TSX Growth Companies With High Insider Ownership And At Least 38% Earnings Growth

As central banks in Canada and the U.S. adjust interest rates in response to shifting economic indicators, investors are closely monitoring the impact on various market sectors. In this environment, growth companies with high insider ownership on the TSX may offer appealing opportunities, particularly those demonstrating robust earnings growth, as they can be better positioned to navigate economic fluctuations with aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.4% | 55.0% |

goeasy (TSX:GSY) | 21.5% | 15.5% |

Payfare (TSX:PAY) | 15% | 38.6% |

Allied Gold (TSX:AAUC) | 22.5% | 71.7% |

Ivanhoe Mines (TSX:IVN) | 12.5% | 67.2% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Artemis Gold (TSXV:ARTG) | 31.7% | 48.8% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's dive into some prime choices out of from the screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.79 billion.

Operations: The revenue segments for the company are distributed as follows: Americas at CA$2.53 billion, Asia Pacific at CA$616.58 million, Investment Management at CA$489.23 million, and Europe, Middle East & Africa (EMEA) at CA$730.10 million.

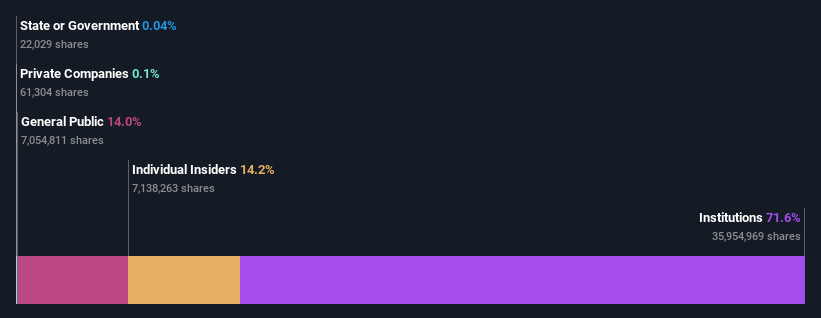

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group is poised for significant growth, with earnings forecasted to expand by 38.3% annually, outpacing the Canadian market's 15% growth rate. However, challenges persist as debt coverage by operating cash flow remains weak and shareholder dilution has occurred in the past year. Recent strategic moves include a partnership with SPGI Zurich AG to strengthen its EMEA presence and a contract to assist Diamondhead Casino Corporation in marketing and financing property development.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$25.25 billion.

Operations: The company primarily generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 12.5%

Earnings Growth Forecast: 67.2% p.a.

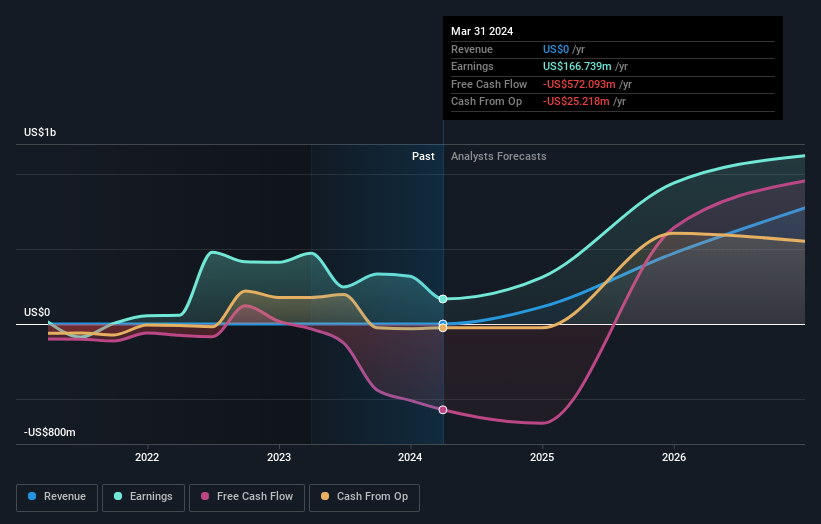

Ivanhoe Mines, a growth-oriented company with substantial insider ownership, has recently completed its Phase 3 concentrator at the Kamoa-Kakula Copper Complex ahead of schedule and on budget, signaling operational efficiency and growth potential. This development is expected to significantly boost copper production, reinforcing Ivanhoe's strategic position in the mining sector. Despite a recent net loss in Q1 2024, Ivanhoe's revenue and earnings are forecasted to grow substantially above market rates. The company also actively explores mergers and acquisitions to further enhance shareholder value.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in the identification, acquisition, and development of gold properties, with a market capitalization of approximately CA$2.25 billion.

Operations: The company is primarily engaged in the development of gold properties, focusing on their identification and acquisition.

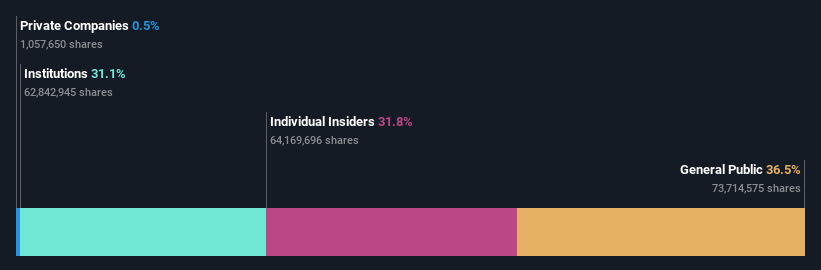

Insider Ownership: 31.7%

Earnings Growth Forecast: 48.8% p.a.

Artemis Gold, with high insider ownership, is poised for significant growth with a projected annual revenue increase of 51.6%. Despite a recent net loss of CA$6.65 million in Q1 2024, the company expects to turn profitable within three years. The Blackwater Mine project remains on budget and schedule for its first gold pour in late 2024, demonstrating strong operational progress and financial management under stable insider guidance. However, shareholder dilution over the past year raises concerns about equity value erosion.

Key Takeaways

Click this link to deep-dive into the 28 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:IVN and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance