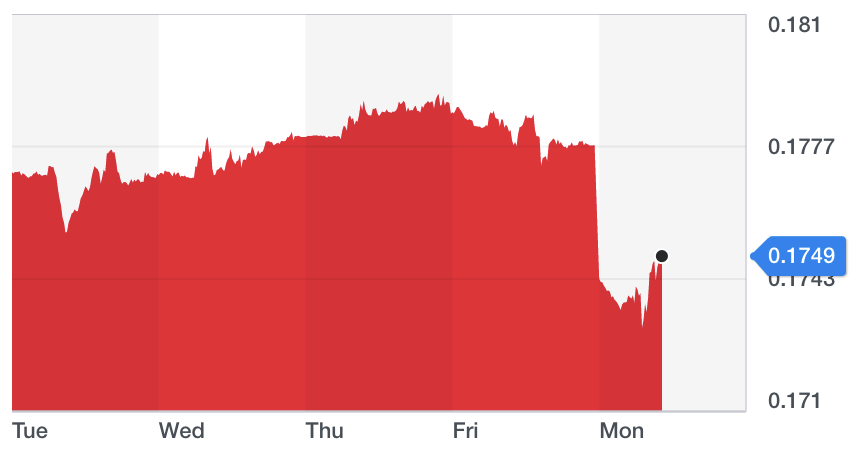

Turkish lira sinks against the US dollar as Erdogan sacks central bank chief

The Turkish lira against the US dollar (TRY/USD) slipped in early Monday trading after Turkish President Recep Tayyip Erdogan sacked the governor of the central bank and replaced him with his deputy.

TRY/USD fell by over 1.5% after no official reason was given for firing Murat Cetinkaya.

Over the last couple of years, investors have been worried over President Erdogan’s increasing influence on the economy and monetary policy.

Reports suggest that Erdogan disagreed with Cetinkaya over interest rates — which the President has been trying to lower to boost economic growth. Over the last year or so, Erdogan has been pushing for lower interest rates and has been trying to use a backdoor method to avert a currency crisis.

Usually in times of the currency crashing, a central bank would raise benchmark rates. Initially this didn’t happen and the central bank employed a backdoor method of squeezing lira liquidity in the market. This means that lenders have had to borrow cash overnight, which is more costly than drawing liquidity from usual auctions of one week cash.

However, in September last year, Turkey increased its benchmark interest rate from 17.5% to 24%. Erdogan has previously called high interest rates as "mother and father of all evil."

Yahoo Finance

Yahoo Finance