TSX Growth Leaders With High Insider Ownership July 2024

Recent market conditions have seen the TSX displaying resilience amidst a broader global context of fluctuating interest rates and shifting economic policies. As Canadian equities navigate through these changes, growth companies with high insider ownership may offer investors a unique blend of stability and potential upside, given that high insider stakes often align management’s interests closely with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.6% | 55.0% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Payfare (TSX:PAY) | 14.8% | 38.6% |

Allied Gold (TSX:AAUC) | 22.5% | 68.3% |

Ivanhoe Mines (TSX:IVN) | 12.4% | 67.2% |

Alpha Cognition (CNSX:ACOG) | 18% | 66.5% |

Aya Gold & Silver (TSX:AYA) | 10.3% | 68.5% |

Artemis Gold (TSXV:ARTG) | 31.4% | 45.6% |

Magna Mining (TSXV:NICU) | 10.6% | 95.1% |

Almonty Industries (TSX:AII) | 17.7% | 105% |

Below we spotlight a couple of our favorites from our exclusive screener.

Colliers International Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$9.20 billion.

Operations: Colliers International Group generates revenues from various geographical segments, with the Americas contributing CA$2.53 billion, Asia Pacific CA$616.58 million, Investment Management CA$489.23 million, and Europe, Middle East & Africa (EMEA) CA$730.10 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.3% p.a.

Colliers International Group is enhancing its global footprint, notably through a new partnership with SPGI Zurich AG to bolster its EMEA platform. This strategic move, coupled with the company's involvement in significant projects like the Diamondhead Casino development, underscores aggressive expansion efforts. Financially, Colliers has shown robust growth with a recent revenue increase to US$1 billion and a notable turnaround in net income. However, challenges remain as debt is not well covered by operating cash flow, reflecting some financial vulnerability despite positive insider buying trends over recent months.

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market capitalization of approximately CA$3.37 billion.

Operations: The company generates CA$153.99 million from its easyhome segment and CA$1.17 billion from its easyfinancial division.

Insider Ownership: 21.5%

Earnings Growth Forecast: 15.8% p.a.

goeasy Ltd., a Canadian firm, recently increased its debt financing to US$200 million at 7.625%, aiming to strengthen its financial base for corporate needs including debt repayment. This move coincides with a leadership transition, as CEO Jason Mullins plans to step down by year-end, maintaining board involvement for continuity. Financially, goeasy is trading below fair value estimates with high insider ownership but faces challenges in covering dividends and debt through operating cash flow. Despite these issues, the company's revenue and earnings growth projections outpace the market average, suggesting robust potential amidst strategic adjustments.

Take a closer look at goeasy's potential here in our earnings growth report.

Our valuation report unveils the possibility goeasy's shares may be trading at a discount.

Vitalhub

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology solutions for health and human service providers across Canada, the U.S., the U.K., Australia, Western Asia, and other international markets, with a market capitalization of approximately CA$367.16 million.

Operations: The company generates CA$55.17 million from its healthcare software segment.

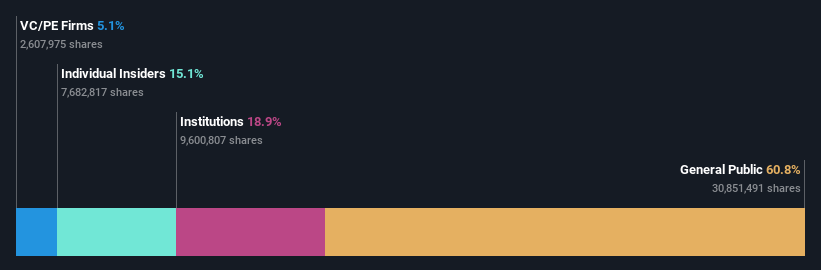

Insider Ownership: 15.1%

Earnings Growth Forecast: 38.1% p.a.

Vitalhub, a Canadian healthcare technology company, reported a significant increase in Q1 2024 revenue to CAD 15.26 million and net income to CAD 1.32 million. Recent strategic moves include promoting internal leaders for growth and operational efficiency, alongside forming a partnership with Lumenus Community Services to enhance service delivery using their TREAT platform. Despite high insider ownership, shareholders experienced dilution over the past year. The company's earnings are expected to grow significantly, outpacing average market forecasts.

Summing It All Up

Access the full spectrum of 29 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:CIGI TSX:GSY and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com