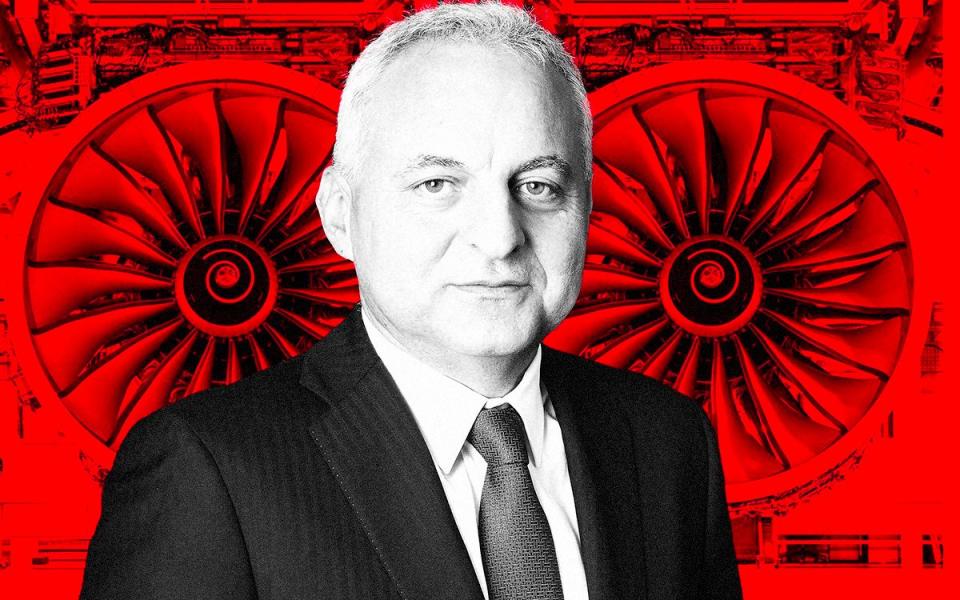

‘Turbo’ Tufan has wielded the axe at Rolls-Royce – now he’s after its culture

Ten months after joining, Tufan Erginbilgic’s master plan to rescue Rolls-Royce is emerging.

The chief executive has announced up to 2,500 job cuts in an effort to make the engineering giant “fit for the future”.

In the process, he will be hoping to crush the corporate fiefdoms that have confounded the efforts of his predecessors to modernise the company.

By targeting redundancies in areas such as finance, HR and procurement, Erginbilgic – who has been nicknamed “Turbofan” by analysts in reference to the modern jet engine – will curb the autonomy of the company’s three biggest divisions in an attempt to fix the loss-making business for good.

While Rolls-Royce is best known for making engines for passenger jets, the company also makes turbines for fighter jets and bombers and has a large business called Power Systems, mostly based in Germany, that makes diesel-burning engines for electricity generators, trains and ships.

Each division has historically had wide leeway to manage its own budget and this has led to duplication of both jobs and costs in areas such as personnel management or legal advice.

Erginbilgic was not shy in calling out these inefficiencies when he took charge. He told staff in January that the company was a “burning platform” and had “not been performing for a long, long time”.

The former BP executive then said in May that the power business had been “grossly mismanaged”, stoking speculation that he may sell the division.

Instead, he is bringing it closer into the Rolls-Royce fold. The cuts will centralise many of the spending and buying decisions of the three businesses: civil, defence, and power.

Predecessors have tried to slim the business before. Warren East, who ran the company before Erginbilgic, cut 4,600 jobs in 2018, slashing management and administrative positions.

But siloed decision-making meant uncoordinated hiring crept back in after East’s cuts, say insiders.

Erginbilgic has made hiring harder, with senior management approval now needed to bring on new staff.

Rolls now employs 42,000 people, with about 21,000 in the UK, largely split between Derby and Bristol. About 11,000 are based in Germany and 5,000 in the US. The company also has a presence in Singapore and a base in China.

The power business may be the hardest hit by Erginbilgic’s job cuts because it is the least integrated with the rest of the company.

The power business is also vulnerable because some jobs in defence are safeguarded, meaning cuts will be forced to fall elsewhere. About 3,600 UK jobs are focused on making propulsion systems for nuclear submarines and will not be affected by the restructure.

Erginbilgic has also put the finishing touches to a reshuffle of Rolls-Royce’s management team, alongside the redundancy plan.

He promoted Simon Burr from a director’s role in the civil aviation division to head of engineering, technology and safety across the business. He joins new Erginbilgic hires including chief transformation officer Nicola Grady-Smith and finance chief Helen McCabe, both of whom worked with the Rolls chief at BP.

With the transformation of the company’s structure now under way, Mr Erginbilgic’s next task will be to make his mark on Roll-Royce’s culture.

Workers on the factory floor describe a company that moves slowly, in part because of its well-earned sense of purpose and history. Rolls has a special place in British corporate history, known for being the engine maker for the Spitfire fighter and the former home of the luxury motor car brand now owned by BMW.

Careers are usually measured in the decades rather than years, but this means teams rely on the same pool of personnel and ideas for long periods

Erginbilgic has yet to meaningfully change a culture that has proved resistant to reform under other chiefs, insiders say.

His direct approach and the clarity of his plans may help him succeed where others have failed, says Nick Cunningham, an analyst at Agency Partners.

“Previous management have been analytical, and nice,” says Cunningham, who has been following Rolls-Royce since the 1980s. “But they have found reforming Rolls like wading through treacle. Tufan, you don’t argue with him, and I think he knows what he needs to do.

“He’s very straightforward and very clear about what he wants and why he wants it. “

After much upheaval at the company, he also has the licence to make sweeping changes, Cunningham says.

The company suffered a near-death experience during the pandemic when its income from engine maintenance dried up. It then needed an emergency capital injection from investors and government support to survive.

Other recent setbacks include production problems with its Trent 1000 engine, which powers the Boeing Dreamliner jet, and a settlement paid to the Serious Fraud Office over historic bribery and corruption allegations. The SFO settlement, engine problems and the pandemic cost the company about £8bn during East’s tenure.

Investor patience has been worn thin and the race to reach profitability is now more important than ever, says Cunningham. The company lost £1.5bn last year.

Making the company more competitive will be key to turning around performance.

Rolls has two rivals when it comes to making the largest passenger jet engines: Pratt & Whitney, which is owned by missile maker RTX Corporation; and General Electric (GE).

While Rolls’s margins on its civil business are less than 10pc, GE boasted an 18pc margin last year and said in March it expected returns of more like 20pc from 2025 onwards.

Investors will want to know how Erginbilgic plans to close this gap when he unveils his strategic review of Rolls next month.

Keeping Power Systems may beg the question of what else the company might sell, if anything, to boost profits.

Dropping the company’s electric business is unlikely, says Cunningham, since it offers great promise in creating hybrid jet engines that could play a role in the net zero transition.

Rolls has raised money in other ways: its small modular reactor (SMR) business, which aims to develop factory-made nuclear power plants, sold stakes to outside investors including Qatar’s sovereign wealth fund. Other divisions could be treated in a similar way, insiders have hinted.

The existence of the SMR business points to the bigger challenge facing Rolls-Royce: how to adapt to net zero. Erginbilgic will have to make sure the company is not just competitive with rivals but also ready for a world in which the very nature of the engine is changing.

“Where do you direct your research money? How are you going to manage the relationship with the customers? In particular, how are you going to cope with the pressure to decarbonise?” says Cuningham.

“I think, relatively quickly, we’ll be past the recovery phase, you know, within the next two years. And then you start to think about, well, what should this business be in the long run?”

As Erginbilgic swings the axe, those questions still hang in the air.

Yahoo Finance

Yahoo Finance