Turning Point Brands Inc. (TPB) Q1 2024 Earnings: Strong Performance with Significant Growth in ...

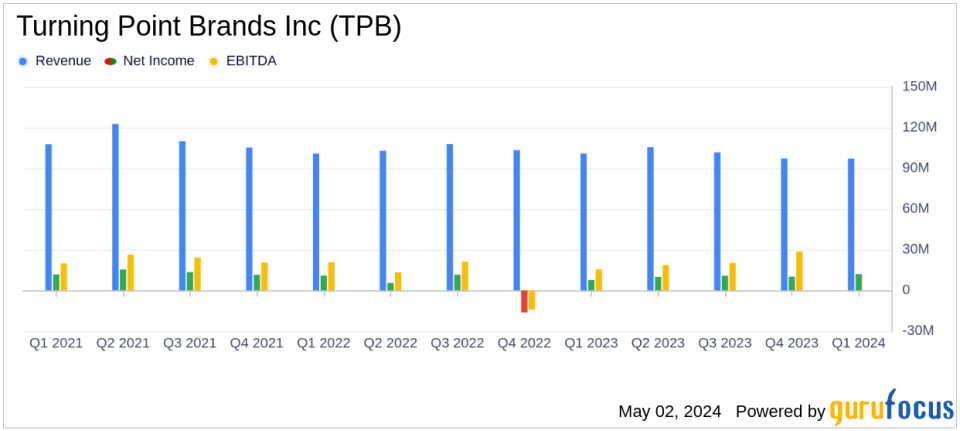

Q1 2024 Revenue: Reported at $97.06 million, surpassing estimates of $90.66 million.

Q1 2024 Net Income: Reached $12.01 million, significantly surpassing the previous year's $7.60 million.

Earnings Per Share (EPS): Achieved $0.63 diluted per share, falling short of the estimated $0.67.

Adjusted EBITDA: Increased by 22% year-over-year to $25.3 million, demonstrating strong profitability and operational efficiency.

Gross Margin: Improved in the Zig-Zag Products segment by 550 basis points to 59.0%, driven by favorable product mix.

Stokers Products Revenue Growth: Grew by 8.0% to $36.4 million, with significant contributions from the Modern Oral product FRE.

Full-Year 2024 Guidance: Reaffirmed adjusted EBITDA expectations of $95 to $100 million, indicating confidence in sustained financial performance.

On May 2, 2024, Turning Point Brands Inc. (NYSE:TPB), a prominent player in the tobacco and related products industry, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a robust quarter with significant growth in its Zig-Zag and Stokers segments, aligning with earnings per share (EPS) projections and surpassing revenue expectations.

Company Overview

Turning Point Brands Inc. operates as a manufacturer, marketer, and provider of consumer products in the Other Tobacco Products (OTP) spectrum in the U.S. The company's portfolio includes moist snuff tobacco (MST), loose-leaf chewing tobacco, premium cigarette papers, make-your-own (MYO) cigar wraps, cigars, liquid vapor products, and tobacco vaporizer products. TPB operates through three segments: Zig-Zag products, Stoker's products, and NewGen products, with Zig-Zag products generating the maximum revenue.

Financial Highlights

For Q1 2024, TPB reported net sales of $97.06 million, a decrease from the previous year's $100.96 million but still surpassing the estimated revenue of $90.66 million. The Zig-Zag Products segment saw an 11.5% increase in net sales to $46.7 million. This segment, representing 48% of total net sales, experienced a gross profit increase of 23.0% to $27.5 million, with gross margin expanding by 550 basis points to 59.0%. The Stokers Products segment, accounting for 38% of total net sales, reported an 8.0% increase in net sales to $36.4 million.

The company reaffirmed its full-year 2024 adjusted EBITDA guidance of $95 to $100 million, reflecting confidence in its ongoing operations and market strategy. Notably, the adjusted EBITDA for Q1 2024 stood at $25.3 million, marking a 22% increase over the prior year.

Operational and Market Performance

Graham Purdy, President and CEO of TPB, expressed satisfaction with the quarter's outcomes, highlighting the sustainable growth trajectory of Zig-Zag and the market share improvement in Stokers products. The successful national launch of the Modern Oral product FRE also contributed positively to the company's performance.

The company's operational efficiency is evident from its management of selling, general, and administrative (SG&A) expenses, which were $32.6 million, up from $30.8 million in Q1 2023. TPB's strategic initiatives have enabled it to maintain a strong market position despite competitive pressures.

Financial Position and Future Outlook

Turning Point Brands demonstrated a solid financial position with total liquidity of $189.9 million as of March 31, 2024. This includes $130.9 million in cash and $59.0 million of asset-backed revolving credit facility capacity. The companys proactive management of its debt profile and shareholder-friendly actions, such as the repurchase of 72,545 shares for $2.1 million during the quarter, underscore its commitment to delivering shareholder value.

Looking ahead, TPB remains focused on leveraging its core brands and expanding its market presence through innovative product offerings and strategic market initiatives. The company's reaffirmed EBITDA guidance for 2024 reflects its optimistic outlook and expected continued growth in its key segments.

Conclusion

Turning Point Brands Inc. has started 2024 on a strong note, with performance in key segments driving growth and profitability. The company's strategic focus on its Zig-Zag and Stokers segments, coupled with effective cost management and innovative product launches, positions it well for sustained success in the competitive tobacco products market.

For detailed financial figures and further information, please refer to the official 8-K filing by Turning Point Brands Inc.

Explore the complete 8-K earnings release (here) from Turning Point Brands Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance