TSX Growth Companies With Strong Insider Ownership: Spotlight On Three Stocks

Amidst a backdrop of cautious interest rate cuts by the Bank of Canada and a pause from the Federal Reserve, Canadian consumers are showing signs of fatigue even as spending remains robust. This mixed economic sentiment, coupled with ongoing inflation moderation efforts and rising stock market values, sets a complex stage for investors. In such an environment, growth companies with strong insider ownership can be particularly compelling as these insiders may be better positioned to navigate through uncertain economic waters due to their vested interests and deep understanding of their businesses.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.3% | 58.7% |

Payfare (TSX:PAY) | 15% | 46.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 73.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 64.7% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Below we spotlight a couple of our favorites from our exclusive screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$7.50 billion.

Operations: The company generates revenue through its operations in the Americas (CA$2.53 billion), Asia Pacific (CA$616.58 million), Investment Management (CA$489.23 million), and Europe, Middle East & Africa (EMEA) (CA$730.10 million).

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group has shown robust financial performance with earnings growth of 119.8% over the past year and forecasts indicating a significant annual profit increase of 38.3%. Despite challenges like debt not being well covered by operating cash flow and recent substantial insider selling, the company's revenue is expected to outpace the Canadian market with a 9.5% annual growth rate. Additionally, Colliers was recently chosen to assist in marketing a major property in Mississippi, underscoring its active role in large-scale projects.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd., operating under the easyhome, easyfinancial, and LendCare brands, offers non-prime leasing and lending services in Canada with a market cap of approximately CA$3.18 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.5%

Earnings Growth Forecast: 15.8% p.a.

goeasy Ltd. has demonstrated substantial growth, with earnings increasing by 54.3% over the past year and projected to rise by 15.8% annually, outpacing the Canadian market's average. Despite a dividend coverage issue due to inadequate cash flows, goeasy's revenue growth forecast at 32.4% annually significantly exceeds market expectations. Recent executive appointments aim to strengthen its consumer credit operations, further supporting its aggressive growth trajectory amidst some concerns about debt coverage by operating cash flow.

Propel Holdings

Simply Wall St Growth Rating: ★★★★★☆

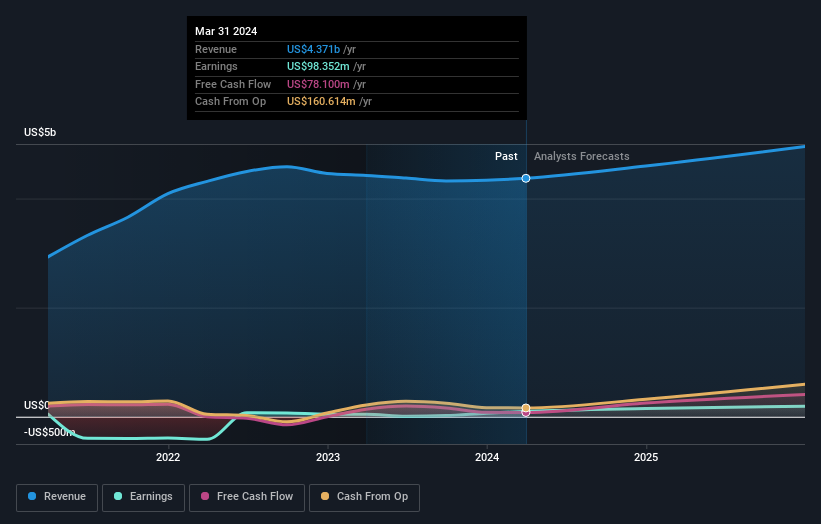

Overview: Propel Holdings Inc. is a financial technology company with a market capitalization of approximately CA$774.40 million.

Operations: The firm generates revenue primarily through offering lending-related services, amounting to CA$347.37 million.

Insider Ownership: 40%

Earnings Growth Forecast: 36.4% p.a.

Propel Holdings has shown robust growth with earnings increasing by 79.4% over the past year and projected to rise by 36.44% annually, outpacing the Canadian market significantly. Despite some concerns about dividend coverage and interest payments, insider activities suggest confidence with more buying than selling in recent months. Recent initiatives include a dividend increase and the launch of a new insurance product, indicating proactive management and potential for sustained growth.

Seize The Opportunity

Unlock our comprehensive list of 29 Fast Growing TSX Companies With High Insider Ownership by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSX:PRL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance