe NDX Volatility Index rose as much as 8.6%, hitting the highest in about two months. The spike comes after a lull in volatility that saw the index drop to the lowest since 2019 a month ago.

Top Tech News

Samsung Electronics Co. is targeting double-digit growth for its latest flagship smartphone series, powered with an array of new artificial intelligence features.

Apple Inc.’s iPhone dethroned Samsung Electronics Co. devices to become the best-selling smartphone series over the course of 2023, the first time South Korea’s largest company has lost the top spot since 2010.

Verizon Communications Inc. is writing down the value of its business services division by $5.8 billion, a sign of the company’s declining enterprise operations.

Alphabet Inc.’s Google is rolling out a series of broad changes to some of its core search, browser and data products in Europe, in order to step in line with the European Union’s new rules to rein in Big Tech’s market dominance.

Artificial intelligence startup Anthropic is working on a feature that would give its chatbot Claude the ability to analyze images, according to unpublished wording contained in the code of the company’s website. The tool could widen the product’s appeal to users and help the company catch up with larger competitors.

Rivian Automotive fell after Deutsche Bank downgraded the electric-vehicle maker to hold from buy, citing downside to 2024 volume and margin outlooks.

Google DeepMind, Alphabet Inc.’s research division, said it has taken a “crucial step” towards making artificial intelligence as capable as humans. It involves solving high-school math problems.

--With assistance from Jeran Wittenstein.

(Updates first chart)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance